Wastewater management is becoming a critical issue in the growth of unconventional resource plays. Interest in wastewater treatment is driven by growing volumes of produced water from hydraulic fracturing that need disposal.

Based on our research there are multiple factors that will impact how oil and gas producers will handle wastewater one of which is federal and state regulations on saltwater disposal (SWD). We have looked at existing and emerging regulations for saltwater disposal (SWD) wells in detail and summarized our insights in this blog post.

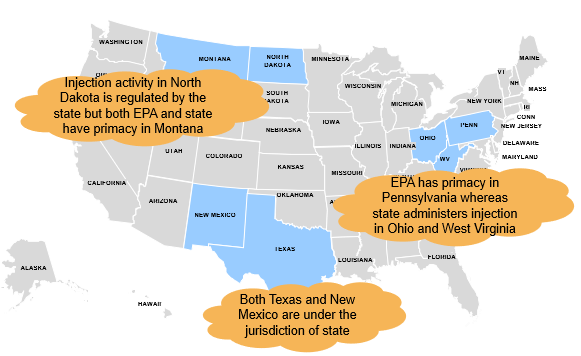

Primary enforcement authority, often called primacy, for SWD wells varies across different shale plays. In general, states administer SWD regulations but in some states either the Environmental Protection Agency (EPA) or both state and the EPA together have jurisdiction. Figure 1 provides an outline on primacy for saltwater disposal wells in shale plays Marcellus, Utica, Bakken, Eagle Ford and Permian.

Figure 1. Wastewater disposal wells jurisdiction by state

Marcellus and Utica:

Operators in Marcellus and Utica are investing in pipeline and related infrastructure to recycle and reuse water because of the high cost ($4 to $6 per barrel) of hauling water from Pennsylvania to Ohio via trucks.

Water is trucked all the way to Ohio because of a shortage of disposal wells in Pennsylvania as EPA directly administers SWD wells here and takes more than a year to grant a disposal well permit. Further, SWDs in Ohio are closer to active drilling areas in Pennsylvania than the local disposal well sites.

On the contrary, disposal well permits can be obtained readily (in three to five months) in both Ohio and West Virginia as both fall under the jurisdiction of the state. However, in 2011 some injection wells in Ohio triggered earthquakes which led the state to proactively monitor any micro seismic activity. This initiated new regulations from October 2012 wherein producers must include a seismic monitoring plan in their permit applications.

Ohio’s seismic monitoring program has been instrumental in the development of a similar network of seismic monitors in Pennsylvania.

Bakken:

North Dakota operates around 600 disposal wells, a majority of which are in the Inyan Kara (a large sandstone reservoir with a porosity of ~20%) and Broom Creek formations. The Inyan Kara reservoir is shared jointly by the states North Dakota and Montana.

Unlike Pennsylvania, state authorities have primacy over disposal wells in both North Dakota and Montana because of which disposal activity in the Bakken is not exposed to stringent regulatory objections.

Apart from lack of regulatory pressure, there is an abundant supply of fresh water available in the Bakken region; with Lake Sakakawea being a primary source. Water recycling initiatives will likely be low given the lack of regulatory pressure.

Eagle Ford and Permian:

Disposal of produced water is and will likely be the first choice in the Eagle Ford and Permian with a moderate interest in reusing water because operators find it cheaper to dispose than recycle water.

The Railroad Commission of Texas (RRC), the state regulatory agency that oversees injection activity in Texas, closely monitors seismic events to understand the relationship between earthquakes and saltwater disposal.

Further, seismicity is not as big an issue in Texas as in some other areas because active drilling areas in Texas such as Midland have a flat geology and are sparsely populated due to which it does not raise concerns for general population. As a result, there have not been any significant developments from a regulatory standpoint in both New Mexico and Texas although disposal well permitting activity has marginally declined from the past. However, RRC might impose a few prospective regulations including injection into deeper rock formations if disposal wells are found to induce earthquakes.

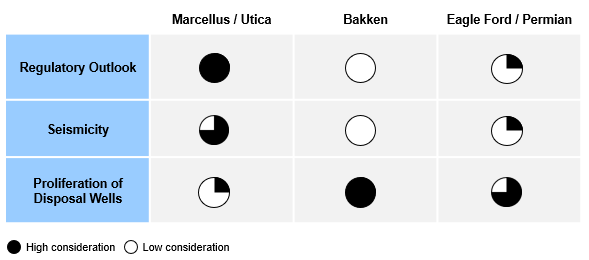

Figure 2 summarizes our findings on disposal and regulatory outlook on saltwater disposal in key shale plays in the United States. Saltwater disposal regulations are most stringent in the Marcellus and Utica where the EPA has primacy over the state and disposal wells are linked to earthquakes. This has led to a reduction in the number of saltwater wells drilled in Pennsylvania. Next, operators in the Bakken can inject water in a large number of disposal wells available and face minimal regulatory pressure as disposal is not linked to earthquakes. Lastly, in the Eagle Ford and Permian wastewater disposal regulations are comparatively relaxed since seismicity does not pose a problem and disposal will continue to be the best option to get rid of produced water.

Figure 2. Saltwater disposal and regulatory outlook in shale plays

While interest in treating wastewater is slowly increasing, we believe its growth will be driven by the regulatory outlook on SWD activities. ADI has done significant work in identifying and understanding wastewater treatment, trends, costs, and regulatory outlook across key shale plays in the United States. Please get in touch with us to learn more about our work.

– Palak Puri and Uday Turaga