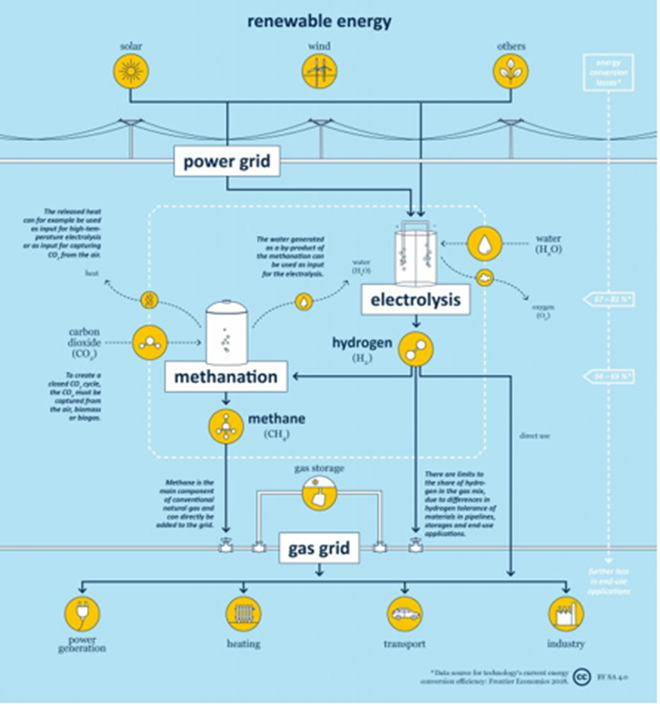

Renewable energy capacity has grown significantly in recent years as it has become more cost competitive with natural gas and coal-fired power generation. Even as the market forces of falling cost and regulatory action are in favor of renewable energy, storing renewable energy has been challenging. Storing renewable energy is inefficient and large amounts of renewable energy is lost at the grid. Cheap and reliable storage technology is needed to ensure the viability of renewable energy and there are a number of technologies vying for widespread adoption. One promising solution is power-to-gas which converts excess power into synthetic natural gas. An overview of the power-to-gas conversion process and end use applications is provided in Figure 1.

Power-to-gas uses excess power from renewable sources such as solar and wind to break water into hydrogen and oxygen through electrolysis. The separated hydrogen can be used to produce power, or it can be combined with carbon dioxide through the methanation process to create methane (synthetic natural gas).

Power-to-gas electrolyzer technologies include:

Alkaline Electrolysis (AEL): A mature and well-established technology which uses an aqueous solution as the electrolyte. This technology requires a larger footprint than other technologies and takes 30-60 minutes to restart following shutdowns making it less suitable for handling intermittent renewable power. AEL is currently the cheapest commercially available power-to-gas electrolyzer technology at $115/kw.

Polymer Electrolyte Membrane (PEM) Electrolysis: Uses a polymer electrolyte membrane and water as an electrolyte solution to avoid the recovery and recycling of potassium hydroxide electrolyte solution. Has a higher efficiency than AEL due to its compactness and quicker response to load changes, but also a shorter equipment lifecycle than AEL and is nearly twice the price at $230/kw.

Solid Oxide Electrolysis (SOEC): A newer technology not yet commercialized which uses ceramics as the electrolyte and requires a heat source as it uses steam for high-temperature electrolysis. SOEC is expected to have lower material cost and higher efficiency than AEL and PEM.

The attractiveness of power-to-gas is its high energy value, low carbon footprint, and ability to be used with existing natural gas infrastructure. There are, however, some drawbacks as there is significant energy loss during the production process which is inefficient and it is not yet cost competitive in regions with abundant natural gas such as the U.S., for power generation, heating, or transportation. Due to the high cost of power-to-gas, commercialization success has been limited to regions with high natural gas prices or regulatory incentives e.g., Europe and California. Technological innovation is needed to drive down cost and promote widespread adoption.

As with many other energy storage technologies, high cost and a lack of efficiency is hindering adoption and growth of power-to-gas. The long-term viability of power-to-gas is heavily dependent upon the commercialization success of SOEC as this technology will improve cost competitiveness and efficiency. Driving down cost and improving efficiency is critical to expanding opportunities for power-to-gas beyond long-term energy storage for renewable power peak-shaving.

ADI has conducted extensive research and consulting work across a broad range of topics related to the energy transition and renewable energy. Please contact us to learn more about ADI’s consulting work and research capabilities around power-to-gas and energy storage.

-Brandon Johnson