The U.S. has imposed trade tariffs on imports from China, Mexico, Canada, and the EU which is having a huge impact on trade of several commodities one of which is ethanol. In response to the U.S. sanctions, multiple countries have also levied tariffs on U.S. products.

Apart from exports, U.S. produces ethanol for blending with gasoline to meet ethanol mandates defined under Renewable Fuel Standards RFS1 and RFS2. However, domestic ethanol consumption is expected to decline with a decline in gasoline demand driven by improved Corporate Average Fuel Economy (CAFE) standards.

Both, trade tariffs and decline in ethanol demand for blending is raising concerns on the growth of ethanol exports from the U.S. This blog post presents ADI’s perspective on U.S. ethanol exports taking into account these uncertainties.

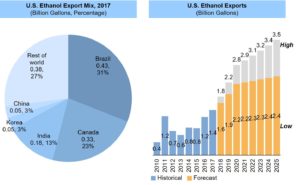

The U.S exports ethanol to several countries worldwide driven by their local ethanol blending mandates and demand growth for gasoline. In 2017, U.S. exported 1.4 billion gallons of ethanol to five major destinations including Brazil and Canada followed by India, Korea, and China as shown in Figure 1 (left).

Exhibit 1. U.S. ethanol export volumes and destinations.

Figure 1 (right) shows that ethanol export from the U.S. will likely range between 1.6 billion gallons (in low case) to 1.8 billion gallons (in high case) in 2018 and rise to 2.4 to 3.5 billion gallons in 2025.

We see that the U.S. ethanol exports outlook is unsteady due to the ongoing trade talks. For example, China, which imported about 47 million gallons of ethanol from the U.S. in 2017 will potentially need more ethanol in the future as the Chinese government is mandating the use of E10 fuel (gasoline containing 10 percent ethanol) by 2020. However, under the new tariffs, China is now cutting off imports from the U.S. and has imposed an additional 15% tariff on top of the existing 30% tariff on ethanol imports from the U.S. Even so, as the demand for ethanol in China will grow significantly to meet the E10 mandate, domestic ethanol supplies might fall short, driving China to resume imports from the U.S.

Similarly, exports to countries such as Brazil and India will continue to increase as the local ethanol production is not enough to meet the ethanol demand. In 2017, Brazil imposed a 20% tax on ethanol imported from the U.S. to protect local producers despite which the imports continued to grow. Brazil has now surpassed Canada and emerged as the largest importer of U.S. ethanol. India currently uses ethanol imports in the industrial sector and only indigenous ethanol (from sugarcane molasses) is used for blending with gasoline. However, due to the cyclical nature of sugarcane crop, India is currently blending about 5% ethanol with gasoline, far behind its aspirational target of 20% blending by 2030. To achieve this target, India will likely export significantly higher volumes of ethanol from the U.S. in the near- to medium-term.

Finally, our assessment of the U.S. ethanol industry suggests that ethanol exports will continue to increase despite the ongoing trade war. Further, the increase in ethanol exports will potentially offset the decline in ethanol consumption in the U.S. leading to the overall growth of the U.S. ethanol industry.

ADI Analytics has been closely following the development of the U.S. ethanol industry and has completed several client engagements in this area. Please get in touch with us to learn more about our research.

– Palak Puri and Uday Turaga