A third of the world’s population is today living in countries that have enforced moderate to severe lockdowns on virtually all human activity to mitigate the spread of COVID-19. In all, 27 countries have imposed lockdowns with nearly all of them opting for severe measures. Only three countries – Israel, Ireland, and the Czech Republic – have chosen to impose moderate lockdowns. In addition, there are a handful of countries where lockdowns have not been mandated but citizens in caution have voluntarily limited activity.

Download article Locking

Download article Locking

Both the World and Oil Down

How much oil demand is impacted?

These lockdowns are collectively impacting oil demand in an unprecedented fashion. ADI estimates that the 27 countries under moderate to severe lockdown consume ~61 million barrels of oil daily. Including other countries such as Brazil where gangs are enforcing lockdowns, almost two-thirds of global oil demand – ~66 million bpd – is under threat of significant destruction from COVID-19 (see Exhibit 1).

What can we learn from China’s lockdown?

These lockdowns are uncharted waters with little guidance on the extent of oil demand destruction. China is the only example we have of a region that has gone through this crisis before. Transportation data released by the Chinese Ministry of Transport suggests that lockdowns cut ~55% of road transportation and ~33% of truck traffic in February 2020.

How much oil demand will coronavirus destroy?

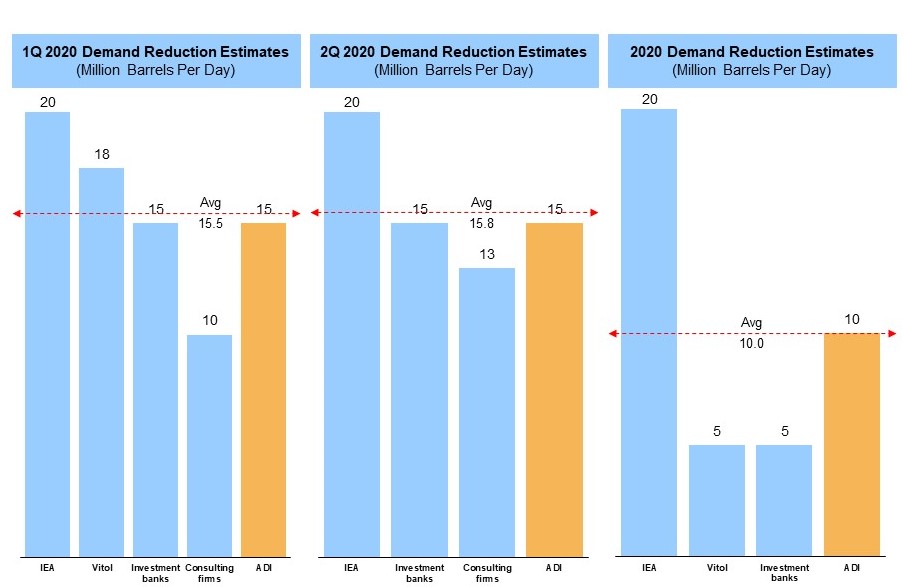

Let us assume that these reductions in road and freight traffic hold across the ~30 countries with lockdowns. You can also believe that 60% of oil use in transportation is via gasoline, and the rest diesel and jet fuel. Given these assumptions, ADI estimates a collective loss in oil demand of ~23%, which when applied to the ~66 million bpd of demand in the locked down countries translates to ~15 million bpd of demand destruction in 2Q 2020.

Our estimates compare well with other estimates as shown in Exhibit 2. But there are significant uncertainties, e.g., will COVID-19 impact all countries the same way as it did in China? Assumptions around the share of fuels in oil demand may also vary. Finally, we don’t address demand elasticity at depressed prices, potential for a quicker rebound or an extended lockdown, and impact of government stimuli.

So what?

- Oil and gas producers will intensify capital cuts to cut growth. Marginal assets such as stripper wells will be distressed, and, in fact, some have already started shutting in.

- The industry will be caught up in a stampede for oil storage, which is underway with limited access to it especially for smaller producers.

- Refiners will likely intensify cuts to crude runs and start ramping down utilization further as fuel demand evaporates.

- Lack of fuel demand will trigger force majeures by oil refiners. Some refiners are invoking force majeures on crude oil purchase contracts for April.

- Significant changes in the product mix should be expected as refiners will try to shift yield toward diesel where demand destruction is expected to be lower than that for gasoline.

- As operators start cutting runs and utilization rates, they are likely to advance turnaround and other maintenance activities although this will vary based on asset type, location, and historical maintenance patterns.

- Petrochemical producers will start evaluating their feedstock mix as refined product prices decline dramatically impacting relative competitiveness of naphtha and ethane for producing olefins.ADI has a new study about navigating oil & gas through this “perfect storm”. The report includes granular forecasts for upstream (shale and offshore), midstream (gas processing, NGLs, and pipelines), LNG, refining, and petrochemicals. Learn more by downloading the study prospectus and contact us at info@adi-analytics.com or +1 (832) 768-8806 to learn more.