Downstream oil and gas margins and returns, especially for refining, have shown some volatility this year. This has led to concerns among investors who are questioning whether the traditional stability seen in those segments has run its course. Such concerns are overblown, and the volatility seen in the past few months is primarily due to planned and unplanned outages and well within the historical range we have seen for downstream and chemicals.

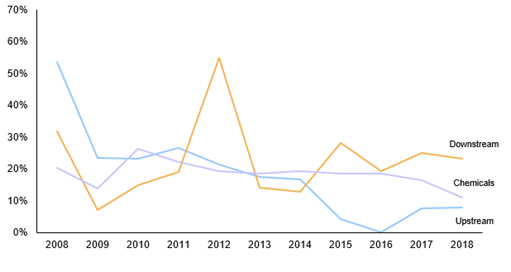

As an example, we look at return on capital employed (ROCE) for various business units at ExxonMobil in Exhibit 1. It is clear that downstream and chemical businesses demonstrate fairly stable performance albeit with some volatility in a few years. In comparison, upstream demonstrates higher volatility accentuated, of course, by a difficult oil price environment.

Even so, drawing conclusions for an entire industry segment by looking at returns of one company is fraught with uncertainty. Supplementing such data with fundamentals-driven analysis of the industry — as we do every month for the ADI Downstream Market Advisory — will reveal that consistent demand growth in markets for refined products and fuels coupled with reasonably stable industry structure should lead to stable returns thereby driving companies such as ExxonMobil, Chevron, and national oil companies to make new investments in refining and chemicals.

– Swati Singh and Uday Turaga