As discussed last month, polymers are increasingly designed keeping very specific properties in mind. Thus, multi-layered polymers are often required when multiple properties are needed in a single structure. Depending on the type of polymer used for the targeted properties, tie layer resins are often required to produce these multi-layered structures. Exhibit 1 below shows the adhesion characteristics of different polymers, which play a key role in choice and use of tie-layer resins.

Exhibit 1. Adhesion characteristics of polymers

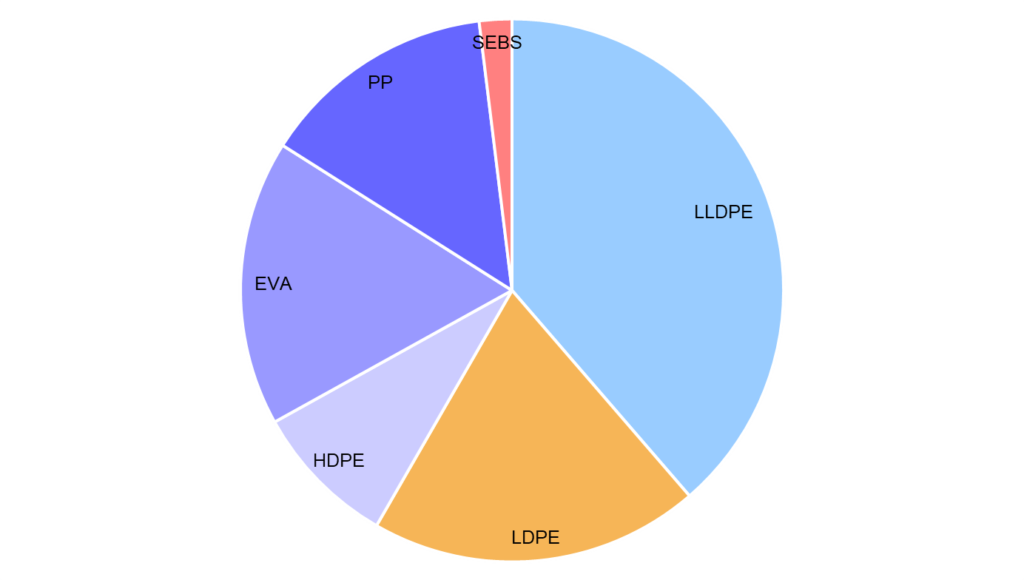

Tie layer resins can be categorized based on the base resin used in their composition, namely LLDPE (linear low density polyethylene), LDPE (low density polyethylene), HDPE (high density polyethylene), PP (polypropylene), EVA (ethyl vinyl acetate) or SEBS (styrene- ethylene- butylene-styrene). Tie layer resins that were initially introduced for flexible packaging applications used LLDPE as a base resin. With tie layer resins finding application in other areas as discussed in the previous blog, LDPE, HDPE, PP, EVA and SEBs are increasingly used. Exhibit 2 shows breakdown of the North American tie layer resin market by base resin.

Exhibit 2. North America tie layer resins market breakdown by base resin type in 2019

LLDPE-based tie layer resins are most widely used mainly in packaging and automotive gas tank applications. They have replaced EVA- and LDPE-based tie layer resins owing to their better adhesive properties, product consistency, strength and dimensional stability.

LDPE-based tie layer resins have a low melting index and are, therefore commonly used in blown film applications for their bubble stability properties. They are also used in cast and sheet applications. They are also clear of taste/odor characteristics and compete with LLDPE- and EVA-based tie layer resins for packaging applications. They also compete well with SEBS-based tie layer resins.

The key features and applications of various tie-layer resins are discussed in the 2019 Global Tie-Layer Resins Market Assessment that ADI Chemical Market Resources has just released. The report covers market size and segmentation by region and product type, key players and their competitive positions, growth opportunities, and strategic implications. You may download the study prospectus and contact us at info@adi-cmr.com or +1 281 506 8234 to learn more and subscribe.

By Uday Turaga and Panuswee Dwivedi