LNG has in recent years transformed into an exciting fuel market. Decarbonization efforts and policies, low costs, and regulatory pressure to lower toxic gas emissions have driven demand for LNG. Global LNG demand and capacity have grown at 5.1% and 5.8% per year, respectively, in the past decade.

The U.S. has emerged as a major LNG supplier in recent years, enabled by the discovery and development of shale gas resources in the past decade. Low shale gas prices and cost-competitive projects in the U.S. have contributed to LNG supply growth and price declines globally. These, along with cost-effective transportation options at various scales and growing use in various emerging applications coupled with decarbonization and environmental policies, familiarity with LNG, and energy supply security goals make small-scale and containerized LNG an attractive fuel in various parts of the world.

Recognizing this potential, the U.S. Department of Energy (DOE) commissioned U.S. Energy Association along with Gas Technology Institute and ADI Analytics to conduct a study assessing the potential of LNG specifically in Central & Eastern Europe. This study focused on 15 countries in the region, namely, Albania, Austria, Bosnia & Herzegovina, Bulgaria, Croatia, Czech Republic, Hungary, Kosovo, Montenegro, North Macedonia, Poland, Romania, Serbia, Slovakia, and Slovenia. Further, given that this region’s needs are more fragmented in comparison to other parts of Europe which have come to rely on LNG use via traditional, large-scale volumes, the scope of the study was deliberately limited to small-scale (less than 1 mtpa) and containerized (~10,000 gallons or so) LNG.

The project was completed in three phases with frequent interactions and consultations with a wide range of stakeholders. The first phase included a series of kick-off workshops with key stakeholders in the region to identify relevant issues and validate the proposed study scope and plans. The second phase was focused on developing the report using a mix of research tools and analytical methods. In addition, interviews with approximately 75 relevant stakeholders across the 15 countries of interest. These included stakeholders from government agencies, U.S. embassy staff, gas and LNG project developers, end-users, and equipment vendors, and regional oil and gas companies. The final phase of the project included a series of virtual workshops to disseminate our findings and facilitate conversations around specific initiatives and projects.

The study has several findings and a few are discussed briefly here:

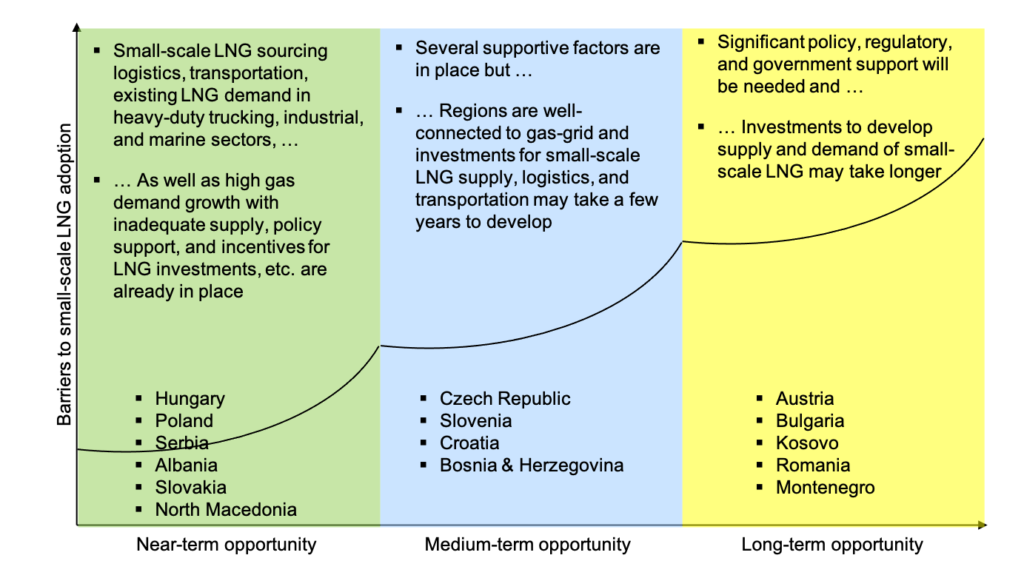

- A third of the countries in the region – Hungary, Poland, Serbia, Albania, Slovakia, and North Macedonia – can immediately benefit from small-scale LNG given the growth in their economy growth and demand for diesel, remote energy, and natural gas. Exhibit 1 summarizes the country-level opportunity assessment conducted in this study for small-scale LNG in Central & Eastern Europe. Also shown in the exhibit, are Czech Republic, Slovenia, Croatia, and Bosnia & Herzegovina that have opportunities in the medium-term and Austria, Bulgaria, Kosovo, Romania, and Montenegro that have long-term opportunities around use and adoption of small-scale LNG.

Exhibit 1. Opportunity assessment by country in Central & Eastern Europe.

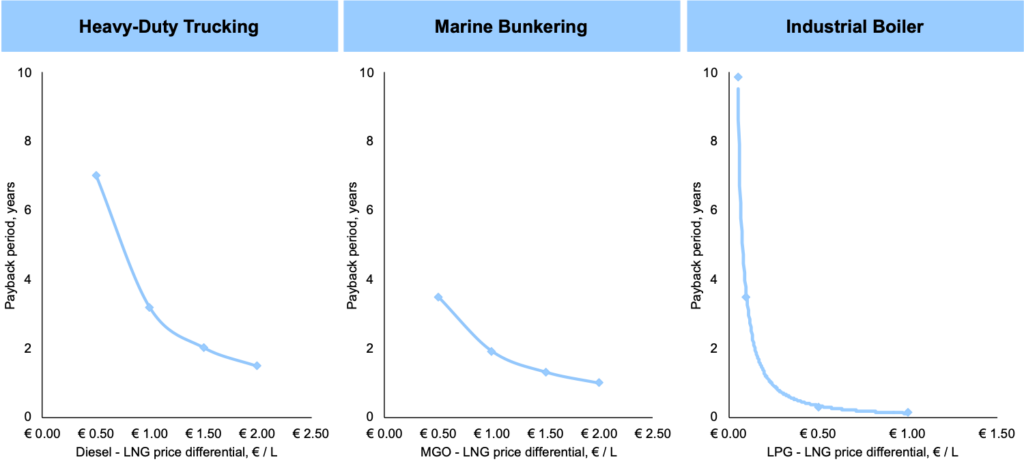

- Trucking and industrial followed by marine are promising applications for small-scale LNG in Central and Eastern Europe. As shown in exhibit 2, payback periods for LNG-fueled trucks are most attractive followed by ships and industrial boilers with robust price differentials to incumbent fuels in most cases. Industrial demand will be in areas inadequately connected to existing gas grids and defined as remote energy demand in our study.

Exhibit 2. Payback period in years for use of LNG as fuel in various applications.

- We find that the region has limited LNG infrastructure and particularly at the smaller scale. Even so, LNG is now so cost-competitive, thanks in part to the U.S., that it can compete even if trucked or barged into the region from nearby terminals.

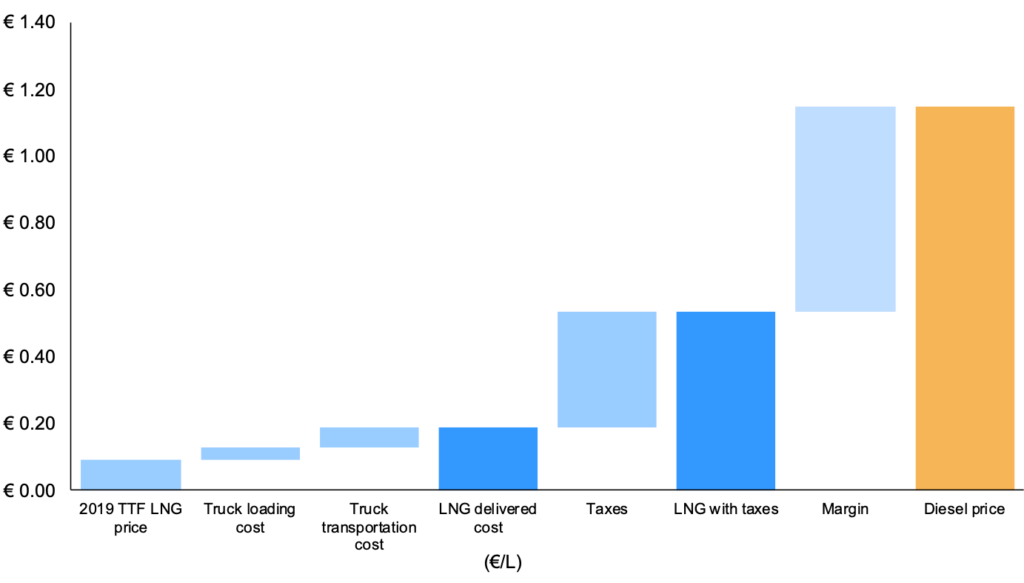

Exhibit 3 shows the comparison between diesel price and LNG delivered via an existing terminal and trucked to the end-user to replace diesel. New investments are necessary in small-scale LNG services at existing or upcoming terminals or new sea and river ports to handle ISO containers. Fortunately, LNG infrastructure costs are falling due to innovation, potentially facilitating these investments.

Exhibit 3. LNG price to replace diesel in heavy-duty trucking.

- Several stakeholders will be key to developing the region’s small-scale LNG market including government agencies, regulators, state-owned and private companies, multilateral institutions, and investors. Transparent and flexible policies, regulatory support and clarity, financial incentives, and public awareness at the country level will drive small-scale LNG adoption as detailed in our report.

In addition to these key findings, ADI has studied the region in detail on a country-to-country basis including demand and supply of small-scale LNG, existing and upcoming infrastructure, and policy recommendations to drive adoption and growth of small-scale LNG. To learn in detail about the methodology and findings from the study, please fill the form here to download the full report.

In addition, ADI, with their partners, Gas Technology Institute and U.S. Energy Association, shared key insights from the study with key stakeholders. The workshop recording is available on ADI’s YouTube channel.

By Panuswee Dwivedi and Uday Turaga