Phillips 66 is planning to convert its San Francisco refinery in Rodeo, California into a plant that by starting 2024 will mainly produce renewable diesel along with some sustainable gasoline and jet fuel. The Rodeo refinery already has an existing renewable diesel project underway that is expected to be completed by 2021 and both projects together will transform the company’s San Francisco refinery into the world’s largest renewable diesel facility with ~389,000 barrels per day (bpd) of capacity.

However, Phillips 66 is not alone in the recent race to grow renewable diesel capacity. Marathon Petroleum also has plans to convert its Martinez, California refinery into a terminal that will include a 48,000-bpd of renewable diesel plant by 2022. In addition, Global Clean Energy converted its recently purchased Bakersfield, California refinery into a renewable diesel plant and has already entered into a fuel supply agreement with ExxonMobil. Other upcoming renewable diesel projects have been announced by companies such as Diamond Green Diesel, Next Renewable Fuels, Renewable Energy Group, Ryze Renewables, World Energy, Readifuels, and Holly Frontier as ADI has reviewed previously.

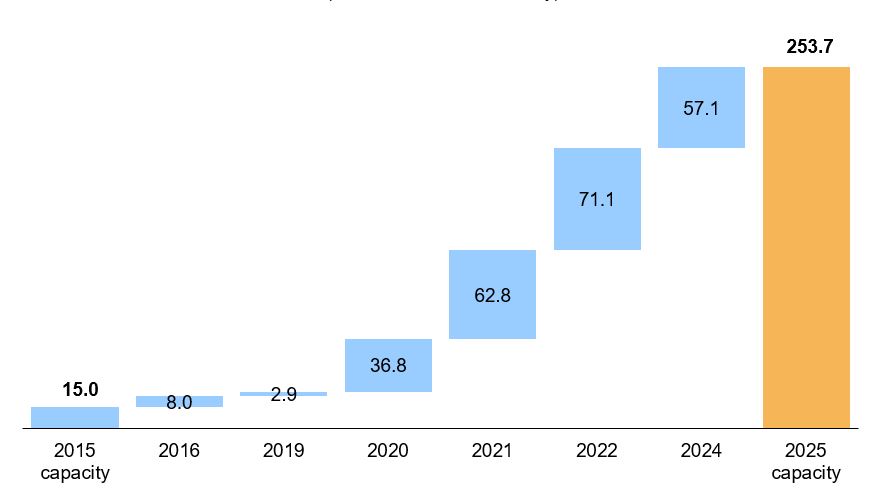

Currently, U.S. renewable diesel demand is met through five existing domestic plants with combined capacity of ~26,000 barrels per day and imports from Singapore that grew by almost 50% last year. In response to this supply gap, U.S. refiners are expected to dramatically grow their renewable diesel production capacity by almost 228,000 barrels per day, a 300% increase over the next five years (Exhibit 1). Most of the U.S. renewable diesel demand is driven by the state of California’s Low Carbon Fuel Standard (LCFS).

California Air Resources Board’s LCFS program has set standards to incrementally decrease the carbon intensity of motor gasoline and diesel fuel by at least 10% by 2020 relative to their 2010 targets. Other states in the U.S. West Coast such as Oregon, Nevada, and Washington are also likely to adopt environmental regulations that will drive U.S. West Coast renewable diesel consumption in the near-term.

Further, federal RIN D5 credits and blenders tax credits generate additional subsidies supporting all the U.S. renewable diesel projects. Renewable identification numbers (RINs) are credits used for compliance with the U.S. Renewable Fuel Standard (RFS) program. Renewable fuel producers can generate and trade RINs to meet their and other obligated parties’ compliance for RINs. Hence, the upcoming renewable diesel plants will minimize U.S. refiners’ expenses tied to both RIN and LCFS credits and generate revenue by selling surplus credits. In addition, U.S. refiners will also be able to capture renewable diesel export markets in Canada that currently purchases the fuel from Europe and Singapore. Export markets for fuels and hydrocarbons will be key to U.S. refining industry’s competitiveness.

In general, exposure to the renewable diesel market segment will help U.S. refiners increase revenues amid depressed fuel demand and falling refining margins for gasoline and diesel. However, the dramatic growth in U.S. renewable diesel capacity can also result in overcapacity. If the domestic and export demand for U.S. renewable diesel lags the capacity build-up, it may quickly create a bottleneck for refiners to find incremental markets for the fuel. Another issue of such a rapid build-out in capacity can be with the procurement of feedstocks. While some companies have already hedged their feedstock needs for renewable diesel capacity, others might struggle in keeping up with their feedstock needs.

In conclusion, renewable diesel capacity growth will continue to gain traction in the U.S. market supported by environmental legislations such as RFS and LCFS, by higher margins through RIN sales and LCFS credits, and through exports potential to Canada and Europe. But there may be challenges associated with feedstock procurement and potential overcapacity in the near future.

ADI has supported numerous clients on biofuel markets. In addition, we have published reports on biofuels and ethanol, along with advising private equity clients on ethanol and renewable diesel markets. Please contact us if you need more information about ADI’s biofuels expertise.

-Swati Singh and Uday Turaga