Saudi Aramco, the Saudi Arabian state oil company is the world’s largest integrated oil and gas company. It recently disclosed its financials for the first time providing great insight into its footprint, economics, and financial and operational performance. This recent transparency is driven by a desire to better integrate the company with global financial markets to fully exploit its enterprise value amid growing uncertainty around the outlook for oil and fossil fuels.

In 2018, the company produced 13.6 million barrels per day of oil equivalent with a net income of $111 billion which was more than the combined incomes of the oil majors – Shell, ExxonMobil, Chevron, Total and BP. The company has a gross refining capacity of 4.9 million barrels per day which will presumably increase to 5.6 million barrels per day by the end of 2019. Saudi Aramco’s revenues primarily consists of sales of crude oil, natural gas, refined products, petrochemicals products, and services provided to third parties, joint operations, joint ventures, associates and government agencies, such as the operation and maintenance of facilities for third parties.

However, Aramco’s revenues have a heavy tax burden as the company pays a 50% income tax on its profit, plus royalties at 20% of revenue that may go up with an increase in oil prices. The company’s tax burden aims to pave the way for increased domestic and international investment, promote national economic diversification programs, and create job opportunities in alignment with the country’s Saudi Vision 2030.

In line with its stated statement goals, Saudi Aramco recently announced a deal worth $69.1 billion to acquire a 70% stake in the Saudi petrochemical company, SABIC from the Public Investment Fund (PIF). The company raised $12 billion from its debut international bond issued in April 2019 with maturities ranging from three to thirty years to help raise funds for a down payment on the SABIC deal which will increase petrochemicals production in its downstream value chain.

In Europe, Saudi Aramco completed acquisition of the remaining 50% stake in Netherland-based Arlanxeo, its joint venture with the Lanxess, becoming its full owner in December 2018. The deal was worth $1.68 billion. In Asia, the company is interested in building a $10 billion refining and petrochemical complex in China. Aramco recently set up a joint venture with two Chinese companies to develop a facility in Liaoning province and will supply as much as 70% crude needed by the new complex, which includes a 300,000 barrels per day refinery, an ethylene cracker and a paraxylene unit. Further, the company is also planning to invest $1.6 billion in purchasing a 17% stake in South Korea’s Hyundai Oilbank, a subsidiary of Hyundai Heavy Industries, and a petrochemical complex in Malaysia. Furthermore, Aramco is in talks to acquire a 25% stake in Reliance Industries’ refining and petrochemical business in India.

Within the Kingdom, Aramco is planning to buy Shell’s 50% stake in the 305,000 bpd SASREF joint venture refinery in Jubail, Saudi Arabia for $631 million. In addition, the company is also interested in expanding the Jafura gas plant in Saudi Arabia next year which will produce a combined 3 Bcf of sales gas, ethane, condensate and natural gas liquids over the next decade. To support these projects, Aramco will spend $16 billion on contracts with small and medium-sized enterprises.

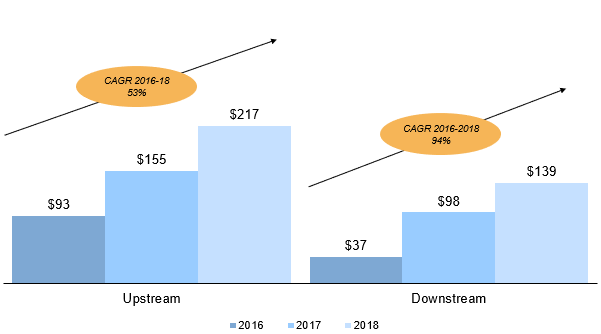

The company’s downstream revenues have grown by almost 94% since 2016 (Exhibit 1), and Aramco is strongly focused on further integrating its chemical business with its refining operations through debottlenecking or new assets. The company aims to increase its presence in developing and new markets as a part of its long-term growth strategy to capture additional margins, balance refinery systems production, reduce margin volatility and increase production of higher-value chemicals and specialty products. In November 2018, Aramco’s chief executive Amin Nasser said the company will spend $500 billion over the next 10 years to expand internationally, with a fifth of the total amount allocated for petrochemical projects and $160 billion for natural gas projects. In addition to this, Aramco is also interested in spending billions of dollars to acquire natural gas assets in the U.S. and become a global gas player going forward.

In summary, Saudi Aramco is focused on growing its downstream business in refining, petrochemicals and natural gas production and capture growth opportunities in these areas. The company is investing heavily to maximize its global downstream portfolio and is likely to emerge as a leader in the refining and petrochemical business across the world going forward.

ADI’s Downstream Market Advisory, a monthly subscription service looks at trends in refining and petrochemicals. We have been following the refining industry closely evaluating refiners’ upcoming projects, capital spending, operating costs, fuel demand, crack spreads, fuel prices and, outages. Contact us to subscribe to the Advisory.

– Swati Singh and Uday Turaga