The European Commission presented its first strategy to reduce methane emissions since 1996. This strategy detailed measures to reduce methane emissions in Europe as well as abroad and included plans to ban routine flaring and venting practices along and an obligation to improve detection and repair of leaks in natural gas infrastructure. This ruling is very similar to EPAs Quad Oa regulation which also regulates methane emissions and both signal a change in regulatory sentiment around emissions in the oil and gas industry going forward.

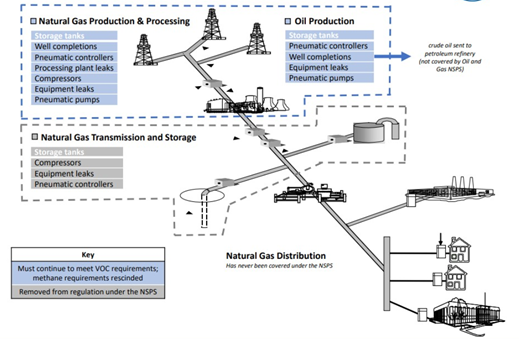

Quad Oa, introduced in 2016, identified compressor stations, pneumatic controllers, compressors, and storage vessels as sources of methane emissions. Emission limitations were placed on those sources under the New Source Performance Standards (NSPS) for volatile organic compound (VOC) and methane emissions across the oil and gas industry which included production, gathering and processing, transmission, storage, and distribution. This regulation included increased leak monitoring, recording, and reporting, as well as adding the requirement of optical gas imaging surveys.

Historically, EPA only regulated VOCs in the industry through Quad O, but due to growing public pressure and increased environmental scrutiny, the EPA took aim at methane emissions across the industry. While the regulations only applied to new or modified sources, it was a wake-up call to midstream operators as Quad Oa opened the path for additional methane regulations in the future. On August 13, 2020 the EPA issued policy and technical amendments, diluting Quad Oa by removing transmission, storage, and distribution sources from the regulation regarding methane, reducing fugitive leak monitoring at gathering and boosting compressor stations from quarterly to semi-annually, and extending the repair window from 30 to 60 days. These amendments are illustrated in Figure 1.

The rolling back of EPA’s methane regulations is currently being challenged by states and environmental groups. Regardless of the outcome, environmental scrutiny will continue to intensify even if the current Presidential administration does not change in November 2020. A change in the administration will likely accelerate methane regulations while regulatory pressure will ease in the short-term if there is no change. Irrespective of what happens on Election Day, public scrutiny, ESG pressure from investors, and the possibility of more stringent regulations from states are driving operators to develop long-term strategies to reduce their environmental footprint.

-Brandon Johnson & Uday Turaga