2017 North America Natural Gas and NGL Forum Highlights: Natural Gas Exports

ADI Analytics hosted its first North America Natural Gas and NGL forum in Houston late February. The forum was well-attended with representatives from a wide range of companies including integrated oil and gas majors, refiners, E&P independents, industrial gas suppliers, equipment providers, technology licensors, investors, and media outlets.

The forum featured several presentations by ADI analysts and panel sessions featuring external speakers and industry experts. The presentations highlighted key demand drivers, supply outlook, pricing forecasts, strategic implications, investment opportunities, and regulatory concerns around natural gas and NGLs. The panel sessions built off of the presentations and featured in-depth discussions focusing on small- and mid-scale LNG, natural gas conversion to fuels, and new innovations including the Industrial Internet of Things.

One topic that ADI Analytics covered extensively during the forum was natural gas exports through LNG and pipelines. ADI prepared and presented an in-depth view and outlook for natural gas exports based on its proprietary research, modeling, and analytics developed for research products and client work. In 2016, Cheniere began exporting LNG from its Sabine Pass liquefaction facility, marking the beginning of a new era for U.S. natural gas monetization. In addition to LNG exports, pipeline exports have also begun to increase as Mexican demand for natural gas begins to rise. At a high level, ADI sees three major themes in natural gas exports from the U.S.

Exports will become a major natural gas demand driver in the U.S. Since the shale boom, U.S. natural gas supply growth has far exceeded demand growth. Natural gas exports have become one of the most popular options to monetize surplus natural gas supply. Cheniere’s Sabine Pass facility was the first large-scale project to export LNG, but there are several other projects that have secured offtake agreements with buyers and are now under construction. In addition to LNG export terminals, natural gas exports via pipeline are also expected to grow. Between LNG and pipelines it is likely that U.S. natural gas exports will reach as high as 20 billion cubic feet per day (bcfd) by 2025. This equates to exporting 25% of all U.S. natural gas production in 2025.

While many LNG projects have been announced, few will move forward. More than 40 planned LNG facilities have applied for Department of Energy export approval. The majority of these projects will not move forward. The projects that are moving forward have two major things in common. First, they all have the proper regulatory approvals. Second, they have contracted offtake agreements with buyers.

Large-scale LNG plants require billions of dollars of investment and a final investment decision will not be taken until planned LNG capacity is already contracted to buyers. Additionally, large-scale LNG projects have multiple liquefaction trains that each have their own final investment decisions and construction timeframes. Each train is very much like a project within a project. The projects that currently have trains under construction also have trains that are planned, have received all necessary regulatory approvals, but have not reached a final investment decision due to a lack of offtake agreements. This has implications for projects that awaiting regulatory approvals, offtake agreements, and do not have any trains under construction.

We can look to the projects that have some trains under construction and view them as the best projects in their class. It is much more likely that a best-in-class project will be able to secure an offtake agreement and take a final investment decision on an additional train rather than a brand new unproven project receiving all regulatory approvals, securing offtake agreements, and beginning construction. Entirely new projects will be unlikely to move forward unless projects that are currently under construction make final investment decisions on additional planned trains.

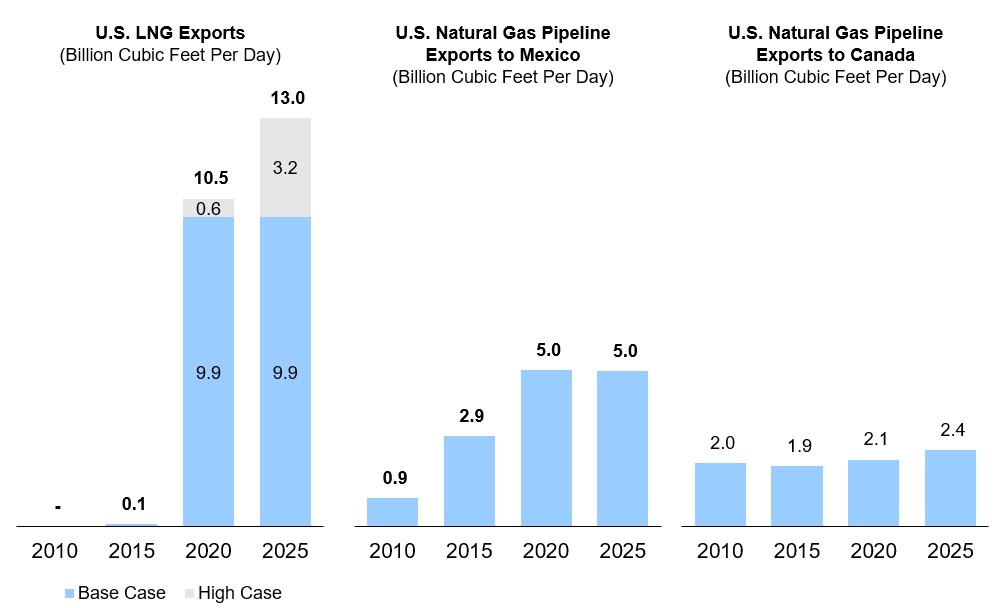

We expect all trains that are currently under construction to eventually begin exports. Additionally, we believe that some trains that have not yet taken final investment decisions, but are part of projects that are currently under construction will eventually produce and export LNG. In total, the U.S. will likely be exporting between ~10 bcfd and ~13 bcfd of LNG by 2025.

Pipeline exports will increase to Mexico and stay stagnant to Canada. The U.S. exports natural gas to both Mexico and Canada via pipeline. Pipeline exports to Mexico are expected to continue to grow. In 2010, the U.S. exported less than 1 bcfd of gas to Mexico, but by 2015 that had grown to just under 3 bcfd. By 2025, pipeline exports to Mexico are expected to reach 5 bcfd. Today, Mexico is undersupplied with natural gas, consuming almost twice as much as it produces each year. The gap between consumption and production will only grow as Mexico plans to add ~16 gigawatts of natural gas-fired power generation capacity from 2015 to 2025.

Canada, on the other hand, produces about 50% more natural gas than it consumes. However, the U.S. still exports natural gas to Canada. Most Canadian natural gas production takes place in the western part of the country, while the eastern part consumes most natural gas. It is cheaper for Canada to import natural gas from the U.S. northeast into eastern Canada than it is to send natural gas from western to eastern Canada. In total, U.S. natural gas exports to Canada via pipeline have stayed at ~2 bcfd since 2010 and will likely remain relatively steady through 2025.

In total, between pipelines and LNG exports it is likely that the U.S. will export between 17 and 20 bcfd of natural gas by 2025. This represents between 20% and 25% of total U.S. natural gas production being exported by 2025. Figure 1 shows three charts, each showing historical and forecasted natural gas exports. On the left is LNG exports, with the blue bar representing the base case where all trains that are currently under construction begin exporting LNG, while the gray bar represents the high case where planned trains at projects that currently have some trains under construction take final investment decisions and begin exports. The middle and right charts show historical and forecasted U.S. pipeline exports to Mexico and Canada, respectively.

Presentations and videos from the 2017 North America Natural Gas and NGL forum will soon be available online. Additionally, we will be hosting the forum again on February 13th 2018 with more information and details to follow soon. Please contact us with any questions regarding the forum and our work.

-Tyler Wilson and Uday Turaga