Lower domestic fuel production coupled with rising fuel demand outlook has led Latin America to increasingly rely on U.S. fuel exports. However several dynamics in the region may pose challenges to these trade flows in the future. First Latin America is witnessing rapid growth in its biofuels production and fuel quality standards supported by regulations, incentives, and pollution control initiatives which will reduce its demand of gasoline and diesel. Second some countries in the region are moving forward with reforms such as privatization of their refineries to facilitate professional management as well as increase regional fuel production. Third Latin American refiners are also planning massive expansions and upgrades of their refineries to boost fuel production and minimize reliance on imports. And finally, potential growth in electric vehicles and alternative fuels supported by government incentives will also continue to put downward pressure on Latin American fuel demand in the medium-to longer-term.

Although Latin America accounts for less than 10% of world’s transport energy demand it has approximately 25% share of global biofuels demand. Latin American countries such as Argentina and Brazil are the two largest biofuels markets in the region. Brazil has introduced a new biofuel policy, RenovaBio, under which the country will require a 10% reduction in transportation-related greenhouse gas emissions by 2028 and have an 18% share of sustainable biofuels in the country’s energy mix by 2030. Further, Brazil’s CNPE (National Energy Policy Council) has recently approved a resolution that establishes guidelines for ethanol producers to sell the biofuel directly to gas stations.

To support inclusion of biofuels in the energy mix, several Latin American countries have had mandates on ethanol and biodiesel blending. For instance, Brazil has a mandate of blending 27% ethanol with gasoline. Argentina which is the world’s sixth-largest biodiesel producer requires 10% biodiesel blending while Brazil currently has 11% with plans to increase to 15% by 2023 through a stepwise approach. Furthermore, Colombia has also increased their biodiesel blending mandate from 10% to 12% over the past year.

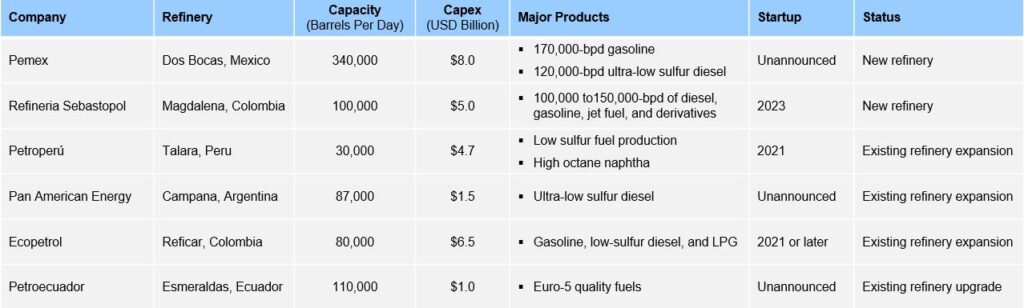

Second several delayed Latin America refinery capacity addition, expansion, and upgrade projects are now gaining momentum (Exhibit 1). For instance, Pemex is investing $8 billion in construction of a 340,000-bpd Dos Bocas refinery in Tabasco, Mexico which will be the largest refinery in the country and will produce 170,000-bpd of gasoline and 120,000-bpd of ultra-low sulfur diesel. Colombia is another country that is investing $5 billion in its new privately owned 100,000-bpd Refinería Sebastopol which will likely begin operation in late 2023. The refinery is expected to produce between 100,000 to 150,000 bpd of diesel, gasoline, jet fuel, and other crude oil derivatives. Peru’s state oil company Petroperú will also invest $4.7 billion to modernize its Talara refinery which is expected to come online in 2021. And Ecuador is planning to launch a tender process for a 20-25 year contract to operate the largest refinery in the country, 110,000-bpd Esmeraldas refinery. With investment of close to US$1bn, the Esmeraldas refinery could produce Euro-5 fuels.

Some of the other refinery expansion and modernization projects in Latin America include Pan American Energy’s $1.5-billion investment in its 87,000-bpd refinery in Argentina, Ecopetrol’s investment of $6.5 billion in its 80,000-bpd Reficar refinery in Colombia, and Repsol’s investment of $4.2 billion in its 100,000-bpd refinery in Cartagena making them some of the world’s most modern refineries. These refinery investments will strengthen Latin American fuel production and potentially create pressure on the region’s fuel imports.

Third a few Latin American countries are also exploring options to divest their refining assets. Brazil’s Petrobras is planning to sell its 323,000-bpd Landulpho Alves (Rlam) refinery to Mubadala Investment as a part of Petrobras’ $20-30 billion sales program to divest half of the company’s refining capacity. Trinidad and Tobago government will sell its 160,000-bpd Pointe-a-Pierre refinery to Pet company due to refinery’s lack of economic competitiveness in the absence of upgrades. In Curacao, state-owned RdK has contracted Klesch to operate its dormant 335,000-bpd Isla refinery which was previously run by Venezuela’s national oil company PdVSA. The Jamaican government has taken over PdV’s minority stake in 35,000-bpd Petrojam refinery in anticipation of a likely shutdown and conversion into a fuel terminal; and Dominican Republic is planning to get rid of its 34,000-bpd Refidomsa refinery. In aggregate, privatization and sale of refineries to players who can operate them more efficiently will definitely help with growing Latin American fuel production and consequently decreased regional fuel imports.

Finally, electric vehicles in Latin America have emerged over the past couple years. In 2018, EV sales grew rapidly by more than 85% with sales continuing to grow in the following year too. Although Latin America accounts for only ~ 1% of global EV sales, government tax incentives such as tariff exemptions and value-added tax exemptions coupled with targets for pollution mitigation and cost efficiency have increased prospects for the region’s EV adoption in the medium-term. Pilot programs for electric taxis and buses, local manufacturing of electric micro-cars, BEV carsharing and car rental services, EV carsharing initiatives, and ICE-to-BEV retrofitting start-ups are some of the key themes that will support EV sales in Latin America going forward.

While Mexico and Brazil are expected to be the largest EV markets in Latin America, Colombia and Chile will witness the fastest growth. Some of the major Latin American countries’ EV-related government initiatives were in countries such as Mexico, Brazil, Argentina, Colombia, Peru, Uruguay, and Ecuador. Mexican government is offering exemption from the tenure tax – tax related to the ownership of vehicle and the ISAN tax – federal tax on new cars.

Further, as a part of Mexico’s trade agreements, EV car imports from its main partners are tariff-free. Mexico is currently proposing additional incentives for electric vehicles. Brazil is providing tax exemptions for hybrid and electric vehicles. Companies and professional drivers in Brazil are now exempt from IOF tax when financing the purchase of electric and hybrid vehicles in the country regardless of horsepower. Imposto sobre Operações Financeiras (IOF) is a Brazilian tax applied on some financial transactions, including foreign exchange, loans, insurance, investments, and securities. The tax benefit saves almost 3% per year on financing. Argentina has also lowered duty on EV cars imports from 35% to 5%, 2%, and 0% depending on the category to promote vehicles powered by renewable energy.

Further, the Colombian government launched the National Strategy for Electric and Sustainable Mobility which establishes that electric vehicle tax rates may not exceed 1% of the commercial value of the vehicle. Peru is planning a regulatory package to adapt the National Vehicle Regulations that will promote electric charging stations across the country. The government is also investing in more efficient cars, preferably vehicles utilizing renewable energy. Finally, Uruguay and Ecuador have announced incentives and financing programs to promote e-bus adoption in local fleets and have some of the largest penetration rates of hybrid technologies over the total market. Such developments in the EV vehicles market will displace some oil-based transportation reducing Latin American fuel demand.

In conclusion, all these four key themes in Latin America fuel market have a high probability of impacting the region’s fuel demand in the foreseeable future which can result in headwinds for U.S. fuel exports to the region. ADI is launching a new multi-client study – “Market Outlook for U.S. Refined Products Exports to Latin America” − which is focused on a comprehensive assessment and forecast of U.S. fuel and refined product exports to Latin America through 2030. The study will address several strategic questions that arise on the Latin American fuel market’s outlook over the next decade including forecast for U.S. fuel exports to Latin America through 2030, opportunities, risk, and competitive strategy that U.S. refiners and traders will need to consider especially post-COVID. Please download the multi-client study prospectus for the ADI study, “Market Outlook for U.S. Refined Products Exports to Latin America”, and contact us to learn more.

-Swati Singh and Uday Turaga