The energy transition is the journey from a fossil-based to a carbon-free energy system. In order to achieve the energy transition, utilities must strive towards 100% electrification. Advocacy groups such as the Sierra Club have been pushing for decarbonization and are collaborating with cities and utilities to enact regulations and implement best practices in sustainability and clean energy. Looking historically, the mix of energy sources in the U.S. has changed. Once nuclear and hydropower played significant roles for U.S. utilities but now coal-fired and natural gas-fired power lead the way. Renewables are likely next in line and the closure of coal-fired power plants, declining cost of renewables, and improved battery storage technologies are will accelerate capacity growth.

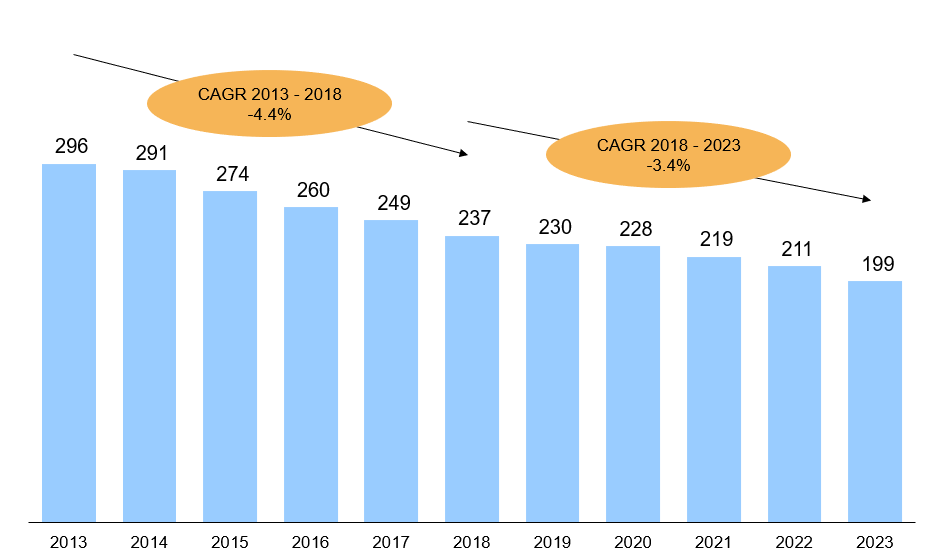

Coal, once the dominant fuel source for utilities, has seen significant capacity declines as shown in Figure 1. Coal plant retirements are related to a mix of economics mainly but also environmental regulations. While U.S. coal-fired capacity from 2013 to 2018 declined 4.4% annually, we expect capacity to decrease 3.4% annually going forward through 2023. Past retirements focused on older and less profitable plants, while projected coal-fired power plant closures will be smaller and less efficient plants. On average, coal plants that retired from 2013 to 2018 were 63 years old and had a capacity of 473 gigawatts. Expected closures from 2019 to 2019 will be of plants that are on average 45 years old and have a capacity of 287 gigawatts.

Historically as coal fired generation capacity has declined the average capacity factor has declined as well. The capacity factor is the percentage of plant capacity actually used. Utilization of coal plants is declining due to poor economics and regulations as coal is increasingly being relegated to daily and seasonal load following as natural gas has become the preferred baseload resource. Although natural gas prices increased in 2018, coal-fired production declined due to the growing cost competitiveness of wind, solar, and energy storage. As demand remains flat and coal plants continue to retire, utilities are left with a hole to fill in their generation capacities. This void can be filled with either a natural gas-fired power plant or with some combination of wind, solar, and energy storage. In the short-term this solution has been natural gas, which has better economics and is a much cleaner solution.

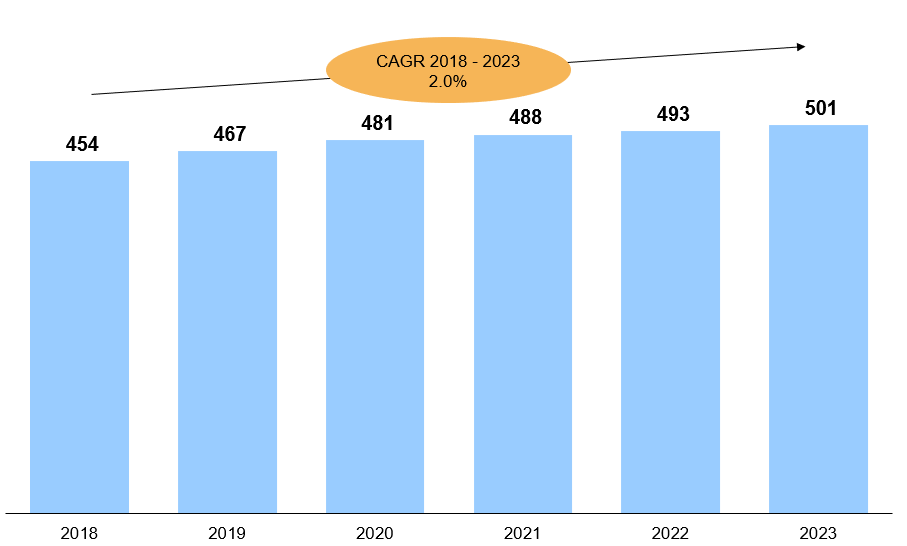

As coal-fired power capacity retires, natural gas-fired power capacity has increased. Natural gas-fired capacity factors are increasing at a faster rate than natural gas-fired power capacity. Currently natural gas-fired power generation capacity is 467 gigawatts and we expect capacity to grow moderately to 500 gigawatts by 2023 as shown in Figure 2. While natural gas is believed to be a bridge fuel from coal to renewable energy, and natural gas sustained lower pricing has helped, utilities and local governments are nevertheless working together to phase out fossil fuels. Long term, natural gas-fired power generation may experience a similar fate as coal-fired power generation as many utilities are shifting away from fossil fuels. As a result, it is becoming increasingly difficult for utilities to secure the capital necessary to build a natural gas-fired plant as many investors are no longer thinking of just 20-year-investments.

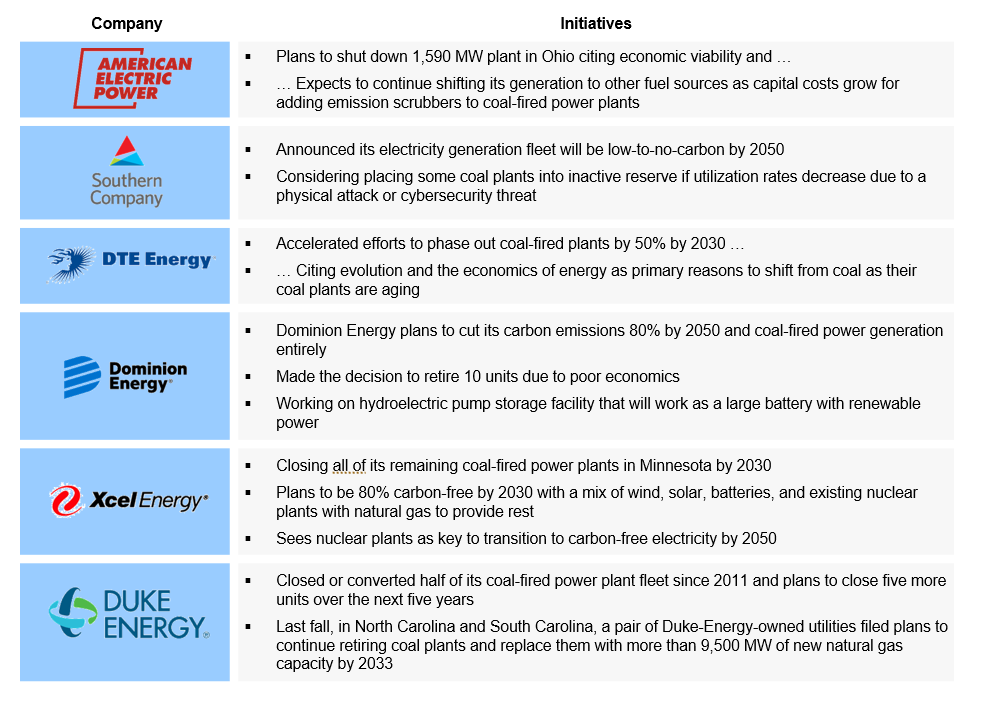

Utilities who were once reluctant are now endorsing the energy transition and are working with local governments. Many states have began pushing for 100% electrification over the next 20 to 30 years and utilities have began preparing long-term for a low carbon, coal-free future. A list of initiatives from utilities regarding the energy transition is shown in Figure 3. First it was wind then solar but now battery storage has become a larger part of the discussion when it comes to the energy transition. In order to achieve the energy transition, cheap energy storage solutions are needed as wind and solar power are variable and cannot be turned on and off, or up and down. Cheaper energy storage solutions will smooth and balance out these fluctuations, making renewable energy more reliable. Renewable energy power capacity and capacity factor have been increasing significantly and will continue to do so as find ways to increase their capacities and utilization.

The complete electrification of the grid is still many years away but adoption will grow as technology evolves leaving a bleak future for the role of coal-fired power generation. Natural gas demand will likely remain robust as utilities will utilize it as a backup or supplemental fuel to renewables. Regulations and the looming energy transition are forcing utilities to seek new solutions, creating opportunities for renewables and energy storage equipment and technology providers. Significant investments are needed in order to move towards the energy transition and regulators, utilities, investors, and technology providers have to develop a deep understanding of this market, emerging opportunities, and strategies on how to be on the forefront of the energy transition

ADI has been supporting clients on this topic. Please contact us to learn more about our experience and how we can be of support.