Interest in hydrogen for transportation, power, and industrial markets is growing rapidly due to climate change concerns. Conceptually, a hydrogen-based economy can afford significant reductions in carbon emissions. For example, a hydrogen-based economy can lead to dramatic reductions or even complete elimination of carbon emissions especially if hydrogen can be used to power fuel cell vehicles in transportation and if renewable electricity from solar or wind is used for water electrolysis to produce hydrogen. Fuel cell vehicles, which generate electricity onboard vehicles, combining oxygen from the air with stored hydrogen fuel, will only emit water vapor in the environment. However, the technology for producing, storing, transporting, and utilizing hydrogen in various applications needs to improve further both technically and economically.

Join us at the 2020 ADI Forum on January 15 in Houston where Jonathan Crane, Vice President, Wells Digital Deployment, Shell will be speaking on the upstream panel. www.adi-forum.com

Over the past few years, several countries such as China and Germany have implemented policies increasing the role of hydrogen in various applications. These and other drivers will increase demand for hydrogen to around 80 million tons per year by 2020 and over 183 million tons per year in 2050 as shown in Exhibit 1. Asia Pacific is expected to account for the bulk of hydrogen demand followed by North America and Europe.

Exhibit 1: Outlook for world hydrogen demand in million tons per year.

Hydrogen in transportation

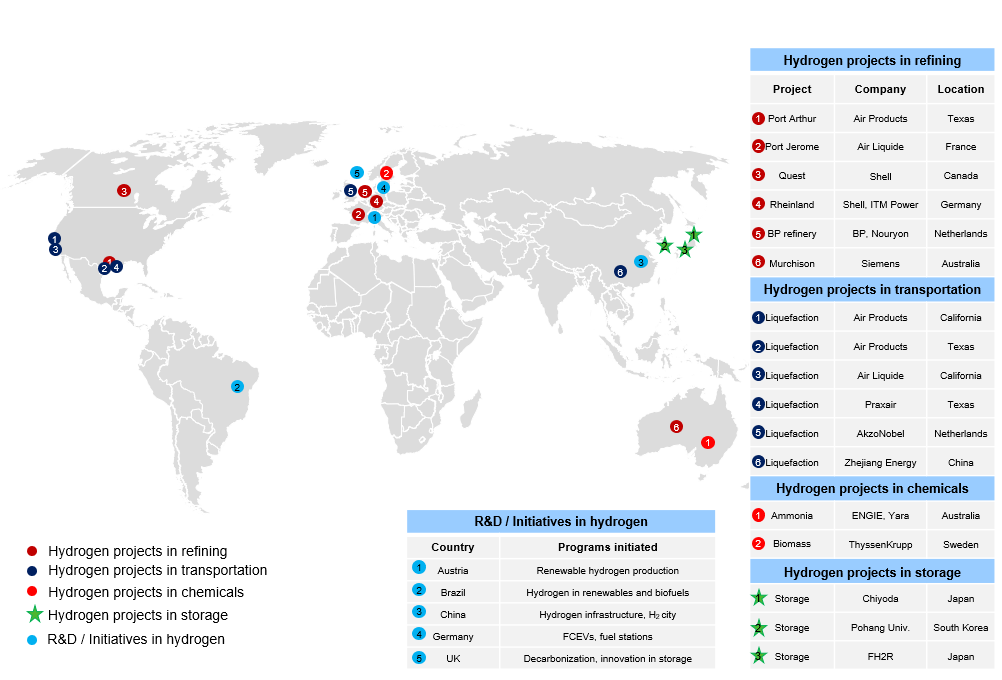

Hydrogen is seen as an alternative to refined oil products and natural gas and complementing other alternatives such as electricity and advanced biofuels. Hydrogen fuel cell electric vehicles (FCEVs), in comparison to battery electric vehicles (BEVs) offer many advantages including lower refilling times, greater vehicle mileage, and smaller volume storage needs. Today, about 34,000 FCEVs are running in North America alone, of which ~10,000 are passenger vehicles and remaining being material handling vehicles, buses, trucks, and light commercial vehicles. The FCEVs market is likely to reach one million units by 2030 in North America. Gas producers such as Air Liquide, Air Products, Praxair and several start-ups have installed fueling stations and hydrogen liquefaction plants. In China, a pilot liquefaction plant is planned to treat 19,200 m3 of hydrogen gas per day to give 1 m3/hr of liquid hydrogen.

Hydrogen in the refining sector

Currently, almost all the world’s hydrogen is supplied from fossil feedstocks in processes that emit CO2, unless the CO2 is adequately captured and stored. Producing hydrogen in a cleaner way is therefore vital to achieving a significant reduction in emissions from refining operations. Against this background, together with sizeable demand already existing today, the refining industry offers a potential early market for low-carbon hydrogen.

Several companies have invested heavily in developing methods to produce carbon-free hydrogen for commercial use. Shell and ITM Power have partnered to build a 10 MW hydrogen electrolysis plant in Germany. BP and Nouryon are jointly assessing the feasibility of a 250 MW electrolysis plant to produce 45 kilo tons of hydrogen per year for the BP refinery in Rotterdam. A list of select hydrogen projects in the oil and gas industry is illustrated in Exhibit 2.

Exhibit 2: Illustrative list of key hydrogen projects in the oil and gas sector.

Hydrogen in the chemical sector

The chemical sector uses hydrogen primarily for ammonia and methanol production. Most of the hydrogen production occurs using fossil fuels, and this generates considerable quantities of greenhouse gas emissions. Measures such as energy efficiency and fuel switching away from emission-intensive fuels, have already been adopted in many chemical plants. Engie, a French multinational company, is assessing the feasibility of integrating 100 MW electrolysis-based hydrogen into its ammonia plant operations in Australia. Thyssenkrupp Industrial Solutions plans to commission the world’s first commercial-scale biomass gasification demonstration plant in Sweden to produce methanol.

Hydrogen in storage

Hydrogen storage is a key enabling technology for the advancement of hydrogen and fuel cell technologies in applications including stationary power, portable power, and transportation. The smooth operation of large-scale hydrogen value chain will depend on adequate capacity and functionality of storage systems. If hydrogen can be used close to where it is made, these costs could be minimized significantly. Several research and development projects are being carried out across the globe. In North America, lightweight composite tanks with high pressure ratings (10,000 psi) and conformability are being developed for compressed hydrogen. For liquid hydrogen storage, improved insulated-pressure vessels are being investigated. The U.S. Department of Energy is working on carbon nanostructures being explored to ascertain possible novel hydrogen uptake mechanisms. In Japan, Chiyoda Corporation is working on developing the SPERA hydrogen system which can be used to store hydrogen for a longer time. Pohang University in South Korea is developing methods to improve hydrogen storage capacity inside the structure formed by water molecules called gas hydrates.

This blog illustrates some of the numerous initiatives and projects that are currently underway as hydrogen gets a new impetus and renewed interest. ADI Analytics has been closely following trends and technologies in the hydrogen economy and we have assisted clients with go-to-market strategies, identified opportunities, and forecasted market. Please contact us to learn more about our research on hydrogen.

-Utkarsh Gupta and Uday Turaga