Flying into Midland isn’t quite the same as flying into Bay Area so drawing a parallel between Silicon Valley and the Permian is not easy. Even so, the parallels start emerging after one spends some time visiting operators and oilfield service players as I recently did in the Permian. A wider range of operators, including those with limited acreage and drilling budgets, have fully bought into the need to innovate and experiment with new work flows, approaches, technologies, and equipment, and have significantly accelerated their efforts in these directions today.

The drop in oil prices have driven oil and gas companies to focus on their best assets, e.g., the areas with high production rates and high rates of return. For many U.S. oil and gas companies those best assets have been in the Permian basin. Tremendous growth in production coupled with the region’s ability to respond quickly has made the Permian a force in the global crude oil supply market. According to Baker Hughes, 40% of the 936 U.S. rigs during the week of October 6, 2017 were in the Permian and the share of new rigs is even higher.

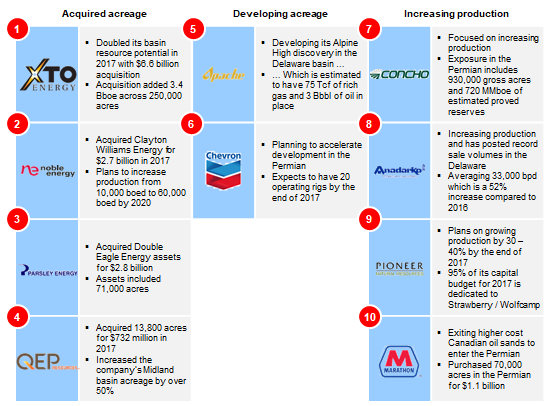

Growing focus on the Permian has caused significant increases in M&A activity and price per acre. Due to its growing potential and attractiveness, the average price per acre in the Permian grew from $1,000 in 2012 to $60,000 in 2017. There has also been an uptick in acquisition activity as producers are focusing on securing acreage and increasing production. Recent initiatives from the Permian’s top producers are listed in Figure 1. For example, XTO Energy, Noble Energy, and Parsley Energy have acquired acreage, Apache and Chevron have accelerated development of their acreage, and Anadarko and Concho Resources have increased production in the Permian.

Permian has quickly become one of the most attractive oil plays in the world. Since 2012, oil production in the Permian has more than doubled and is now 2.3 million barrels per day (mmbpd). In 2016, only 11 countries recorded oil production higher than the Permian basin’s production and only one conventional oilfield, Saudi Arabia’s Ghawar Field, produced more oil (over 5 mmbpd). The Energy Information Agency (EIA), expects production to reach 2.9 mmbpd by the end of 2018 and account for 30% of total crude production in the U.S. Longer term, Wood Mackenzie believes that Permian production could be as high as 5 mmbpd by 2025.

Activity in the Permian is growing rapidly because of several reasons including its stacked pay potential, large resource volume, attractive well economics, established pipeline and processing infrastructure, and sophisticated oil and gas company incumbents with proven capabilities to adapt to changing conditions. For example, in 2016, the U.S. Geological Survey announced that one of the layers within the Permian, Wolfcamp, contained 20 billion barrels of undiscovered oil which is the largest estimate of continuous oil that they have ever assessed.

Second, the amount of oil coupled with improved well economics has made the Permian the most attractive play in the world. Instead of spending capital on drilling new horizontal wells for $5 – $9 million per well, companies have focused on drilling and recompleting older vertical wells for $1 – $2 million per well. Another driver that has contributed to growth are breakeven costs which fell from $100 per barrel in 2012 to as low as $40 per barrel in 2017. Improvements in drilling efficiency, drilling and completion technology, and tighter well spacing have also reduced well costs and drilling and completion time.

Attractive breakeven costs and an abundance of oil in the region has positioned the Permian to play a major role in the global market. Collectively, OPEC is still the swing producer but the U.S., particularly the Permian basin, will likely have a say in how and when OPEC decides to increase or decrease oil production.

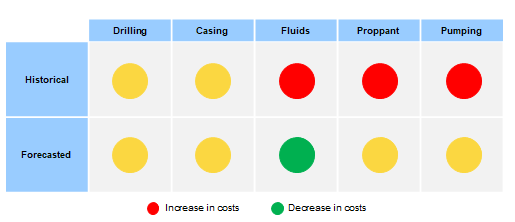

Even so, continued growth in the Permian may be at risk due to tighter well spacing, cost inflation, and reduced productivity. Tighter well spacing may lead to well-on-well interference which will test the geological limits of the play. The Permian may also become a victim of its own success as costs are expected to rise. Land acquisition, service, and equipment costs have and are expected to continue rising with estimates ranging from 5% to as much as 25%. Service and equipment costs are rising as there are few players competing for jobs and there are constraints on equipment and personnel in the region. Lastly, although rig count in the Permian is increasing, production per rig declined in 2017. The decline in productivity per well is impacting well economics and break even costs and may reduce growth in the Permian going forward.

Operators are mitigating risks by focusing on engineered completions, improving reservoir models, and operating smarter. Risks impacting growth in the Permian may be offset with improvements with efficiency. This includes, longer laterals, more stages, and more proppant and fluid pumped into each stage. ADI Analytics has identified the best opportunities for cost reduction in the Permian in Figure 2. Going forward, the best opportunities for cost reduction are in completions.

ADI Analytics has assessed the costs and economics of major oil and gas plays within the U.S. and continues to monitor them closely. Please contact us to learn more about our research in unconventional cost and economics.

– Uday Turaga and Brandon Johnson