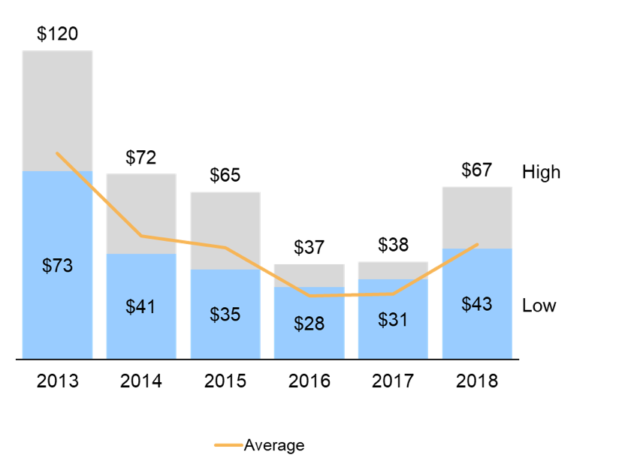

The U.S. is rapidly emerging as a major exporter of LNG, and especially of cargoes sold on a spot basis to various countries around the world. In light of this, LNG shipping rates are important to the sector’s competitiveness. Daily LNG charter rates are increasing surprisingly and quickly after being stable and low for two years as show in Exhibit 1. Drawing on ADI’s recent consulting and research, we try to understand in this blog post the key factors impacting LNG shipping charter rates.

Exhibit 1. LNG shipping daily charter rates in thousand USD per day.

Specifically, we see three key factors. First, LNG demand picked up much faster than expected in contrast to general market expectations of LNG being an oversupplied market until the early 2020s. Second, new FSRU adoption has been faster than anticipated enabling several new countries to become LNG importers. Finally, U.S. LNG is finding its way to farther places driving up ton-miles, and increasing demand for large LNG carriers.

Going forward, the dynamics of LNG shipping rates are expected to change as well. They have historically been driven mainly by oil prices, and that traditional pricing model is likely to evolve in the near future. First, the International Maritime Organization’s new sulfur limits on marine fuels starting 2020 will bring new fuels and, therefore, new pricing dynamics into the shipping landscape.

Second, pricing models will get granular and will be more closely tied to the type and quality of the ship including carrier size, containment design, propulsion mechanism, engine efficiency, and shipping route. For example, most LNG carriers are 90,000 to 170,000 cubic meters in size. Carriers over 170,000 cubic meters, called Q-max vessels, need more fuel and cannot pass through Panama Canal resulting in longer routes that cause shipping rates to increase. Similarly, carrier shapes include membrane- (quasi-rectangular) or moss-type (spherical) with the latter being able to carry more volume for the same occupied area.

Further, the propulsion mechanism — steam turbine (ST) or dual fuel diesel electric (DFDE) – has efficiency implications. Steam turbine-based vessels, which is an older technology, have 28% efficiency and are gradually being replaced by newer DFDE vessels that have 50% efficiency. Finally, shipping routes, e.g., east or west of the Suez Canal to Asia or Europe have some impacts on rates and will be factored into pricing models.

Finally, as the LNG market itself evolves with a growing share of spot trading, the LNG shipper landscape will have to respond bringing in new players and financing mechanisms that will lead to changes in the way capital is recovered thereby impacting shipping rates.

ADI recently shared more of our research on LNG shipping economics, cost, and trends at the 4th Liquefied Gas Senior Executive Forum. A copy of the presentation is available at the ADI store at https://adi-analytics.com/product/presentation-market-cost-and-economic-trends-in-lng-shipping/. Contact us to learn more about our on-going LNG research and consulting.

-Uday Turaga and Panuswee Dwivedi