The International Energy Agency (IEA) predicts there will be 157 million electric vehicles on the road by 2030, up from 2 million in 2016. Leading electric vehicle manufacturers, Nissan and Tesla, have already began expanding production capacity as they prepare for a significant increase in sales. Traditional automakers including Volkswagen, BMW, and Mercedes, are also planning for a spike in electric vehicle demand as they have announced plans to either phase out production of diesel- or gasoline-only vehicles and increase electric car production as they plan to switch to hybrids or all-electrics.

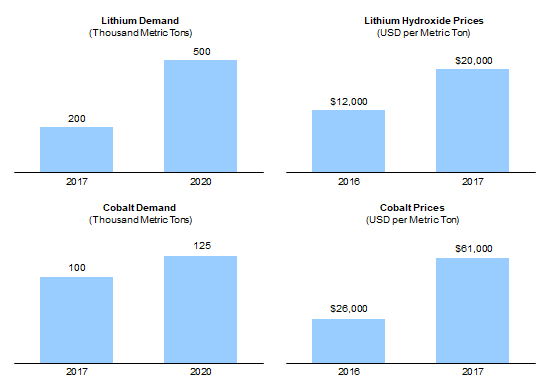

All electric cars run on batteries, mostly lithium-ion technology. The substantial increase in electric vehicles will impact the battery supply chain as demand and prices for lithium and cobalt are growing significantly as shown in Figure 1.

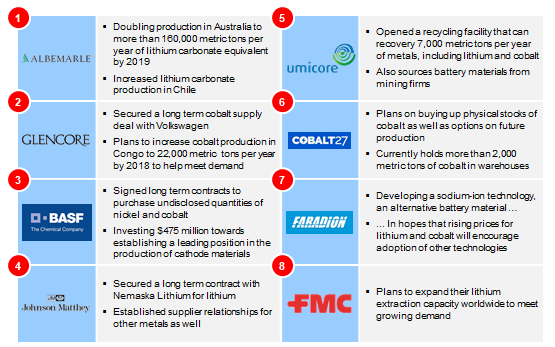

As prices and demand for key battery materials continue to rise, battery value chain players are securing long term supply contracts, increasing production capacity, and stockpiling raw materials. Other alternative material suppliers are hoping higher material prices of cobalt and lithium will increase adoption of their technologies. Cost competitive solutions include sodium-ion and solid electrolyte systems which avoid the need of cobalt.

We have summarized initiatives of battery material firms in Figure 2.Given the dynamics, players are resorting to various initiatives and strategies. For example, Albemarle and FMC is investing in new capacity, Umicore is increasing recycling, and Faradion is developing a new technology. As the market for electric vehicles grows, stakeholders will have to innovate and develop new business models and strategies to succeed.

– Brandon Johnson and Uday Turaga