Ever since oil prices plunged in late 2014, operators have had to refocus portfolios and reconsider operational approaches. The portfolio reset has led to growing concentration in the Permian as ADI wrote about recently. Another big shift is occurring in operational approaches as operators tweak “factory drilling” with a data-driven mindset that relies on various fact- and science-based inputs to both drilling and completions.

Drilling in exploration-based sweet spots, engineered completions, high-intensity fracs, and play-based production optimization are all examples of what Shale 2.0 looks like. Even so, a large share of unconventional wells drilled in the past decade are heading toward the use of some artificial lift technology to improve flow by increasing reservoir pressure or reducing hydrostatic weight.

Operators have several options with three main types of artificial lift being (1) electric submersible pumps (ESPs), (2) sucker-rod pumps, and (3) gas lift. The oil and gas industry has long been comfortable with ESPs, which work efficiently in horizontal wells and often provide the best assist to well production. ESPs, however, are expensive costing anywhere from $150,000 to $200,00 per pump, need higher levels of maintenance, and struggle with reliability in harsh formation conditions. Given these challenges, operators are increasingly questioning the value of ESPs although 30% to 50% of new wells – depending on the play – utilize them.

Sucker-rod or beam pumps are another popular choice especially for wells that are in the later stages of their lifecycles. Over 80% of old Permian wells have been outfitted with rod pumps. Since most of the well fleet is relatively new, operators are paying little attention to the choice of rod pumps although the intensified focus on costs will drive rod pump adoption.

In contrast, operators are adoption gas lift in droves. Given growing concern around ESPs and their limitations, the proliferation of harsh conditions in several plays such as water and solid particles flowing aggressively through the tubing thereby damaging ESPs, and attractive low costs, gas lift adoption is growing rapidly. A typical gas lift operation can cost from $100,000 to $400,00, can handle harsh conditions more efficiently, and can be used to support multiple wells enabling efficiencies of scale in increasingly-concentrated shale plays. These benefits are collectively overcoming the limitation of gas lifts yielding lower production relative to ESPs.

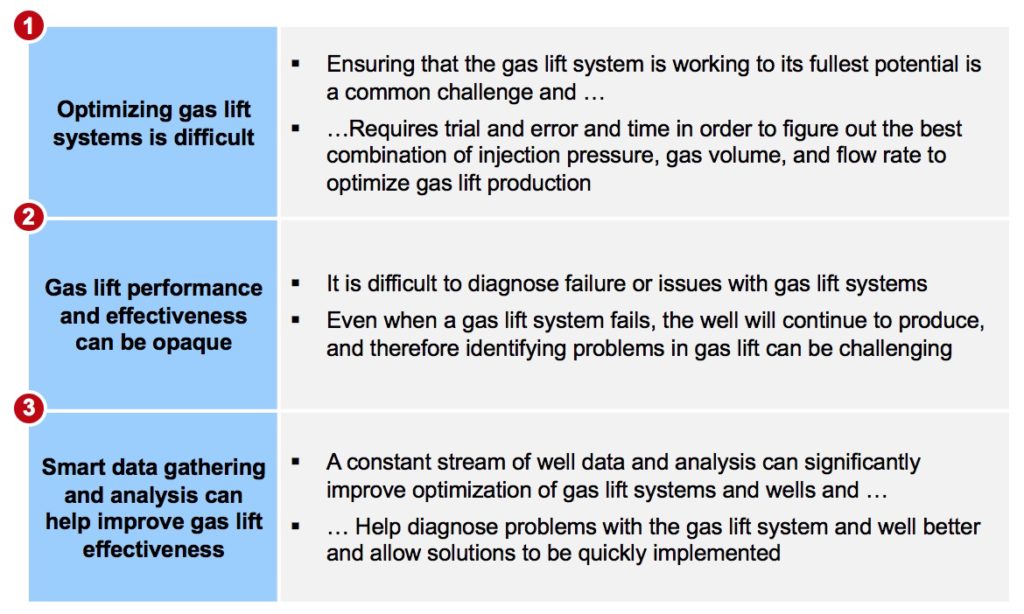

Operator adoption of gas lift has increased dramatically. For example, in plays such as the Permian, anywhere from 40% to 60% of new wells are being outfitted with gas lift equipment. In recent ADI research that sized the gas lift market and identified insights through in-depth interviews with operators, oilfield service providers, and technology developers, there is growing support suggesting that adoption rates are only likely to increase. Finally, although gas lift technology is not without challenges — see Figure 1 — it is being improved with leading operators trying advances such as reverse gas lift, improved sensors and monitoring technologies, and well- and pad-level optimization.

Figure 1. Key challenges for gas lift systems.

— Uday Turaga and Vinamra Prakash