In the previous blog, we discussed about the key drivers and upcoming trends in Permian basin which includes increase in proppant intensity, pipelines bottlenecks and recent mergers and acquisitions to improve acreage positions. In comparison, Bakken operators are more focused on improving completion techniques and optimizing frac design to improve well productivity.

Production growth in the Bakken is attributed to improved economics from service cost reductions and enhanced stage spacing designs. Though wells have long centered around 10,000 feet laterals, operators are increasingly centering proppant loads between 700 and 1,200 lbs. per foot and utilizing roughly 4.5 to 5.5 stages per 1,000 lateral feet.

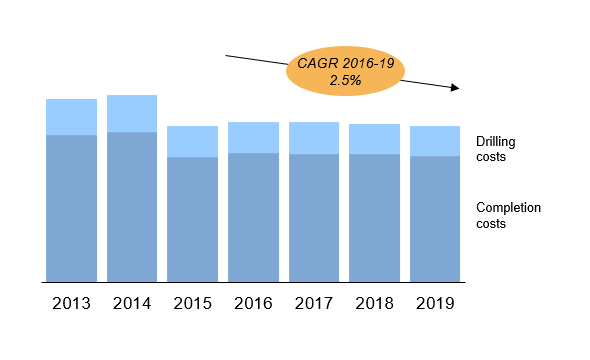

Remarkable growth in Bakken oil production is largely fueled by the play’s dominant players such as Hess, Continental and Whiting. Most of the big players have increased their capital expenditure budgets for 2019. Hess is investing $1.4 billion in 2019 in Bakken to improve well economics and peak production rates. Influx in capital will be used to help shift to higher intensity plug-and-perf wells and increase stage spacing. Enhanced completion designs have played a key role in lowering breakeven costs for the Bakken, which is about $48 per barrel including drilling and development costs. The drilling and completions costs in Bakken have decreased by ~2.5% over the past three years as shown in Exhibit 1.

Exhibit 1: Drilling and completion costs in Bakken.

Continental plans to operate an average of 6 drilling rigs this year and expects to complete approximately 166 gross operated wells with first production in 2019 and average four completion crews. According to Hess, the high intensity plug-and-perf completions are expected to deliver a 15% to 20% increase in IP 180, at least a 5% increase in EUR.

Prior to the completion of Dakota Access pipeline in 2017, Bakken producers had to resort to rail transportation to export oil production. But with Dakota Access, infrastructure bottlenecks in the Bakken basin are temporarily relieved. However, with increasing production rates, we can expect a need for new pipeline capacity driving projects such as Enbridge Sandpiper going forward. Another daunting task that operators in Bakken are facing is the excessive production of associated gas leading to flaring due to limited infrastructure. However, there is an opportunity for Bakken to produce more natural gas and NGLs by developing more infrastructure and implementing new technologies to capture flared gases. However, operators will continue to seek new ways to improve well productivity and drilling economics. In the next blog, we will discuss current and upcoming trends in the Eagle Ford shale play in Texas.

-Utkarsh Gupta and Uday Turaga