A drilled but uncompleted well (DUC) is a new well that has been drilled but not completed. Completion costs are higher than drilling costs and operators routinely drill but do not complete wells for various reasons. Operators are drilling new wells to hold leases and meet the contracts with the land owners. In fact, the nature of unconventional operations requires a certain number of DUC wells in inventory.

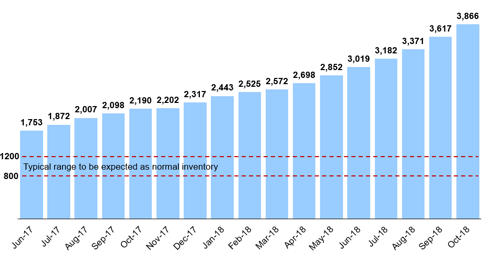

The U.S. Energy Information Administration’s drilling productivity report shows that the Permian Basin’s inventory of DUC wells continues to swell and has almost doubled from 2,190 to 3,866 in the past 12 months. We estimate that steady state DUC inventory in Permian is ~800 to ~1200 wells and what we are seeing in past 12 months is significantly higher than typical inventory levels.

Exhibit 1. Number of DUC wells in Permian Basin.

Key reasons for the increase in DUC count are (1) pipeline capacity constraints and (2) resultant steep discounts in crude oil prices prompting companies to wait for the right price point before tapping their uncompleted wells.

First, operators are being forced to keep wells from being completed due to pipeline infrastructure constraints. Production surged but constraints in takeaway capacity in Permian have forced operators to keep wells from being completed as they wait for upcoming pipeline projects scheduled to be commissioned in the coming years. Second, steep discounts to Permian oil from pipeline constraints has forced many companies to conserve cash by not completing drilled wells.

Going forward, upcoming crude pipeline projects by Enterprise, Epic, and Plains are scheduled to be commissioned next year which should decrease DUC inventory to some extent.

-Utkarsh Gupta and Uday Turaga