U.S. oil output grew from 5.7 million barrels per day in 2011 to a record 12 million barrels per day in early 2019. Of this, Permian accounted for 3.8 million barrels per day, which is expected to grow to 5.6 million barrels per day by 2023.

Key reasons for the surge in Permian crude oil production are (1) operators are focused on drilling longer laterals to increase well productivity, (2) Permian has experienced rapid changes in well design as operators test ever-greater proppant volumes in the Midland and Delaware sub-plays, and (3) recent mergers and acquisition activities have positioned players towards more oil production in the coming years.

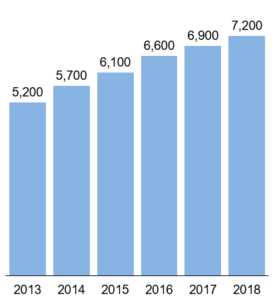

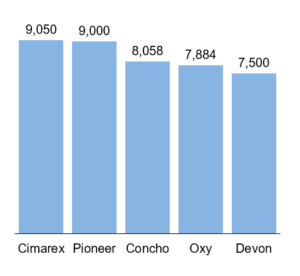

First, unconventional wells have made a lot of progress and operators are now drilling longer laterals with optimized stage lengths to improve production profile. Exhibit 1 shows that the average lateral length of a horizontal well drilled in Permian has increased from 5,200 feet in 2012 to 7,200 feet in 2018. However, bigger operators have more acreage holdings, better resources, and technical sophistication which enables them to drill laterals with lengths reaching as long as 10,000 feet as shown in Exhibit 2.

Exhibit 1: Average lateral length in feet in Permian basin.

Exhibit 2: Average lateral length in feet for top producers in Permian basin in 2018.

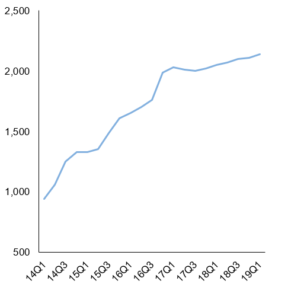

Next, the oil downturn in 2014 pressed operators to cut costs, improve economics, and replace ceramic proppant with cheap and abundantly available frac sand. To maximize well productivity, operators have adjusted their completions designs and substantially increased proppant intensity. Several operators implemented a completion optimization program that combined longer laterals with increased stage lengths, more clusters per stage, and higher levels of fluid volumes and proppant concentrations. Pioneer Natural Resources which holds the largest acreage position in Permian has been able to increase average peak initial production (IP) rate to 3,600 barrels of oil equivalent per day. The average spacing between stages in horizontal wells has come down from 100 to 30 feet in recent years. Operators have increased average proppant intensity levels as shown in Exhibit 3.

Exhibit 3: Average proppant intensity level in pounds per lateral feet in Permian.

Third, the need to increase well productivity has resulted in lot of M&A activity as well. Larger shale operators are now focusing on scale by buying contiguous acreage in Permian. Concho Resources acquired RSP Permian in early 2018 to expand its Permian acreage. Cimarex recently announced plans to acquire Delaware pure-play Resolute for $1.6 billion. Shell and privately held shale operator Endeavor Energy Resources are in negotiations for an $8 billion sale, which will give the integrated major an added acreage of 329,000 acres in Permian basin.

Exhibit 4: Recent completed mergers and acquisitions in Permian.

However, Permian is facing a daunting task to transport its crude to processing facilities. The surge in Permian development over the past few years has constrained labor resources, proppant supplies, infrastructure, and pipeline takeaway capacity for oil, natural gas liquids, and gas. U.S. Energy Information Administration’s drilling productivity report shows that the Permian basin’s inventory of DUC wells continues to swell and has almost doubled in the recent past. Soaring inventory will ramp up production once the necessary infrastructure is in place to transport produced oil. The pipeline shortage is expected to last until late 2019 and we expect a lot of crude oil and natural gas production growth after that.

The coming years will see more developments across major shale plays in North America. Price volatility will determine the course of crude production for operators. However, operators will continue to take measures to improve well productivity and drilling economics by investing in new assets and employing technologies associated with drilling and completion techniques. In upcoming blogs, we will discuss current trends and issues of other shale plays and what measures operators are taking to grow amid rising price uncertainty and competition.

-Utkarsh Gupta and Uday Turaga