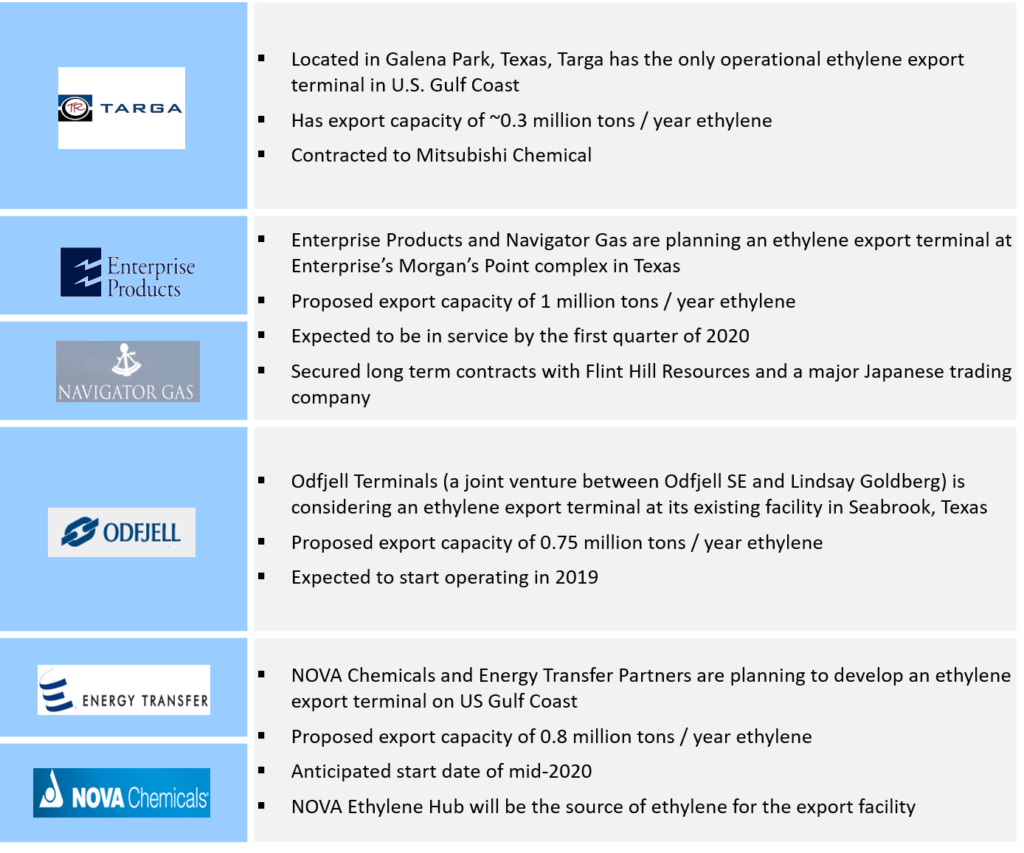

The United States has emerged as a major export hub for various hydrocarbons including crude oil, refined products, natural gas (via LNG and pipelines), and NGLs due to abundant supply driven by the shale boom. For example, Figure 1 shows how export of NGLs has increased about ten times from 131,000 barrels per day in 2010 to nearly 1.2 million barrels per day in 2017. Further, NGL exports are expected to increase to 1.5 million barrels per day by 2020 serving a wide range of countries in Asia, Latin America, and Europe.

Figure 1: U.S. NGL exports by product and region

Figure 1: U.S. NGL exports by product and region

Hydrocarbon exports from the U.S. are now turning toward olefin derivatives and ethylene in particular. The shale revolution is also driving the installation of a significant amount of ethane cracking capacity. Several new ethane-based steam crackers are under construction in the U.S. Gulf Coast and others have been announced in the Appalachia which will all collectively increase ethylene production. Since ethylene derivative capacity investments are not on pace with steam crackers, ethylene is anticipated to go long relative to demand. Ethylene prices have fallen to a 19-year old low recently driven by new crackers that are coming online and a weak outlook for domestic demand growth.

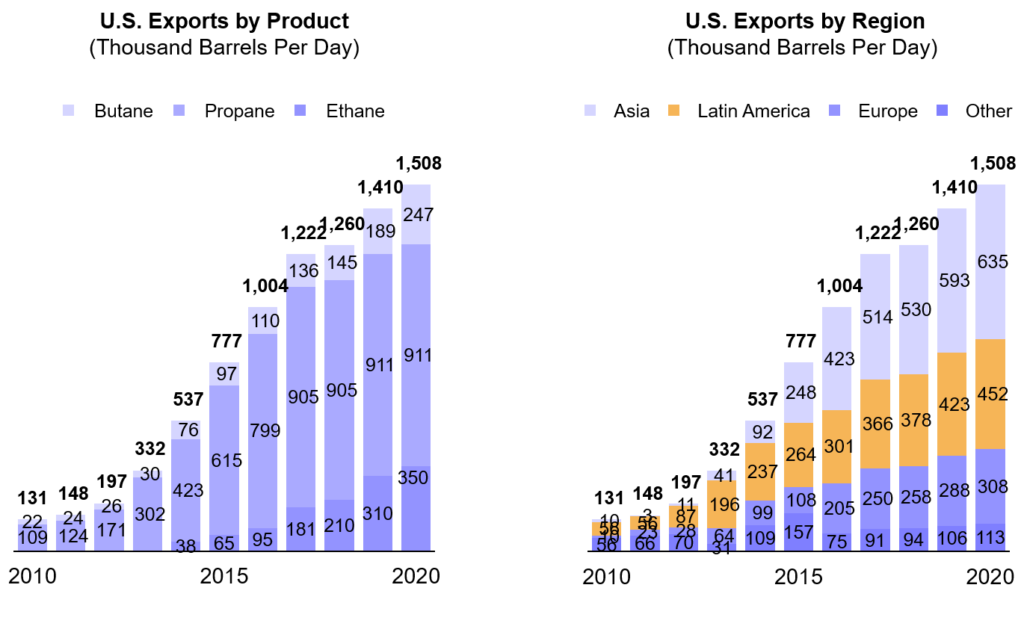

Given this background, there is growing interest in exporting ethylene overseas via export terminals. Currently, a small amount of ethylene is exported from a single terminal operated by Targa Resources and located at Galena Park, Texas. However, three new ethylene export terminals have been proposed in the U.S. Gulf Coast with announced operational dates in 2019 and 2020. Figure 2 presents a summary of both the operational and proposed ethylene export terminals in the U.S.

Figure 2: Proposed and existing ethylene export terminals on the U.S. Gulf Coast

Over the past year, ADI has completed several technical, economic, and commercial feasibility assessments of ethylene exports building on our prior work evaluating U.S. ethane exports. Our research, cost and economic modeling, and market analysis suggests four key questions – detailed below – that will determine the outlook for ethylene exports.

- Will sufficient ethylene be available for export on the U.S. Gulf Coast? The general expectation is that there will be surplus ethylene available on the U.S. Gulf Coast since ethylene derivative capacity investments have not kept pace with those for ethylene crackers. As a result, merchant ethylene is likely to be available for export. However, significant ethylene derivative capacity announcements are being made and, further, new ethylene derivative capacity can be added quickly. Therefore, there is considerable risk around the supply of merchant ethylene that should be carefully considered.

- Will there be sufficient ethane available cheaply on U.S. Gulf Coast? Ethane demand in the U.S. Gulf Coast will rise as several ethane cracker projects are completed and brought online. There is considerable risk that the surge in ethane demand will outpace supply growth in Permian and Marcellus even after reducing ethane rejection levels and drive the need for additional supply from other shale plays including the Rockies and the Bakken. As a result, there is a significant risk that ethane prices will rise increasing ethylene cash costs leaving little room in the netbacks for ethylene exports.

- How will profitability of ethylene exports compare with that of polyethylene exports? Ethylene producers will have to compare the overall economics and netbacks of ethylene exports versus polyethylene exports across the entire value chain including feedstock procurement, ethylene production, storage and shipping, and end-use logistics. Ethylene export logistics are more expensive than those of polyethylene while ethylene derivative investments required capital investments. A careful analysis of these two options on a value chain basis is necessary to find the best option which varies by player and ethylene cracker.

- Will buyers continue to import ethylene? Finally, global demand for ethylene should be considered carefully. Although ethylene demand is robust in several non-OECD regions, several emerging economies are investing in their own refining-petrochemical complexes. Ethylene exports will have to be competitive against these projects and ADI research suggests that the usual suspects are unlikely destinations for ethylene exports.

Ethylene exports can be a promising opportunity, but midstream players and projects developers should carefully consider all of these questions. ADI will continue to track the evolution and outlook for ethylene exports. Please contact us to learn more about our research on ethylene exports.

– Palak Puri and Uday Turaga