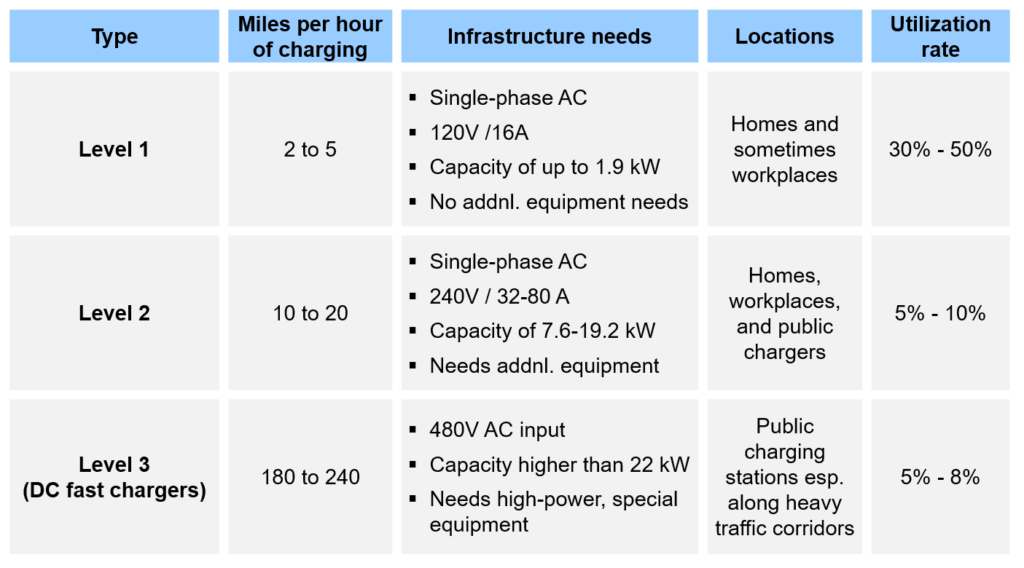

President-elect Joe Biden has committed to build 500,000 electric vehicle (EV) chargers by 2030. However, United States is expected to have nearly 15 million electric vehicles (EVs) by 2030. EV adoption is expected to be fueled by decarbonization goals, decreasing battery costs, growing efficiency, and EV model growth. Another important driver that will drive EV adoption and in turn be also driven by EV adoption is EV charging infrastructure. There are three types of EV chargers with varying power, charging, utilization, and application features as described in Exhibit 1.

Exhibit 1. Types of EV chargers.

It is easy to install a Level 1 or Level 2 charger and can be carried out by a licensed electrician. On the other hand, installing a Level 3 charger needs planning, permitting, and significant engineering design along with utility relationships. An overview of a Level 3 charger value chain includes hardware manufacturers, installation companies (or EPC firms), electric mobility service providers, and host sites or charge points operators.

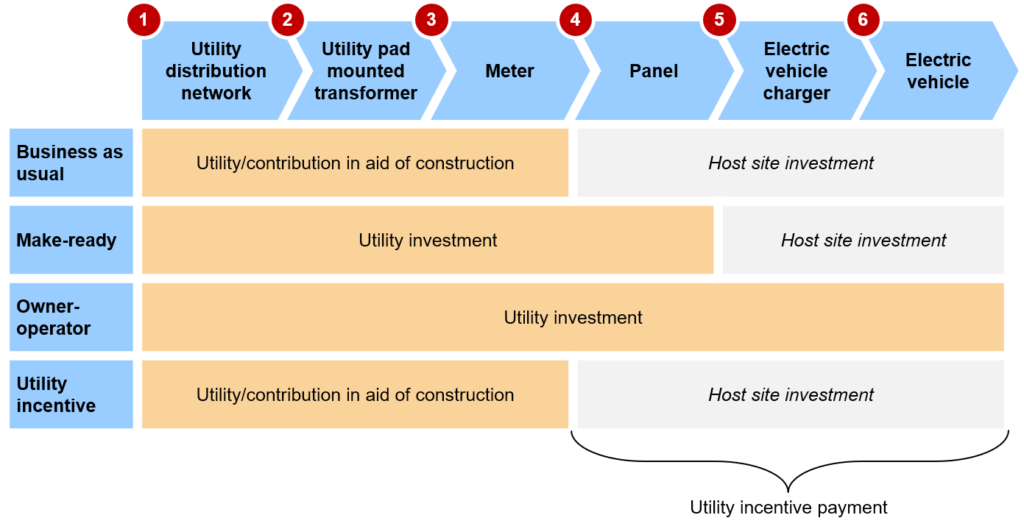

Utilities play an important role in the value chain providing power to the charging. Exhibit 2 shows models of utility investments. Presently, in a business as usual case, utilities’ contribution is limited to the power distribution network, a transformer, and metering but they have multiple options to participate more actively in the EV charging infrastructure market.

One model is make-ready investments which mean that all the necessary electrical infrastructure to mount and operate the charging stations including conduit, wire, panel, and concrete work is completed for the operator to take over the charging station. The owner-operator model is when a utility decides to invest in developing as well as operating the charging station while the utility incentive model is similar to the business-as usual case except that the utility receives incentives from the host-site operator to participate in the EV charging infrastructure.

Exhibit 2. Models of Utility EV Supply Equipment Investment. Source: Brattle

Most utility investments are directed towards ‘make-ready’ charging stations. Out of nearly 77,500 public EV chargers in the U.S., only 1.2%, about 955 public EV chargers are owned and operated by utilities. Some utilities are looking to participate in and invest at a higher level in this space but there are challenges including the level of investment required, uncertainty around whether rate payers will cover these investments, and broader risks around EV adoption. There is, however, growing clarity around utilities, role and rate payer support for EV infrastructure investments. Utilities in some states have significantly invested in EV charging infrastructure and other states are willing to promote the same.

Massachusetts is leading the country and it allows utilities to recover costs of EV infrastructure development and does not interfere with the competitive market while also providing some performance-based incentives. Energy providers Eversource and National Grid received $45 million and $9 million, respectively, in grants to develop EV charging infrastructure in the state. In Maryland, a cost-benefit analysis was used to inform design and investment decision to approve pilot-scale EV infrastructure projects with $104 million budget and Baltimore Gas and Electric Company (BGE) and Pepco Holdings were approved for $22 million to build public charging stations.

In Minnesota, buildout targets are set based on an expectation of EV adoption to spur competitive private investments and Xcel received a $24 million grant for public EV chargers. Ameren Missouri, Georgia Power, American Electric Power (AEP) Ohio, and ConEd in New York received $11 million, $24 million, $10 million, and $39 million respectively, as incentives and grants for investments towards development of public charging infrastructure.

Oregon and California on the west coast are also promoting utility investments in the public EV charging space. Regulations in Oregon allow utilities to own charging stations and budget for outreach and educational programs to boost higher EV adoption. In California, investor-owned utilities (IOUs) received $1.2 billion primarily for medium- and heavy-duty vehicle fleets.

As the scale of EV charger infrastructure grows, the sector will attract a broader range of participants including utilities. Range anxiety is a growing concern among EV owners and in addition to growing the number of private chargers, there will be a significant need for investment in public fast chargers with growing demand with adoption of medium- and heavy-duty electric vehicles.

ADI recently assessed the EV charging infrastructure needs, outlook, and competitive landscape in the U.S. Please contact us to learn more about our work across the electric vehicle value chain.

By Panuswee Dwivedi