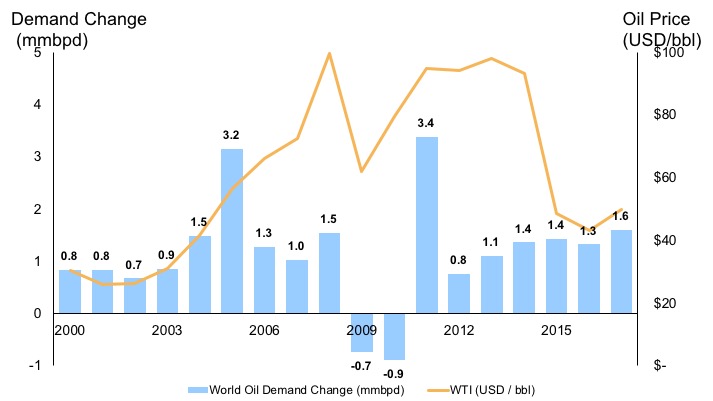

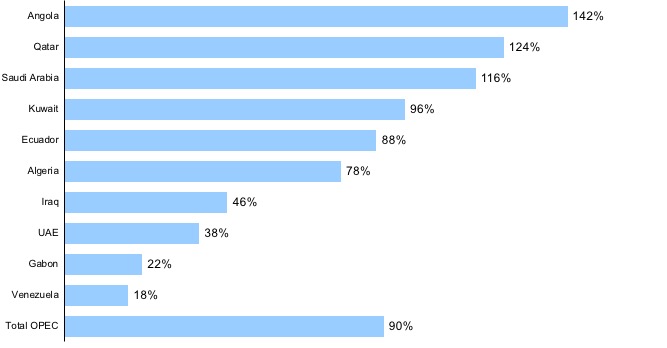

The general consensus is that oil prices are headed towards some stability in the $60s for the near-term barring major supply disruptions. The OPEC supply cut — far more successful than anticipated thanks to the high levels of compliance as seen in Figure 1 — is now serving as a floor for oil prices. Compliance with the OPEC supply cuts has exceeded 100% in the first few months of 2018 draining significant volumes of oil storage capacity.

Figure 1. Compliance of OPEC members with supply cut as percentage of target reduction.

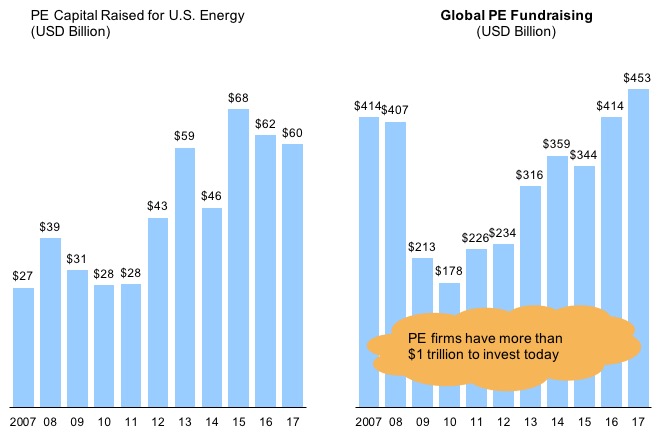

Figure 2 shows that the supply moderation has also been supported by record high demand growth for oil. Oil demand growth in the past three years following the price collapse in 2014 has averaged nearly 1.5 million barrels per day – far higher than the average demand growth of ~1.2 million barrels per day since 2000. Demand growth is expected to continue at similar levels through 2018 driven by robust economic growth across the major global economies.

Figure 2. Worldwide oil demand change and WTI oil price.

Against this backdrop of apparent stability, it is North American shale that now offers the most uncertainty. In addition to the Permian — whose seemingly unlimited potential has attracted investment activity in droves — sweet spots and sub-plays in Niobrara, Eagle Ford, Bakken, and STACK have median breakeven prices of $35 to $45 that are low enough to support new drilling in spite of rising costs.

Even so, large operating companies focusing on shale plays are under growing investor pressure to focus on cash flow and profitability instead of pursuing growth and drilling at all costs. As a result, a number of leading operators have announced cutbacks to capital spending or plans to improve investor returns through share buybacks. However, these efforts are mixed across the large number of shale players as shown in Figure 3. For example, if the independents such as Anadarko and Encana have announced share buyback programs, the oil and gas majors such as ExxonMobil and Chevron – who were slow to the unconventionals party – are beefing up on their unconventional assets through new investments.

Figure 3. North American shale players and their plans around capital discipline.

Arguably there is substantial uncertainty: will rising oil prices stimulate enough oil supply from shale plays to outstrip the robust demand growth that is anticipated or whether the newfound focus on profitability will stem the supply tide, and let oil prices rise beyond current levels?

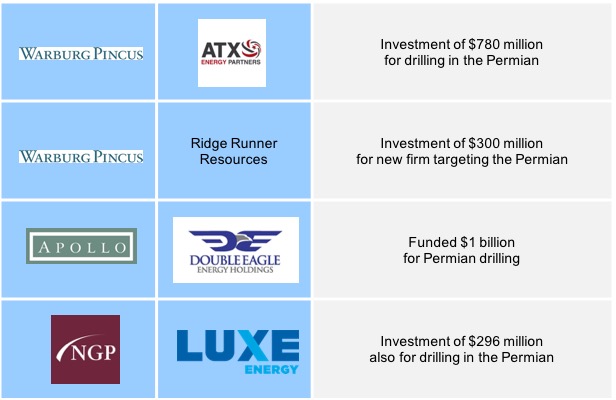

Our research at ADI sees limited room for optimism around oil prices rising beyond current levels given the outlook for private equity-backed investments in unconventionals. Figure 4 shows that private equity funds focused on energy have continued to raise substantial money following the oil price collapse in 2014. Global fundraising by all private equity funds is also at a record ten-year high. As a result, private equity capital is being invested heavily into various unconventionals-focused companies often led by industry veterans who can identify sweet spots and sub-plays even in well-picked basins (see Figure 5 for a few examples of recent investments).

Figure 4. Fundraising by energy-focused and all private equity funds (Source: WSJ, Reuters).

Figure 5. Select recent private equity-backed shale investments.

Collectively, oil prices could rise given declining storage, robust demand growth, strong OPEC compliance, growing discipline among shale players, and rising unconventional costs. But those trends are offset by continued capital investment by large oil and gas majors, and, more significantly, by private equity players with rising coffers. The assertion that North American shale will serve as the ceiling on oil prices will be put to a good test in 2018.

– Uday Turaga