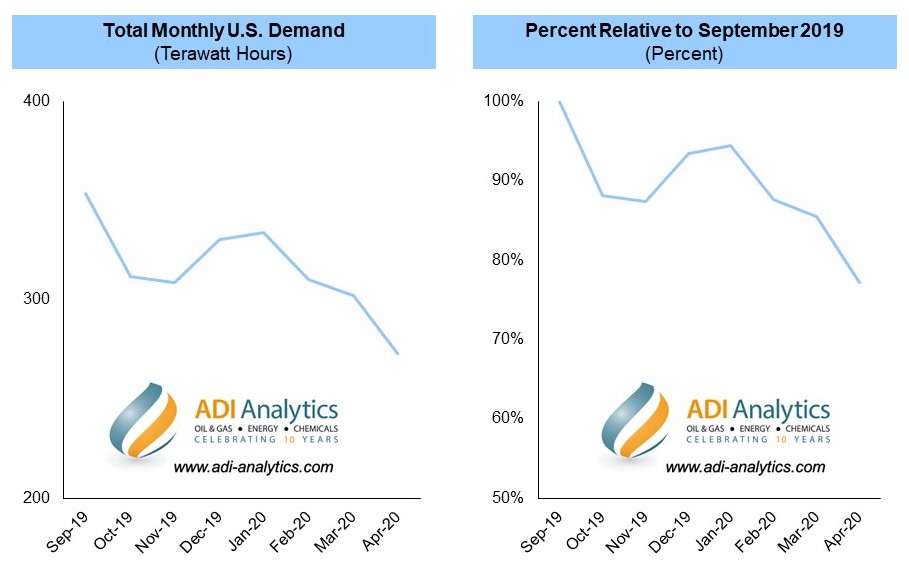

Sweeping impacts across the energy value chain from the COVID-19 pandemic are turning a spotlight now on the corporate and financial performance of various segments. Demand losses at electric utilities have been significant with estimates suggesting a ~5% decline in April 2020 on a year-over-year basis, and as much as 25% when compared to six months ago. Exhibit 1 shows the change in total monthly U.S. demand over the past six months. The annual impact on U.S. electricity demand is forecasted to be a decline of 3% for all of 2020 led mainly by declines in commercial and industrial uses.

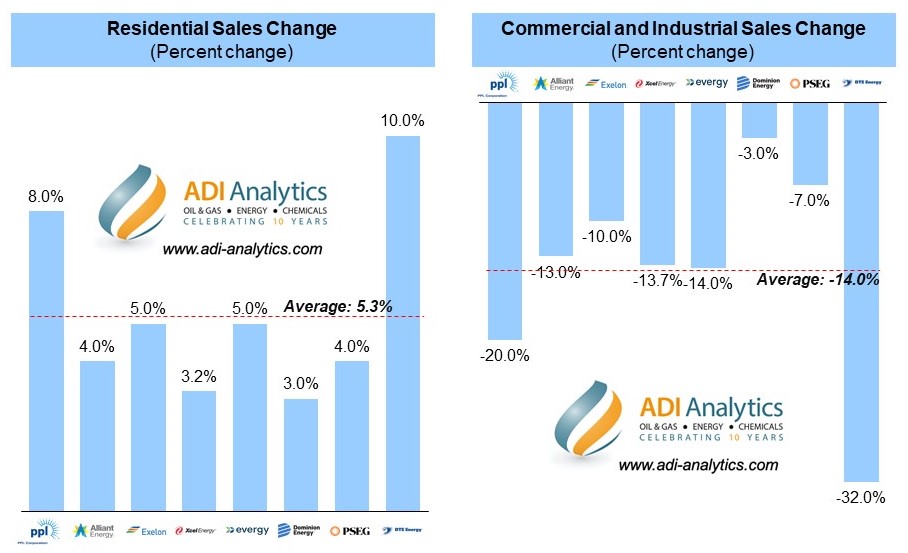

Commercial and industrial sales have fallen by anywhere from 3% to more than 30% as shown in Exhibit 2. The same exhibit, however, shows that, in comparison, residential demand for electricity is doing well. Utilities with a significant presence in residential markets are reporting electric load increases of 3% to as much as 10%. Across a select, illustrative list of utilities, residential sales have increased on average by 5.3%, while commercial and industrial electricity demand has declined by 14%.

Given these significant changes in electricity demand across key demand segments, one wonders what to expect in terms of the financial performance of various utilities. While these are early days – especially with recovery just getting started even as a number of uncertainties loom – our team at ADI has been analyzing and tracking the margin impacts on utilities. Although the demand reductions are significant to make 2020 a difficult year, electric utilities might get away with a limited financial impact especially if the recovery picks up well.

One reason for the limited impact is the margin profile for utilities as illustrated in Exhibit 3. Although commercial and industrial accounts for a significant part of electricity demand, it yields a lower margin in comparison to residential markets. Residential markets support as much as 40% of a utility’s margin, while commercial and industrial customers usually account for only 30% of the total margin. Further, almost 30% of utilities’ margin comes from transmission whose margins are independent of the volume transacted thereby insulating it from the current environment where demand has been declining.

Collectively, although overall sales will decline, utilities may be able to maintain margins through this environment. Even so, utilities have already started reporting an uptick in commercial and industrial demand sooner than expected in some areas, along with encouraging results from strategies to address the challenges from the COVID-19 pandemic. ADI Analytics has been covering these developments and will report on them in a forthcoming blog post.