The steel industry followed by transportation and power generation is one of the three biggest producers of carbon dioxide (CO2). One ton of crude steel production currently results in around 1.4 tons of direct CO2 emissions. In 2020, the world total steel production was ~1,900 million tons and likely emitted a total of ~3 billion tons of CO2 which amounts to ~8% of the total global emissions. Based on current trends, global steel demand is set to increase by around 6% through 2030 driven by population and GDP growth, and economic expansion in India, the ASEAN countries, and Africa even as demand in China might gradually decline going forward.

Today, almost 80% of the steel is produced using primary production methods that convert iron ore to steel as opposed to the secondary production route which utilizes limited supplies of recycled scrap materials for steel production.

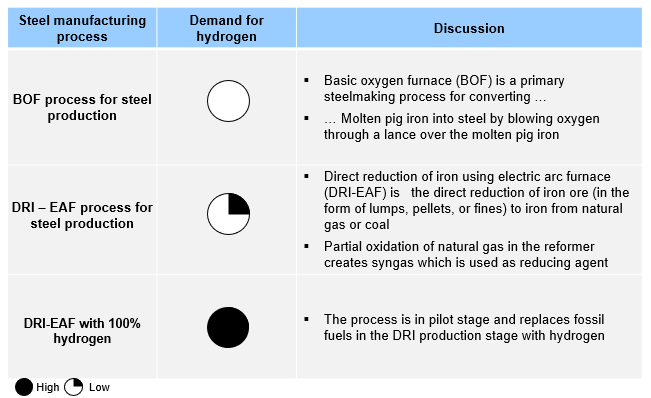

Exhibit 1 discusses about available technologies and outlook for demand of hydrogen by applications. In the Direct reduction of iron using electric arc furnace (DRI-EAF) process, hydrogen is used as a reducing agent which is produced using natural gas through reforming process. The DRI-EAF process with 100% hydrogen replaces fossil fuels in the DRI process with renewable energy or hydrogen. At present, Midrex and HYL are running pilot plants to produce hydrogen using 100% hydrogen.

Exhibit 1: Applications and outlook for demand of hydrogen in the steel industry

While there are strategies to decrease emissions on the blast furnace/ basic oxygen furnace (BF/BOF) route such as the reduction of production losses and efficiency increases, these do not eliminate emissions fully, and to date remain technically unproven. The DRI-EAF route in contrast can be fully decarbonized. This requires steel makers to use renewable electricity to power the EAF, and then add clean hydrogen or biomass which can be used as a reducing agent in the DRI process. Without policy intervention, demand for dedicated hydrogen production in steelmaking is expected to grow from the current level of 4 million tons of hydrogen per year (MtH2/year) to 8 MtH2/year. Dedicated use of hydrogen as 100% fuel or green hydrogen as a reducing agent in the furnace could lead to a 15-fold increase in hydrogen demand by 2050.

In the iron and steel industry, where hydrogen can be used to reduce iron ore to iron, we expect the use of clean hydrogen will be demonstrated by 2030 and adoption will gain momentum by 2035. Decarbonization, cost competitiveness, and strong demand outlook for steel are some of the key drivers that will drive the adoption of hydrogen in the steel industry.

This was the first in a two-part blog on hydrogen in the steel industry. In the next part, we will discuss the competitive landscape, new innovations, and cost competitiveness of hydrogen to other alternatives in the steel manufacturing process.

Our team at ADI Analytics has supported a wide range of clients on hydrogen with our consulting and research projects. Please reach out to learn more about how we can help.

-Utkarsh Gupta