North American refiners have announced their quarterly results and they seem to be performing very well. Leading refiners have recorded a significant growth in their earnings in the second quarter in 2018 over the first quarter in the same year. For example, ExxonMobil’s earnings in the U.S. refining sector have risen from $319 million in the first quarter to $695 million in the second quarter of 2018, while Phillips 66 reported a tenfold increase in the earnings, from $91 million in the first quarter to $910 million in the second quarter of 2018.

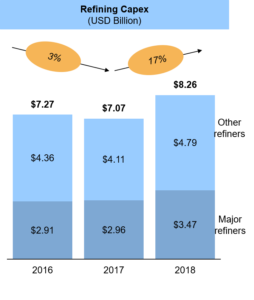

ADI has been tracking capital spending in the North American refining sector. Figure 1 shows that the total refining capex in the U.S. decreased by 3% from 2016 and 2017 but will increase in 2018. We estimate the total capex will grow by 17% from $7.1 billion in 2017 to $8.3 billion in 2018. Several factors are driving the capital spending increase in North American refining including new investments in several projects along with traditional debottlenecking and retrofitting in existing refineries.

Figure 1. Total refining capex in the U.S.

For example, ExxonMobil is planning to invest $20 billion over the next 10 years under its Growing the Gulf program to build and expand refining and petrochemical capacity in the U.S. Gulf Coast. Marathon is continuing its South Texas Asset Repositioning (STAR) program to integrate its Galveston Bay and Texas City refineries thereby allowing it to achieve EPA’s Tier 3 gasoline sulfur standards. Other refiners such as Valero and Chevron are focusing on increasing their alkylation capacity to meet the increasing shortfall in octane barrels as well as growing demand for premium gasoline.

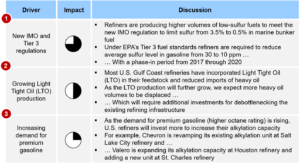

Specifically, we have identified three key drivers (see Figure 2) that are responsible for the growth in the refining capital spending. First, clean-fuel mandates such as EPA’s Tier 3 gasoline standards and International Maritime Organization’s (IMO) 0.5% global sulfur cap for marine fuel by 2020 will push refiners to increase their production of low-sulfur fuels. This means refiners need to build additional hydroprocessing capacity to comply with new regulations.

Second, rising light tight oil production will push the refiners to invest more in debottlenecking the existing infrastructure and replace the heavy oil feedstock with light tight oil. Third, growing light tight oil processing in North American refineries coupled with increasing demand for premium gasoline is driving investments in producing high-octane blendstocks such as isomerization and alkylation units.

Figure 2. Key drivers behind U.S. refining capex

This blog is based on work from our forthcoming subscription service — ADI Refining Market Advisory –which will provide insights on North American refining trends, drivers, economics, and markets. The new service will build on ADI’s work in advising several leading refiners as well as technology licensors, EPC firms, and equipment vendors serving refiners with market research, strategic planning, competitive benchmarking, and technology assessment.

– Palak Puri and Uday Turaga