I gatecrashed an oil and gas conference in India as a grad student in the mid-1990s where India’s then Petroleum Secretary, T.N.R. Rao, while discussing the difficulties of the business lamented, “Cigarettes and beer make more money for gas stations than fuel sales.” The technically sophisticated oil and gas industry has always snickered at consumer businesses. This became evident in the 2000s when nearly every major company worth its salt more or less exited their positions in the fuel retailing part of the value chain citing inferior returns from that segment relative to exploration and production, pipelines and LNG, and refining.

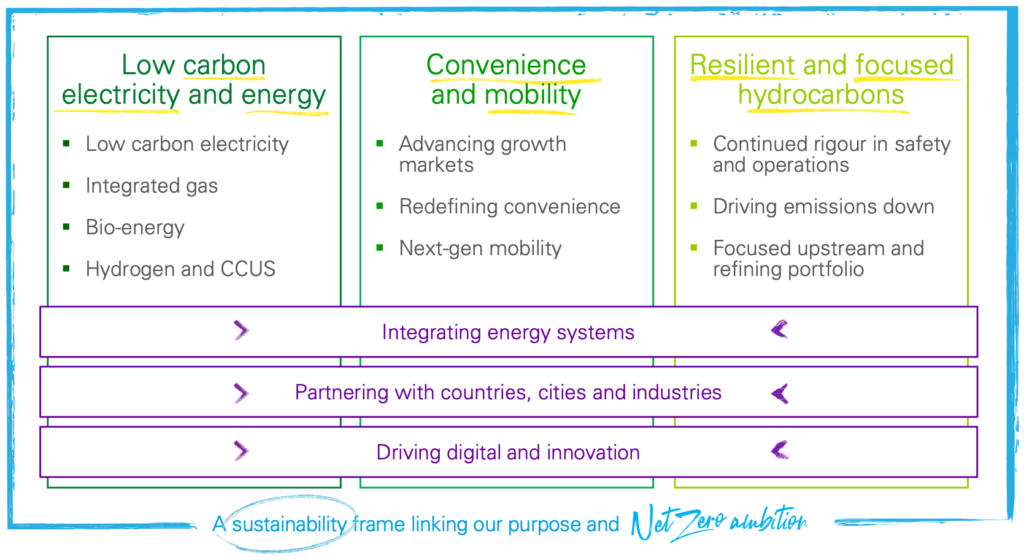

Oil and gas is turning full circle because BP’s new CEO, Bernard Looney, recently reminded us in an interview that the company sold 150 million cups of coffee in 2019. More significantly, BP’s strong footprint of retail fuel stations will enable its Convenience & Mobility business segment — along with the new Low Carbon Electricity & Energy business segment – to drive growth for the company as it pivots away from its primary focus on oil and gas (see Exhibit 1) to a net-zero goal by 2050. This was one of several highlights from BP Week – the company’s equivalent of an Analyst or Capital Markets Day – which concluded last week in London.

There is extensive news coverage of the details associated from BP Week, and this blog post is focused on highlighting a few takeaways that we thought were strategic and insightful.

1. BP’s new strategy is based on the assumption that oil demand will peak in the 2020s driven mainly by policy interventions that will be more supportive of decarbonization that seen until now. In other words, BP’s management is convinced that the policy climate globally will be more difficult for a business-as-usual scenario to continue.

2. BP plans to deliver its historical 8% to 10% returns through a set of strategies tailored to each of its business segments. BP Week has, to its credit, clearly articulated this strategy, and, to a large extent, also presented a plan that investors and analysts see as feasible.

- High grade its oil and gas production as it falls to the projects with the best returns – or “value over volume” as it calls it. We see this as feasible and achievable.

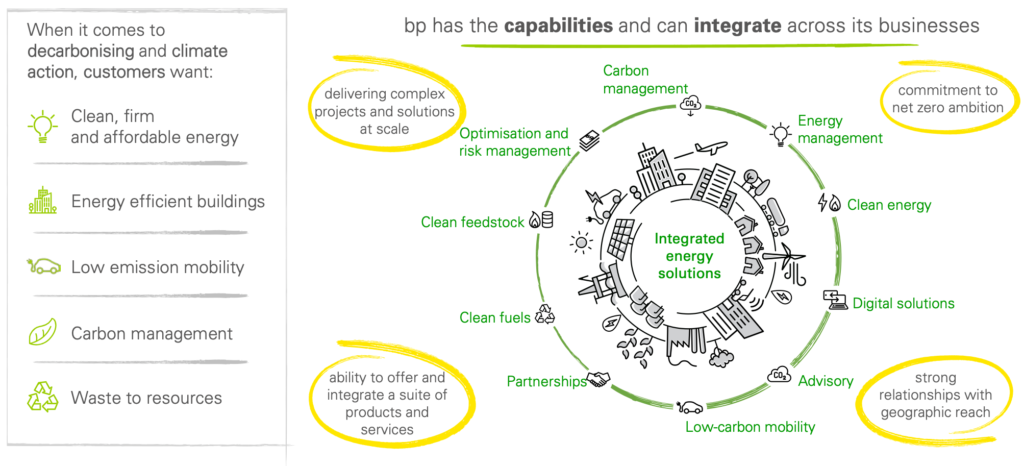

- The biggest risk is to the target return profile is with Low Carbon Electricity and Energy business that BP seeks to scale to 50 GW by 2030. Most renewable power projects have returns of 5% to 6% that can be improved by 1% to 2% with debt and financing that can be achieved by BP. BP’s longstanding expertise with operations and expertise can further improve returns by up to another 1%. The last incremental 1% to 2% return that is needed to break into the 8% to 10% range BP thinks will come from integration. BP’s integration strategy has two key components. The first is by exploiting its strong commercial trading capabilities that has historically enabled many oil majors to expand returns. The second integration component is what will need to be proven although it is novel and clever. BP believes that segmenting the market and focusing on 10-15 large cities and major corporation in a handful of industries — that will value an integrated suite of low-carbon electricity and energy offerings including fuels, electric vehicle infrastructure, energy efficient buildings, waste-to-energy, and other products and services. This is innovative strategic thinking but will need to be proven as most industry sectors and companies that focus on serving municipal customers typically struggle with returns and growth.

- The Convenience and Mobility business segment includes the fuel retailing, lubricants, and other growth offerings such as next-generation mobility. A number of these businesses have enjoyed returns as high as 15% to 20%. Retaining and potentially improving profitability of these businesses is quite likely.

3. BP is, however, not alone in this journey even if the degrees of pivoting may vary. Shell, Equinor, and Total are also pursuing shifts of their own. All of these companies will join the increasingly competitive pursuit of low-carbon electricity and energy projects globally. Such competition for the best projects will, invariably, impact returns and potentially threaten the strategic playbook BP is pursuing.

4. Further, BP’s financials worry a number of analysts. Its debt is too high, capital spending for the low-carbon electricity business is likely insufficient, and free cash flows from its existing suite of oil and gas operating assets are more dependent on oil prices than for some of its peers. As a result, there are real concerns around BP’s ability to effectively fund this pivot.

5. Even so, BP has presented an admirable narrative and strategy that will serve as an effective template for other majors as they explore the pivot to energy from oil. BP Week has demonstrated a path that can be navigated even if there are critical challenges. In the recent past, shareholders have started rewarding other companies – Neste and Orsted are good examples — that have attempted similar shifts fairly quickly in their journeys, and BP is likely betting similar support as it moves forward.

ADI’s research and consulting teams are supporting a wide range of clients – oil majors, independents, investors, oilfield service providers, and industrial companies – with understanding the energy transition and navigating it with insightful market research, strategic plans, scenario planning and war games, and technology roadmaps. Reach out to us to learn more and discuss how ADI can help you address critical problems in oil & gas, energy, and chemicals.

– Uday Turaga