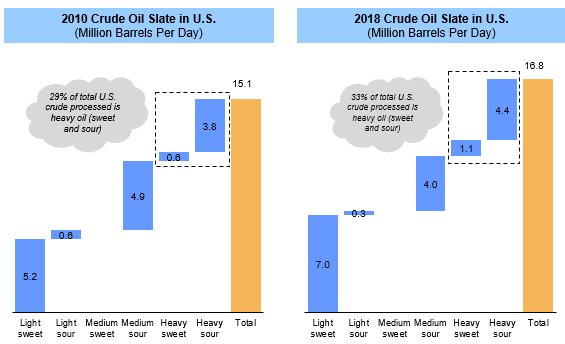

U.S. refiners’ crude slate has lightened due to rising tight oil supply from shale plays but not at the expense of heavy oil. In 2010, 29% of the total U.S. crude processed was heavy oil and that share increased to 33% in 2018. U.S. Gulf Coast refineries have been processing most of the heavy crude due to their higher complexity. These refineries are optimized for heavy crude due to their significant coking capacity.

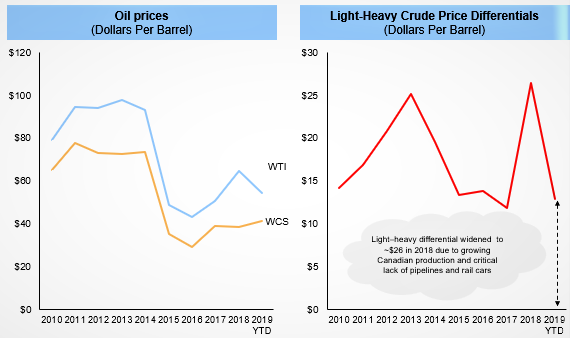

In the past decade, most of the U.S. Gulf Coast heavy crude demand was met by imports from Canada, Mexico, and Venezuela. However, declining Mexican and Venezuelan production, as well as Canadian takeaway constraints have triggered constrained availability of heavy crude in the market. Since 2010, Mexican and Venezuelan supply fell by 27% and 50%, respectively, while takeaway bottlenecks in Canada have limited its supply into the U.S.

The recent heavy oil supply crunch following U.S. sanctions on the Venezuelan state-owned oil company PDVSA has increased heavy oil prices and narrowed light-heavy differentials. Rising heavy oil prices may lead to an acceleration of pipeline capacity additions in Canada, which is the lowest cost supplier of heavy oil and is well positioned to supply the U.S. market. In addition to this, heavy crude imports from Latin America, Iraq, and Saudi Arabia will also continue to grow amid narrowing heavy-light differentials.

On the other hand, options for replacing heavy oil with light crude or medium crude has its own pros and cons. First, a further shifting towards light crude might not be feasible as U.S. refiners are likely full with U.S. light tight oil supply. Refiners will be producing higher volumes of oversupplied light distillates and risk shrinking their gross refining margins. Further, the upcoming IMO 2020 mandate will increase distillates margins and demand and refiners’ interest to optimize their crude appetite.

Second, refiners may also consider increasing medium sour crude runs from inland sources such as Gulf of Mexico. The Gulf of Mexico’s crude oil production reached 1.9 million barrels per day of production in November 2018 and is expected to average 2.0 million barrels per day in 2019, followed by an additional 310,000 barrels per day of production in 2020. This growth is mostly attributed to the 11 new fields that commenced production in 2018 and to the 19 new fields that have been planned to come online in 2019 and 2020.

This post is based on reports from ADI’s new North American Downstream Market Advisory, a monthly subscription service that looks at the trends in refining and petrochemicals. We have been following the North American refining industry closely evaluating refiners’ upcoming projects, capital spending, operating costs, fuel demand, crack spreads, fuel prices and, outages. Contact us to subscribe to the Advisory.

– Swati Singh and

Uday Turaga