In 2019, U.S. renewable diesel capacity was around 26,000 barrels per day (Exhibit 1) but U.S. refiners are growing this capacity by more than twice with several new renewable diesel capital project announcements. U.S. renewable diesel capacity is expected to grow to 171,000 barrels per day over the next five years with several announced plants and expansion projects.

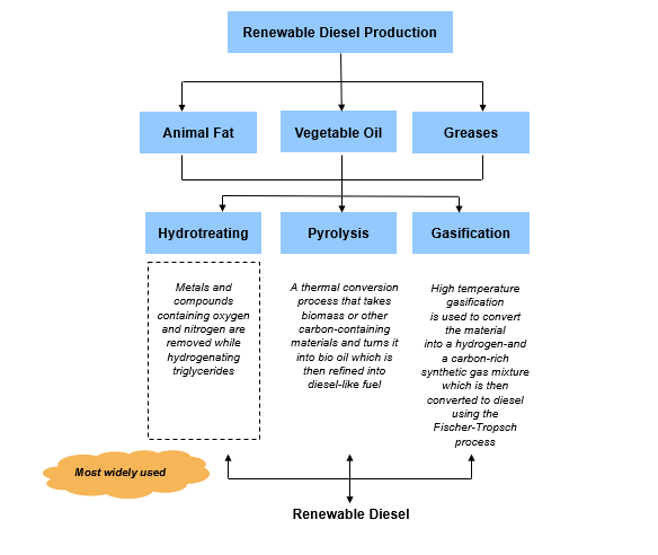

Renewable diesel can be produced using animal fat, vegetable oils, and greases through hydrotreating, pyrolysis, and gasification processes (Exhibit 2). It has higher energy content and produces significantly fewer engine emissions including NOx and PM and can be used directly as a replacement to petroleum diesel in existing engines without any modifications. Further, renewable diesel can be distributed using the existing diesel distribution infrastructure and doesn’t require specialized storage tanks.

Regulatory pressure is the primary driver for the expansion in renewable diesel capacity. U.S. renewable diesel demand is expected to grow dramatically by 2025 primarily driven by environmental regulations both at the federal and state levels. U.S. Environmental Protection Agency has set the Renewable Fuel Standard (RFS) to support biodiesel and renewable diesel economics through provision of tax credits and Renewable Identification Numbers (RINs) for blenders of these fuels.

The tax incentive for biodiesel and renewable diesel which expired in 2017 was retroactively extended through December 31, 2022 under the “Biodiesel Tax Credit Extension Act of 2019” recently. A biodiesel blender that is registered with the Internal Revenue Service (IRS) may be eligible for a tax incentive in the amount of $1.00 per gallon of pure biodiesel, agri-biodiesel, or renewable diesel blended with petroleum diesel to produce a mixture containing at least 0.1% diesel fuel. Further, the RFS program increased the U.S. bio-based diesels’ blending requirements from 50 million barrels in 2019 to 58 million barrels in 2020 and the volumes are expected to increase in the near term. Further, each gallon blended generates a RIN which can be used to meet their renewable volume requirements or can be sold to a third party that don’t have a capability to meet the blending requirements. As renewable diesel generates more RINs than biodiesel for similar blending volumes, the former has attracted more growth from an investment point of view recently.

State-level regulations such as Low Carbon Fuel Standard (LCFS), a market-based incentive program in California and Oregon, seek to reduce the carbon intensity of both gasoline and diesel fuels. California is one of the largest U.S. markets for renewable diesel which has a lower carbon content in comparison to traditional diesel fuel. Under the California LCFS, the state is aiming to reduce the carbon intensity of fuels by 10% in 2020 and by 30% in 2030. Oregon and Washington states are also following California’s footsteps to reduce their fuels’ carbon intensity. Furthermore, similar initiatives by Canada and European countries will also likely support the West Coast renewable diesel exports market going forward.

Finally, the latest regulation by the International Maritime Organization to reduce sulfur level in existing high sulfur bunker fuel oil from 3.5% to 0.5% will also support U.S. renewable diesel demand going forward. Renewable diesel in general has much lower sulfur content and can be used for blending purposes.

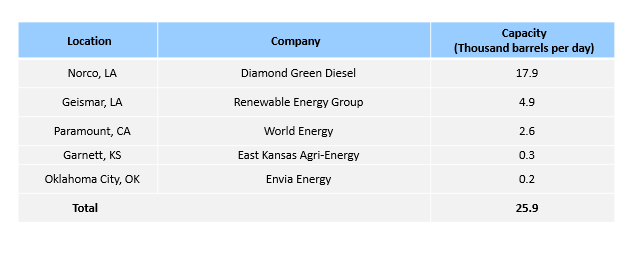

As of 2019, there were five renewable diesel plants with a combined capacity of 25,900 barrels per day with Diamond Green Diesel’s plant in Norco, Louisiana being the largest amongst all with a capacity of 17,900 barrels per day (Exhibit 3). Diamond Green Diesel is a joint venture between Valero and Darling Ingredients.

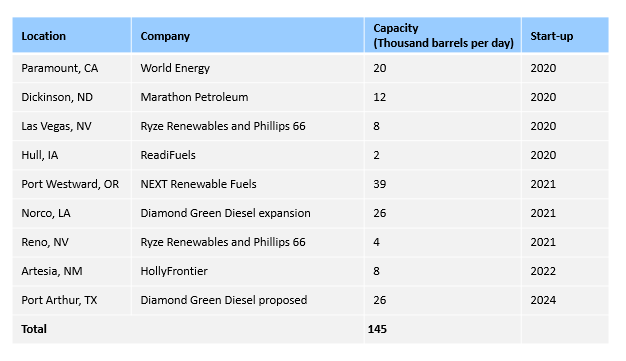

A total of nine renewable diesel plants have been announced so far. One other plant with a capacity of 16,000 barrels per day in Ferndale, Washington ‒ proposed by Phillips 66 and Renewable Energy Group was cancelled recently due to permitting delays and cost uncertainties.

Some of the largest renewable diesel plants planned to be deployed within next five years include NEXT Renewable Fuels in Oregon, Diamond Green Diesel expansion project in Louisiana, World Energy in California, and by Philips 66/Ryze Renewables in Nevada (Exhibit 4).

In conclusion, renewable diesel capacity growth will continue to gain traction in the U.S. market supported by environmental legislations such as RFS and LCFS, by higher margins through RIN sales and LCFS credits, through growing demand for the low sulfur diesel for IMO 2020 mandate, and finally exports potential to Canada and European markets.

ADI has supported numerous clients on biofuel markets. In addition, we have published reports on biofuels and ethanol, along with advising private equity clients on ethanol markets. Please contact us if you need more information about how our biofuels expertise can help you.

‒ Swati Singh and Uday Turaga