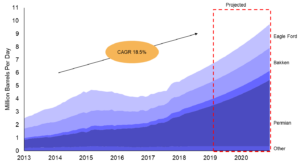

Crude oil production in the U.S. has been increasing steadily with a major contribution from the Permian. This is expected to continue, and, in two years, ADI expects Permian production to be nearly 50% of total U.S. crude oil production as shown in Exhibit 1. However, a major challenge to this growth will be the lack of adequate crude oil takeaway capacity, which is now leading to a price discount in the Permian of almost $10-15 per barrel relative to the price for West Texas Intermediate crude oil in Cushing, OK.

Exhibit 1. U.S. crude oil production by play.

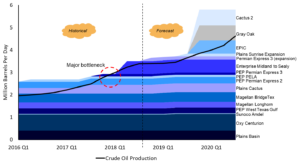

Producers and midstream companies are exploring all options to alleviate the shortage of pipeline capacity including the use of truck and rail, re-purposing pipelines, and injection of chemical additives such as drag reducing agents (DRAs) to improve pipeline throughput, and, finally, announcing new pipeline projects. Exhibit 2 compares Permian crude oil production to pipeline capacity in the Permian including both existing and announced projects.

Exhibit 2. Permian crude oil production vs. existing and announced pipeline capacity.

In addition to showing existing pipelines, Exhibit 2 also includes announced pipeline projects in the Permian. Out of the new projects planned to transport Permian crude, the most important is likely the Gray Oak pipeline as it may end the current bottleneck that plagues the industry. The 700,000 barrels per day-pipeline, a joint venture between Philips 66 Partners and Andeavor, will stretch from Mentone to Corpus Christi and is slated to be in-service by fourth quarter of 2019. Other major projects that are under various stages of planning and development are Cactus II by Plains All American, a 730-mile, 585,000 barrels per day-pipeline stretching from Permian to Corpus Christi, and the 590,000 barrels per day EPIC pipeline again from Permian to Corpus Christi all to be in-service by the fourth quarter of 2019.

Collectively, it may be at least a year before the current pipeline capacity shortage in the Permian will be resolved although new projects have enjoyed strong support as reflected by successful open seasons so far. In the interim, E&P producers will likely curtail production, delay completion of drilled wells which is already taking longer than historical timelines and focus on best-connected acreage. Similarly, midstream players will focus on creative approaches to supplement pipeline capacity. All these approaches, however, will pose delays and cost increases marginally impacting Permian’s competitiveness in the near term.

– Panuswee Dwivedi and Uday Turaga