Qatar recently announced plans to leave OPEC starting January 2019, ending its nearly six-decade long membership. The decision comes amid tensions with neighboring countries as a trade and travel embargo was imposed last June by a group of Middle Eastern countries led by Saudi Arabia and including Bahrain, Egypt, and United Arab Emirates. Political considerations related to these regional tensions are likely a big driver for Qatar’s decision to leave OPEC.

Even so, Qatar’s minister of oil, Saad al-Kaabi, stated the sanctions had no bearings on their decision to leave, but he did mention the decision now provides Qatar the ability to increase oil production without constraints. While not a significant global contributor in oil production at 600,000 barrels per day, Qatar’s departure coupled with U.S. sanctions on Iran, and growing North American production may weaken the influence OPEC has as the world’s swing producer.

Sanctions placed on Iran, OPEC’s third-largest producer, will create a significant void in oil production creating an opportunity to capture market share which we wrote about here. The surge in North American production has positioned the U.S., led by Permian, as the leading oil producer and the U.S. will have a say in how and when OPEC decides to increase or decrease oil production. Collectively these factors bring into question the role OPEC will have long term although such speculation has historically been unfounded. In fact, Russia’s collaboration with OPEC to influence oil prices in since 2016 may suggest that the cartel would continue to be an influential player albeit with new participants.

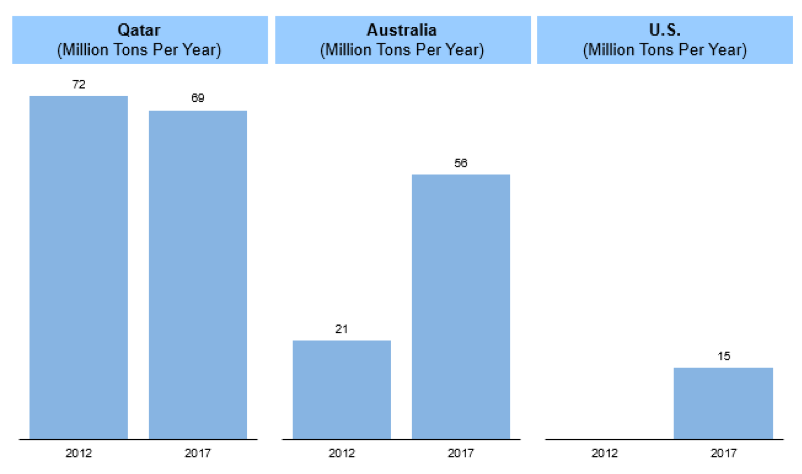

Finally, Qatar’s decision to leave OPEC may have more to do with gas than oil. Qatar is the world’s largest liquefied natural gas (LNG) producer and exporter. Currently there are three major players supplying LNG Qatar, Australia, and the U.S. which is illustrated in Figure 1. With rapid growth in the share of natural gas in the global energy mix, Qatar sees an opportunity to capitalize on its resource and comparative advantage quickly to gain market share in the wake of significant LNG export capacity growth in Australia and U.S. This thinking is likely behind Qatar’s plans to increase their LNG production from 77 to 110 million tons per annum (mtpa). Such capacity growth will require significant capital and Qatar likely views its exit from OPEC as a way to use its oil production to finance its LNG growth aspirations.

Qatar’s departure highlights the increasing attractiveness of the LNG market which is a key area of research and consulting at ADI Analytics. Our team tracks global LNG markets including demand in existing and new countries, supply and utilization, new large- and small-scale projects, pricing and pricing mechanisms, and technology including FSRUs and FLNG. Our team recently published a multi-client study, Micro-, Small- and Mid-Scale LNG in North America, which looks at some of these issues. Please contact us to learn more about our research.

-Brandon Johnson and Uday Turaga