As production began on the Guyana coast, ExxonMobil increased its estimate of proven oil reserves in the Stabroek block to eight billion barrels of oil with its 16th oil discovery since 2015. The Stabroek oil discovery is led by ExxonMobil which owns a ~45% stake, and Hess (30%) and CNOOC (25%). ExxonMobil began pumping from the first phase of its project in December 2019 with a daily output of 120,000 barrels, less than five years after the initial discovery was made.

ExxonMobil is developing multiple oil fields in the block and expects to produce nearly 750,000 per day of oil using five floating, production, storage, and offloading (FPSO) vessels in multiple phases by 2025. This is six times more than the current estimated production of 120,000 barrels of oil per day as shown in Exhibit 1. The development phase for Liza Phase 2 and Piyara is expected to begin in 2022 – 2023 although the oil price crash may affect this decline.

Exhibit 1: Oil production potential in Guyana field in thousand barrels per day

Operators in Guyana are set to boost capital expenditure to develop Liza and nearby fields. ExxonMobil will invest ~$22 billion between 2019 to 2030 in the Stabroek field followed by Hess Corporation which will invest ~$15 billion. Operators are planning to invest an additional ~$21 billion in Liza oil field development, followed by Turbot and Payara fields in the next ten years. The capex contribution of operators and capital investments for the development of each oilfield shown in Exhibit 2.

Exhibit 2: Capex contribution of operators and capital investments for the development of each oilfield in Guyana from 2019-2030

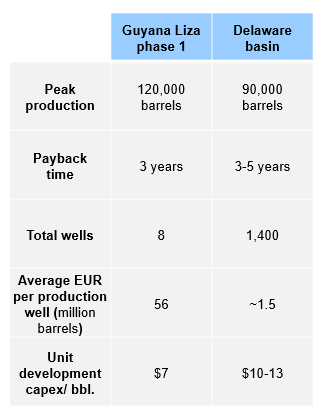

The low development costs and payback time has placed Guyana as one of the most successful deepwater exploration projects in the past few years. The unit development capital costs in Guyana is expected to top $7 per barrel as compared to $12 per barrel in the Delaware basin. Also, the payback time for the project is estimated to be less as compared to North American shale as shown in Exhibit 3.

Exhibit 3: Relative comparison of the Guyana Liza field with Delaware basin in Texas

According to Hess Corporation, Liza oil field has the lowest breakeven cost amongst other similar oil and gas deepwater exploration projects. The breakeven price of $35 per barrel in Guyana is expected to decrease further with improvements in drilling techniques. Exhibit 4 shows the comparative breakeven prices of other deepwater projects and North American shale.

Exhibit 4: Estimated average breakeven prices of crude oil in USD per barrel

Exxon plans to ship two one-million-barrel cargoes of Liza crude in early 2020 followed by similarly sized shipments from Hess and the Guyanese government in February. The first cargo, a Suezmax vessel Yannis P, loaded with about one million barrels of Liza light sweet crude went to Galveston, Texas in January 2020. Liza will be the first Guyanese crude grade produced and offered to the oil market. Exxon plans to process the oil at its refineries in U.S., while Hess could offer it for spot sales. There is a possibility that CNOOC, which has not yet scheduled exports, would ship it to China for refiners using similar medium sweet grades.

The oil price collapse, which followed the early march breakdown of Opec+ talks to restrain oil production and the COVID-19 outbreak, forced ExxonMobil to cut Guyana’s 2020 revenue projections by $300 million. The new projections might force the producers to cut the oil production from Stabroek field for a while.

ADI has done a lot of work across the global upstream oil and gas value chain. We have been following the current global trends in the upstream industry and recently presented the oil and gas outlook for oil for 2020 in our recently concluded ADI forum. Please contact us to learn more.

-Utkarsh Gupta and Uday Turaga