Ethane is a unique market — it’s the only commodity that can either be sold as a fuel with natural gas or be sent to petrochemical plants as a feedstock. It is this chameleon-like attribute that contributes to ethane’s volatility both in terms of production volume and pricing. Limited demand and rising supply depressed ethane prices forcing U.S. NGL producers to reject ethane in the dry natural gas stream, but the recent trend shows that the demand is set to rise with new ethylene cracking capacity and rising export infrastructure.

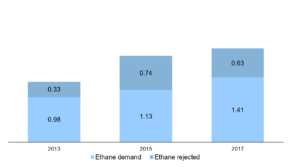

Ethane rejection in the U.S. was ~330,000 barrels per day (bpd) in 2013 and soared to ~740,000 barrels per day in 2015 as shown in Exhibit 1.

However, as also seen in Exhibit 1, ethane rejection fell to ~630,000 bpd in 2017 and ADI forecasts it to decrease further over the next few years. Domestic ethane consumption rose from ~1.1 million barrels per day in 2012 to ~1.2 million barrels per day in 2017. Total ethane produced from gas plant production and refinery and blender net production was ~1.4 million b/d in 2017 with excess production exported via pipelines and ships.

Exhibit 1. U.S. supply of ethane with a breakdown by volumes used and rejected (MMBPD).

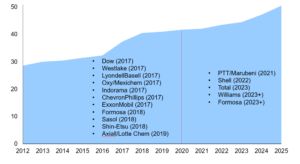

By far the most important use of ethane is as a feedstock for petrochemical plants to produce ethylene. Exhibit 2 shows that in 2012, total U.S. ethylene cracking capacity was 29 million metric tons per year (MMTPA) and it rose to 37 MMTPA in 2017 with additional capacity growth expected through the near future due to expansion plans. Low ethane prices led to a wave of investments in ethylene projects with several that are either in commissioning or development phase. Total ethylene cracking capacity is expected to increase to 41 MMTPA in 2018. A second wave of ethylene crackers has been announced but their outlook is uncertain at this time.

Exhibit 2. Current and projected U.S. ethylene cracker capacity (MMTPA).

Finally, significant ethane export infrastructure is being developed in the country. In 2014, U.S. became a net exporter after the commissioning of two new ethane pipelines that began transporting ethane from North Dakota and southwestern Pennsylvania to Canada. Further, export facilities at Philadelphia, Pennsylvania and Morgan’s Point, Texas will support ethane exports to ethylene crackers in Europe and India. Although current volumes of ethane exports are small, they are expected to grow, and, that, along with rising domestic ethylene cracking capacity will collectively reduce ethane rejection in Appalachia and Permian.

– Utkarsh Gupta and Uday Turaga