In the previous blog, we discussed the global CO2 emissions in the steel industry, primary and secondary production methods to produce steel, and touched on some of the key projects that can help the industry reduce its carbon footprint. In this blog, we will discuss the key drivers for decarbonization in the steel industry, competitive landscape, and alternative technologies and their carbon footprint. We will also discuss the cost competitiveness of various alternatives to produce steel.

The use of steel in the global economy will persist because it is a critical material used for buildings and infrastructure, automobiles, and other industries. On the supply side, decarbonization and cost competitiveness are some of the key drivers that will drive the adoption of low-carbon technologies in the steel industry. On the demand side, end-users of steel are expecting steel producers to produce low-carbon steel. The idea of zero-carbon cities is encouraging the building sector to look for low-carbon construction materials to reduce its carbon footprint. Auto manufacturers are also under scrutiny to demonstrate how the use of steel is assisting them with the energy transition. The circularity of steel is also leading the industry to increasingly use electric arc furnace-based technologies which use recycled scrap steel as a starting material.

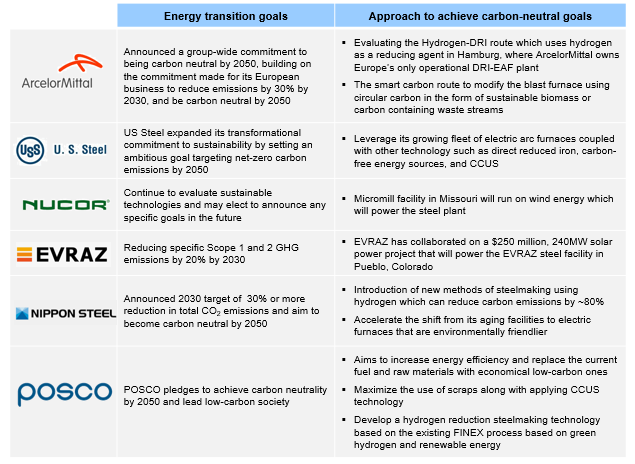

Several steel producers have taken initiatives to reduce their carbon footprint. ArcelorMittal has announced a group-wide commitment to being carbon neutral by 2050. They are evaluating the hydrogen-direct reduction of iron (DRI) route which uses hydrogen as a reducing agent and programs such as the smart carbon route to modify the blast furnace using circular carbon in the form of sustainable biomass or carbon-containing waste streams.

Similarly, Nucor Steel recently announced a net-zero carbon emission goal by 2050. They will leverage their growing fleet of electric arc furnaces coupled with other technologies such as direct reduced iron, carbon-free energy sources, and CCUS. Small producers such as EVRAZ has also set up goals to reduce their scope 1 and 2 emissions by 20% going forward. Exhibit 1 shows an illustrative list of announcements made by steel producers and the approach to achieve their emission targets.

Exhibit 1: Illustrative list of initiatives by steel producers and their carbon emission target

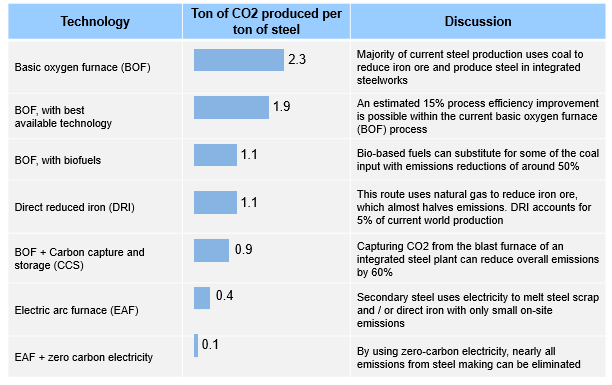

Slower growth will impact the relative supply-demand balance of raw materials which, in turn, will influence technology choice. Energy efficiency gains, CCUS, hydrogen-based DRI, and electrification of steel production using low-carbon electricity could enable near-zero carbon emissions in steel production. Producing steel using the secondary route (i.e. recycled steel scrap that is used as a supplement to pig iron and melted using EAF) can result in lower production costs because it does not require producing iron. For deeper emissions cuts, it would be necessary to use methods of steel production that are still under development. Exhibit 2 shows the CO2 intensity of steel production by technology. Secondary steel-making processes such as electric arc furnace (EAF) emits ~0.4 tons of CO2 per ton of steel produced as compared to the basic oxygen furnace (BOF) which emits ~2.3 tons of CO2 per ton of steel. Combining the EAF process with zero-carbon electricity can reduce emissions further by ~80%.

Exhibit 2: CO2 intensity of steel production by technology (Source: Material Economics)

There is more than one route to achieving low-carbon production of primary steel. However, steel producers need incentives to change as the current economics are unfavorable for market forces to provide decarbonization solution. Using CCS technology to capture carbon in a steel manufacturing facility will increase the price of steel production by 25. Replacing coal with hydrogen will add about 10-15% to the cost of a ton of unfinished steel before considering extra capital costs. Even with lower electrolyzer capital costs in the future, the impact on hydrogen’s price competitiveness may be limited in the near-term compared with fossil-fuel based gray or blue hydrogen, which relies on carbon capture and storage, and with natural gas.

With supportive conditions in place, notably the right infrastructure and a supportive regulatory framework, the steel industry would be able to develop, scale-up, and deploy new technologies that could reduce CO2 emissions and meet climate change objectives.

Our team at ADI Analytics has supported a wide range of clients in the steel industry with our consulting and research projects. Please reach out to learn more about how we can help.

-Utkarsh Gupta