ADI Analytics hosted its first North America Natural Gas and NGL forum in Houston late February. The forum was well-attended with representatives from a wide range of companies including integrated oil and gas majors, refiners, E&P independents, industrial gas suppliers, equipment providers, technology licensors, investors, and media outlets.

The forum featured several presentations by ADI analysts and panel sessions featuring external speakers and industry experts. The presentations highlighted key demand drivers, supply outlook, pricing forecasts, strategic implications, investment opportunities, and regulatory concerns around natural gas and NGLs. The panel sessions built off of the presentations and featured in-depth discussions focusing on small- and mid-scale LNG, natural gas conversion to fuels, and new innovations including the Industrial Internet of Things.

ADI Analytics covers equipment markets as part of its client research and subscription products. As part of the 2017 North America Natural Gas and NGL Forum, ADI shared insights on strategic opportunities for OEMs in the natural gas and NGL value chains. Low oil prices have forced operators to adopt new strategies for sourcing equipment and services. Additionally, the Industrial Internet of Things is driving new innovations as well as acquisitions in the OEM market.

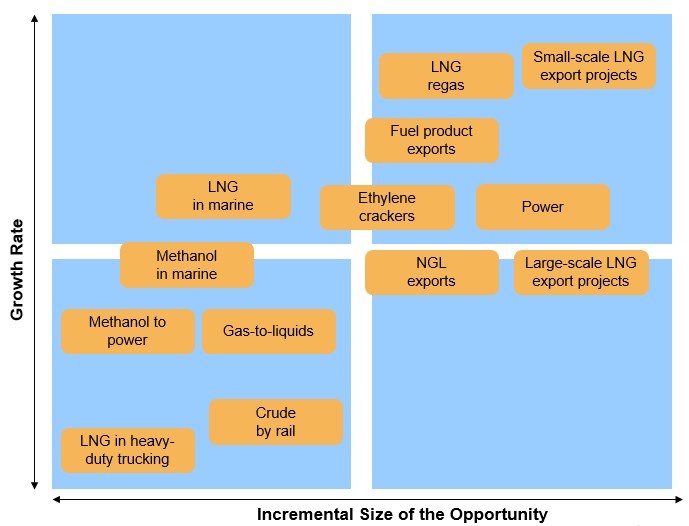

There are a lot of opportunities for OEMs in the natural gas and NGL value chain. ADI Analytics has covered natural gas monetization markets extensively and there are a lot of opportunities for OEMs to supply equipment to operators. However, not all markets are created equal. The best opportunities for OEMs are in LNG applications such as regasification facilities and small-scale LNG facilities.

While most attention has been focused on large-scale LNG projects, the LNG market is oversupplied and capital spending has decreased significantly. LNG regasification terminals and small-scale LNG offer higher growth rates and a larger incremental opportunity for OEMs. Figure 1 shows a map of opportunities for OEMs in the natural gas and NGL value chains.

Operators are putting pressure on OEMs. Low oil and gas prices are forcing operators to cut costs and OEMs can respond in several ways to both better serve operators and improve OEM business models. First, developing products that are standardized and modularized gives OEMs the ability to design one piece of equipment and replicate it many times. This reduces design and engineering costs. Standardization and modularization offers benefits to operators as well by reducing the cost of FEED studies and decreasing overall project development time.

Second, OEMs can offer a wider range of fit-for-purpose products to better serve all client needs. Pump companies have already taken this approach by developing and offering a wide range of options that serve specific operator needs. Having a wide range of pumps benefits both OEMs and operators. Purchasing all fit-for-purpose pumps from a single source streamlines the equipment procurement process for operators. Pump manufacturers that offer a wide range of fit-for-purpose products are more likely to secure contracts with operators with varied pump needs.

Last, operators prefer OEMs who cover the entire product lifecycle through equipment sales and aftermarket service capabilities. Aftermarket parts and services have significantly higher margins than new equipment sales.

The Industrial Internet of Things is driving OEM acquisitions and providing operators with more capabilities. The Industrial Internet of Things offers a lot of promises and is driving interest among both OEMs and operators. OEMs have been expanding their IIOT capabilities through acquisitions and partnerships to better serve their customers. For example, GE and Technip partnered to expand digital solutions for LNG. Emerson purchased Permasense, a company that provides wireless corrosion monitoring devices.

Operators have also begun to adopt IIOT technologies. RasGas and Woodside adopted digital solutions for LNG to improve asset performance through predictive maintenance. BP and PEMEX are using IIOT to increase refinery automation and implement predictive maintenance.

Several new technologies have emerged in response to the natural gas surplus, creating opportunities for OEMs. Reducing flare gas volumes has been at the forefront of many operators’ and regulators’ minds since the shale gas boom. We have written about a number of technologies to reduce flaring and one of them is virtual pipelines. Virtual pipelines take natural gas from multiple wells, compress it, and deliver the compressed gas to end users, enabling operators to monetize natural gas without access to pipelines. This promises to reduce flare gas volumes with moderate capital investment.

At the 2017 North America Natural Gas and NGL Forum ADI Analytics presented on natural gas use in the power segment. One market that is gaining popularity is natural gas-fired distributed power generation. One issue with natural gas-fired distributed generation are spikes or dips in power output due to the nature of gas-fired generators. Start-ups such as FlexGen Power Systems are addressing such issues and smoothening power output through the use of capacitors. A smoother power output can increase the life of electrical equipment such as electric submersible pumps used for artificial lift in the oilfield.

Overall, the OEM market is under a lot of pressure with the collapse of oil prices. However, expanding capabilities, portfolios, and exploring new technologies will help OEMs better serve their customers and maintain profitability.

Presentations and videos from the 2017 North America Natural Gas and NGL forum will soon be available online. Additionally, we will be hosting the forum again on February 13th 2018 with more information and details to follow soon. Please contact us with any questions regarding the forum and our work.

-Tyler Wilson and Uday Turaga