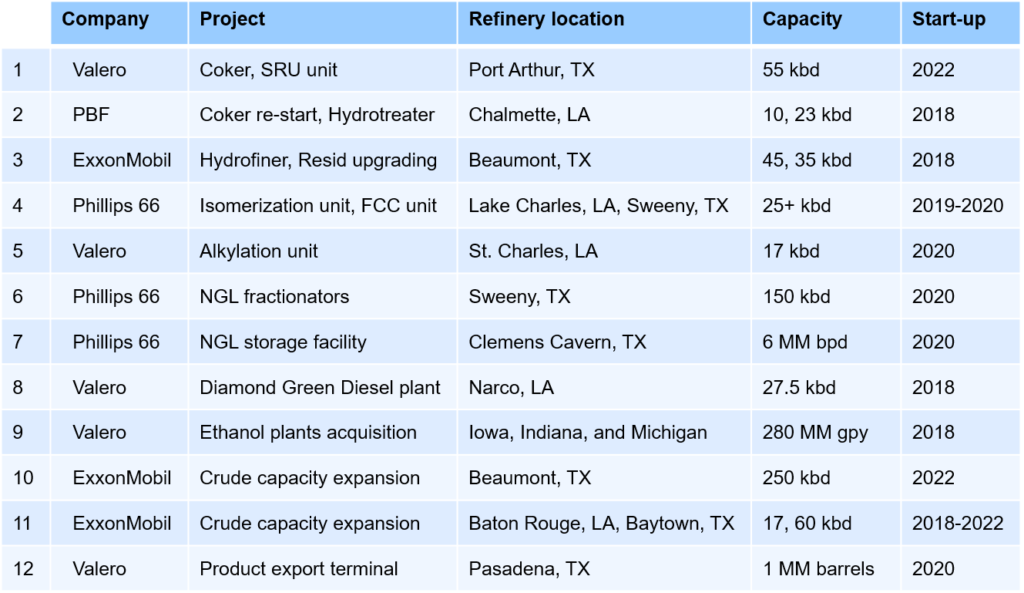

The recent profitability of U.S. oil refineries has been buoyed by the high demand of petroleum products, distillates in particular, both at home and abroad, prospects of IMO 2020, Tier 3 gasoline mandates and most importantly significant price discounts on rapidly growing volumes of light, sweet U.S. crude oil, and heavy Canadian crude. These drivers have also built a robust pipeline of capital projects at U.S. refineries that will come online during the 2018-2022 time period. An illustrative list of these capital projects is in Table 1.

In research completed for ADI’s new “North American Downstream Market Advisory” – a monthly subscription service looking at the trends in refining and petrochemicals, we have studied the portfolio of capital projects in U.S. refineries. Our research showed that all of these projects fall into one of seven major themes including low-sulfur fuel, octane improvement, distillation capacity growth, logistical infrastructure investments and pursuing growth in midstream, petrochemicals, and renewable fuels. We have discussed each of these themes in the following sections.

First, U.S. refiners are continuing capital spending to meet low-sulfur specifications due to IMO 2020 and Tier 3 gasoline mandates. For instance, Valero and ExxonMobil are both investing in coking and hydroprocessing capacities in Texas, and PBF is restarting an idled coker in New Orleans. Second, refiners have projects to meet growing octane demand due to rising light tight oil use, higher demand for premium gasoline, and rising CAFE standards. Phillips 66 is starting an isomerization unit at Lake Charles and Valero is bringing alkylation units online at its Houston and St. Charles refineries in response to this mandate.

Table 1 Illustrative List of Capital Projects by U.S. Refiners

Third, crude expansions are also in vogue to take advantage of growing light tight oil production and inland discounts due to various pipeline constraints. ExxonMobil is pursuing various related projects in the U.S. Gulf Coast and its Baton Rouge, Baytown, and Beaumont facilities. Fourth, looking at the logistical side, refiners are pursuing logistics infrastructure investments around U.S. light tight oil and refined products to help their refining and midstream businesses. For example, Phillips 66 has expanded its Beaumont crude oil terminal and Valero has invested in fuel terminals in Central Texas, Pasadena, and Peru.

In addition, refiners continue to look for growth through midstream vehicles with some but not all investments focused on integrating with their refining asset base. Phillips 66 is expanding NGL fractionators and storage in Sweeny and Clemens Caverns while HollyFrontier is building Permian crude gathering capacity. Further, petrochemicals are another growth strategy for refiners driven by attractive margins and supply of low-cost NGL feedstocks. ExxonMobil has already invested in ethane cracking, and Valero and PBF are optimizing FCC and reforming units for petchem feedstocks.

Finally, refiners already active in biofuels are further expanding to capture margins from growing ethanol use and low-carbon fuel regulations. Valero continues to strengthen its position by acquiring three ethanol plants in the U.S. Corn Belt and expand its Diamond Green renewable diesel plant.

ADI has been following the North American refining industry closely evaluating the refiners upcoming projects in the pipeline, capital spending, operating cost, fuel demand, crack spread, fuel price and, turnaround activities. Please contact us to learn more.

– Swati Singh and Uday Turaga