Halliburton recently launched its own technology incubator joining the ever-growing list of companies that are utilizing the start-up accelerator model as an innovation strategy. Such accelerators can help start-up participants with access to the corporate sponsors’ facilities, technical expertise, industry networks, distribution channels, and customers. Halliburton Labs will certainly offer such benefits to its participants but the parent company is an oilfield services industry leader while the goal of the Labs initiative is to pursue alternative energy investments. While the initiative could provide Halliburton access to early-stage innovators in and around energy transition, it has to be seen how Halliburton’s capabilities can benefit participants focused on energy transition in the Labs initiative.

This initiative by Halliburton puts in sharp focus the challenging medium- to long-term outlook for oilfield services. As their largest oil and gas customers initiate plans to decarbonize and pivot away towards the energy transition, oilfield service companies will have to begin making changes to their mix of target markets, offerings, capabilities, and business models. In 2020 year-to-date returns, oilfield service companies have lost more than 50% of their market capitalization. Some sub-sector such as offshore oil and gas drillers have lost far more and as much as 80% during the course of the year. In comparison, their primary customers, oil and gas operators lost only a little more than 40% in market capitalization so far in 2020. That investors have penalized oilfield service companies more than their operators reflect the concern that pivoting away to energy transition will be far harder for the former in comparison to the latter.

Through ADI’s consulting and research work in supporting oilfield service companies explore and initiate strategies toward energy transition, we see six major takeaways as summarized in Exhibit 1.

Exhibit 1. Key takeaways on oilfield services in the energy transition.

First, is a strong level of messaging on digital investments including data analytics, machine learning, remote operations, and automation. While we see this as an effective tool in improving the competitiveness of oilfield service operations and offerings with the potential to cut costs up to 30-40% in some segments, they are unlikely to create any long-term material competitive advantages that position oilfield service companies for the energy transition.

Second, oilfield service companies have announced plans to cut greenhouse gas emissions from their own operations. For example, Baker Hughes seeks to have net-zero emissions by 2050. Having said that, it must be recognized that oilfield service companies’ operations have a small impact on the overall carbon intensity of the oil and gas industry but limited initiatives in this area could negatively impact investor perceptions.

That a number of oilfield service players already have reasonably strong capabilities around broad energy transition themes is a third finding. For example, Halliburton and Schlumberger both have strong capabilities that can support geothermal energy projects. Similarly, Baker Hughes has been a leader in the natural gas value chain with dominant market share with their compressors in the LNG liquefaction market. Finally, integrated and diversified player such as Technip FMC bring EPC capabilities that can be used for large hydrogen production projects although they are considering a split of these organizations.

Fourth, oilfield services is a broad and heterogeneous market with a wide range of companies, competencies, and offerings. In a recent project, ADI surveyed and assessed 60+ oilfield service and equipment categories and addressed their relevance in an energy transition world. Our work found that the shift to energy transition will be mixed with some segments and companies – e.g., those selling subsea electrical equipment — faring well, and others – e.g., high-pressure pumping services — really struggling.

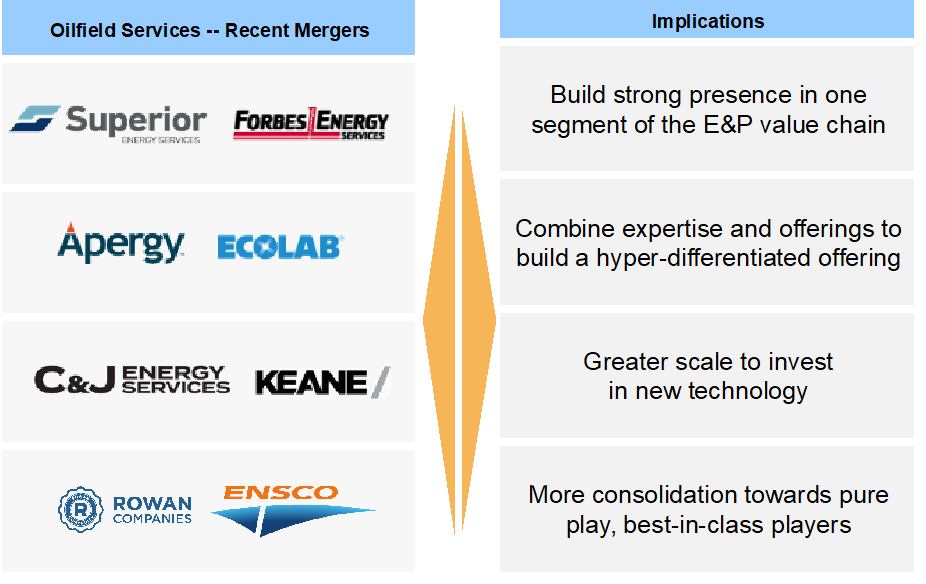

Fifth, navigating the energy transition will need deeper and thoughtful understanding of how the value chains will evolve and what competencies will be necessary. Further, the path towards attaining these competencies may involve M&A strategies that first strengthen positions in the traditional oil and gas markets itself. We have already seen some of these trends in the M&A activity over the past year. Exhibit 2 – discussed in detail at the 2020 ADI Forum — shows some transactions that have occurred in the past year and reflect, among other things, a strong preference for deeper specialization in a segment as opposed to broader offerings.

Exhibit 2. Recent oilfield service consolidation has trended towards specialization.

Finally, oilfield service companies will have to make substantial and material investments to prepare themselves for the energy transition. All of this will require significant capital and robust balance sheets that few can boast of in this environment. As a result, creative deal making and financing structures are likely to prepare oilfield service companies for a new, very different future.

Please contact us to learn more about ADI’s work in oilfield services and preparing them for the energy transition

– Uday Turaga