Environmental, Social, and Governance (ESG) issues have been all the rage in the oil and gas industry. These have impacted upstream, midstream, and downstream as we have written in the past. Refining is no exception and is facing considerable pressure. Last week, Phillips 66 and Marathon Petroleum both announced plans to partner with Southwest Airlines and supply the airline with sustainable aviation fuels produced from their upcoming renewable diesel facilities repurposed from older refineries in California. Around the same time, ExxonMobil expanded its plans to source renewable diesel from Global Clean Energy’s plant also in California. A lot of these announcements were previewed by Valero in its investor deck from March 2021 where it showed that greenhouse gas emission offsets via the production of renewable diesel and ethanol far outweigh the cuts to Scope 1 and 2 emissions at the company’s facilities. Even so, these initiatives would collectively enable Valero to cut its greenhouse gas emissions by more than 70% by 2025 (see Exhibit 1).

Similar to our prior blogs on ESG issues on upstream, midstream, LNG, and chemicals, we introduce and discuss top 10 ESG issues in refining in this blog.

Environment

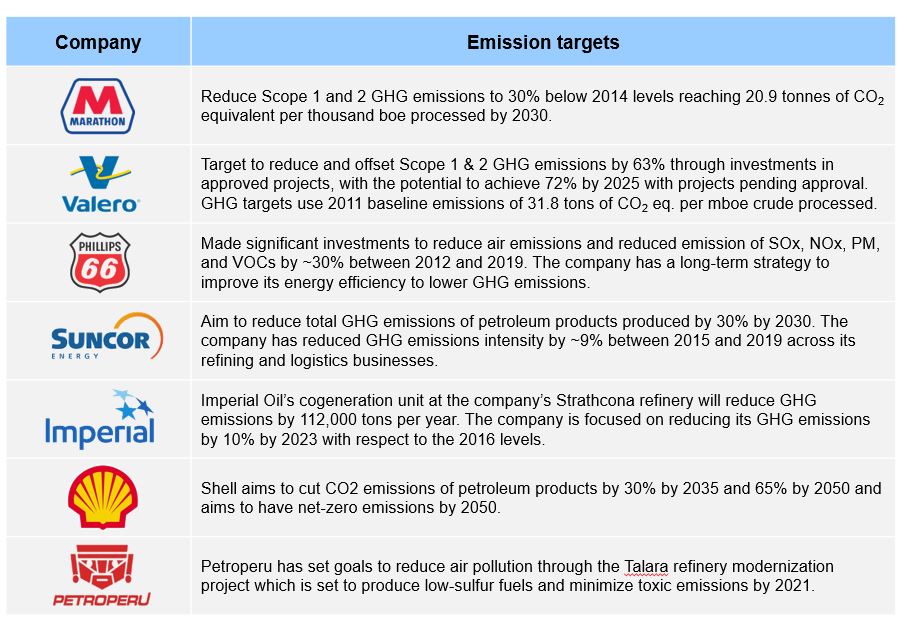

1. Refiners globally are targeting to lower Scope 1 and Scope 2 emissions to reduce their greenhouse gas (GHG) emissions footprint. They are aiming to achieve carbon reduction through various methods ― operational efficiency gains, increased production of renewable fuels such as ethanol and renewable diesel, and carbon capture programs. Several refiners are aiming for GHG as well as NOx, SOx, PM, H2S, and VOCs reduction targets at varying levels (Exhibit 2).

However, addressing the transition from carbon-based fuels to low-carbon and renewable fuels is likely to require significant capital investment and additional costs. This adds huge pressure on simple and small refineries and make them less competitive in the long run in an already oversupplied refining industry. For others, with adequate support from the government incentive programs around biofuel blending credits such as Low Carbon Fuel Standard (LCFS) and Renewable Identification Numbers (RINs) and carbon taxes, capital spending in reducing its environmental footprint will grow in the medium-to-long term.

Further, refiners are less likely to invest extensively in carbon capture, utilization, and storage (CCUS) due to its current unfavorable economics but in the longer term CCUS will potentially play a significant role especially in a net-zero scenario.

2. To minimize their carbon footprint, refiners globally are investing in alternative energy resources such as solar or wind to replace coal and gas-fired electricity that currently powers their refineries with support from government incentives. For instance, Phillips 66 is planning to use electricity from offshore wind to produce hydrogen at its Humber refinery in the U.K. with government support. Further, refinery investment in combined heat and power plants to facilitate efficient operations by minimizing energy intake and GHG footprint is another way in which refiners are diversifying their energy portfolio. For instance, in 2019. Valero’s cogeneration systems and expanders had offset ~330 megawatts of electricity from local power grids.

3. Refiners are improving practices to minimize fresh water withdrawn by recycling and reusing available salt or non-fresh water in other industrial processes especially in water sensitive areas due to increasing scrutiny from local communities on wastewater management. Water is an essential resource in crude refining processes and refineries need to comply with water quality regulations by having on-site water treatment systems to prevent toxic substances in the wastewater coming out of a refinery. Overall, refineries are setting goals to minimize water quality non-compliance incidents while maintaining water pollution standards and preventing potential fines that can add more cost. For example, in 2019, Valero recycled more than 17 times the amount of fresh water withdrawn for its refining operations.

4. Refiners are also planning to invest in advanced technologies, digital tools, and preventive maintenance to reduce their energy consumption and operating costs while ensuring worker safety and GHG reduction. Advanced digital analytics can identify optimal plant settings with real-time data and predict equipment failures to optimize refinery maintenance and performance. Further, refiners are using integrated process control and efficient back-office to aid supply chain transparency.

5. Refiners are ensuring safe transportation of crude oil and refined products in the pipes by practicing preventive measures and minimizing spills and accidents. Land contamination during such accidents can cause financial obligations before the land can be reused. In addition, such incidents can also damage reputation of the company substantially. Hence, to mitigate risks, refiners are preventing any occurrence or reoccurrence of such spills through proactive measures such as pressure cycles adjustment and performing additional advanced level inspections.

6. Refineries also need to minimize and dispose residual products and hazardous waste carefully in compliance with rigorous environmental laws by either incinerating it or recovering, recycling, and reusing it when possible. By increasing the amount of waste recycled, refiners can minimize the waste that goes into landfill. Other methods of disposal include working with contractors to transport the waste to manufacturers in other industries. Refiners are taking initiatives to reduce land use to protect plant and animal life and are carefully considering cleanup of underground fuel storage tanks. For instance, in 2019, Phillips 66 kept more than 4,500 tons of waste out of landfills and provided more than 1.5 million gallons of waste-derived fuel.

Social

7. Workforce safety management is critical due to combustible and polluting nature of refined products which can result in accidents involving fatalities. For examples, 15 workers were killed and 180 injured in an explosion in isomerization process unit at BP’s Texas City refinery in Texas City on March 23, 2005. Refiners need to regularly track and manage incidents and have specific programs in place to educate workforces. Poor management of social and particularly safety factors typically lead to reputational issues, with differing impacts on companies and their creditworthiness. Growing pressure from human right organization, labor unions, consumers, and government are forcing refiners to reduce incident rate, fatality rate, and practice management systems integrating safety into culture.

8. Human capital management also plays an important role in developing a long-lasting productive workforce while reducing potential operational disruptions from workforce mismanagement. Attracting and retaining top talent is increasingly critical to companies where they can make an impact on the welfare of all stakeholders.

9. Refiners are incorporating programs to give back to communities and share their success locally through volunteerism, charitable giving, and the economic support of being a good employer.

Governance

10. To achieve operational excellence and target ESG outcomes, refining companies are focusing on building a strong and diverse corporate governance to facilitate different views. Refining companies are integrating ESG in strategy to manage risks and opportunities by promoting all-employee bonus programs that include ESG initiatives and pay for performance. In addition to professional development across board, companies are also increasing stakeholder engagement and reporting transparency.

Our team at ADI Analytics has supported a wide range of clients in the refining industry with our consulting and research projects. Further, ADI also tracks and monitors the downstream and refining sectors closely and you can access our insights by subscribing to the ADI Downstream Market Advisory service. Please reach out to us if you’d like to learn more about ADI Analytics’ work in and around ESG issues in refining industry.

– Swati Singh