Silicone is a vital polymer as it is used as a raw material to manufacture lubricants, adhesives, sealants, and electrical and thermal insulation. End use markets include construction, electronics, medical, personal care, and automotive. There are two types of moldable silicone raw materials, liquid silicone rubber (LSR) and high consistency rubber(HCR). In recent years, the market for siloxane, a key ingredient in silicone has been constrained which has led to extended lead times and increased pricing for silicones, significantly impacting the global supply chain.

Siloxane capacity has been constrained as facilities have been subject to environmental regulations, work stoppages, and complete shutdowns, and producers have been slow to add capacity and in some cases have taken supply out of the market. Nearly 10% of global capacity has been taken off line since 2010. For instance, in China, facilities with high pollution levels are facing shutdowns by their environmental protection agency. Wacker Chemie, the leading silicone supplier suffered a mechanical breakdown at its Burghausen, Germany facility causing stoppage, and Momentive Performance Materials Inc’s facility in Leverkusen, Germany shut down, taking 80,000 tons of siloxane out of the market.

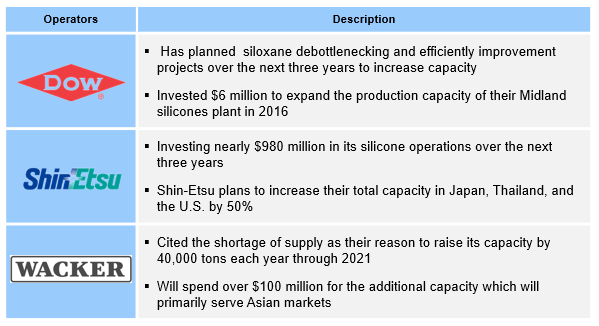

New capacity is on the way as there were a few announcements made in 2018 from Dow Chemical, Shin-Etsu Chemical and Wacker Chemie as shown in Figure 1. Dow Chemical is planning to invest in its upstream and downstream silicone business through debottlenecking improvements and other initiatives through 2021. Shin-Etsu Chemical is investing nearly $980 million in its silicone operations over the next three years. Wacker Chemie is planning to gradually raise its capacities by 40,000 tons each year through 2021. Even with these announcements of additional capacity, end users are still concerned as it will take years for the capacity to come on line, constraining the market through at least 2020.

Historically, global silicone demand has risen on pace with GDP, but growth in the medical, pharmaceutical, and construction industries has outpaced GDP growth. Suppliers have found difficulty meeting this surge in demand as there has not been any investments made in plants or infrastructure upgrades over the past decade. The surge in demand along with the shortage of siloxane supply has caused a rapid rise in siloxane and silicone pricing. Prices have been fluctuating and suppliers have increased prices as much as 15%, significantly more than the normal 3 – 6% per year.

Constraints in supply for the foreseeable future are causing end users to either purchase excess or adopt alternative materials. Buyers are purchasing as much as they can to ensure inventory and many have had to increase storage capacity. Many are reluctant to adopt alternative materials as silicone outperforms other materials, but some companies have began adopting alternative materials such as EPDM as they are cheaper and more abundant. The silicone market is tight and will likely remain tight through mid-2020 until additional capacity comes on line. Until then, prices will remain at historical highs, end users will either purchase excess or adopt alternative materials, and suppliers will be more selective in who and where they sell their materials.

ADI Analytics closely tracks and analyzes global polymer markets including, supply and demand, pricing, feedstock, end-use applications, technologies, and regulations. Learn more about how ADI Analytics helps clients improve their strategy, operations, and technology here.