BP has recently announced a $30 million investment in Fulcrum BioEnergy, a producer of aviation biofuels. As part of the investment, BP has taken an equity stake in the company and has also agreed to purchase 50 million gallons of bio-based jet fuel per year for the next ten years. Fulcrum has also partnered with the refiner Tesoro which will buy biocrude, a byproduct of Fulcrum’s process of producing aviation biofuel, to produce biodiesel. Fulcrum’s technology uses the Fischer-Tropsch process to convert municipal solid waste, which it is receiving from Waste Management who also holds equity in the company, into a syncrude product that is then later upgraded to jet fuel or diesel. This helps Fulcrum reduce the cost of producing aviation biofuel by selling a byproduct of their process to Tesoro.

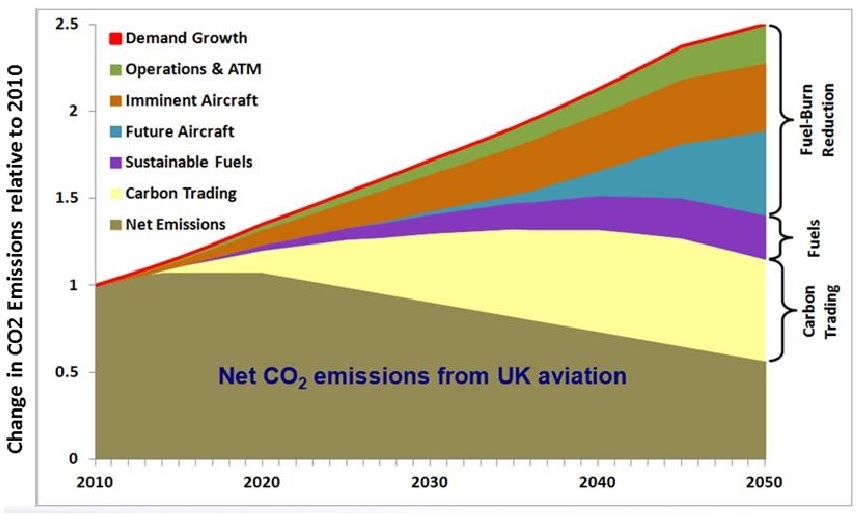

BP plans to use aviation biofuel produced at Fulcrum’s Sierra plant in Nevada. However, Europe and not North America is the main regional driver behind aviation biofuel. The European Union has set targets for reducing the amount of greenhouse gases that are emitted from the aviation industry. This can be achieved through a number of ways. First, through decreased fuel usage which can come from improving current aircraft, developing more efficient aircraft, and through improving operations. Second, through carbon trading to set a limit on total CO2 emissions. Third, by using sustainable fuels such as aviation biofuel. Figure 1 shows a possible path from 2010 to 2050 to reduce CO2 emissions from the U.K. aviation industry. The red line is an estimate of total CO2 emissions if aircraft efficiency, operations, fuels, and carbon trading stay at 2010 levels. If no actions are taken, CO2 emissions are estimated to be more than two and a half times greater than 2010 levels by 2050. The brown bar on the bottom represents the net CO2 emissions from the U.K. aviation industry. Finally, the colored bars represent the decrease in CO2 emissions through each possible avenue. As part of the three avenues to reduce CO2 emissions from the U.K. airline industry aviation biofuels are estimated to account for 13% of the decrease in CO2 emissions in 2050.

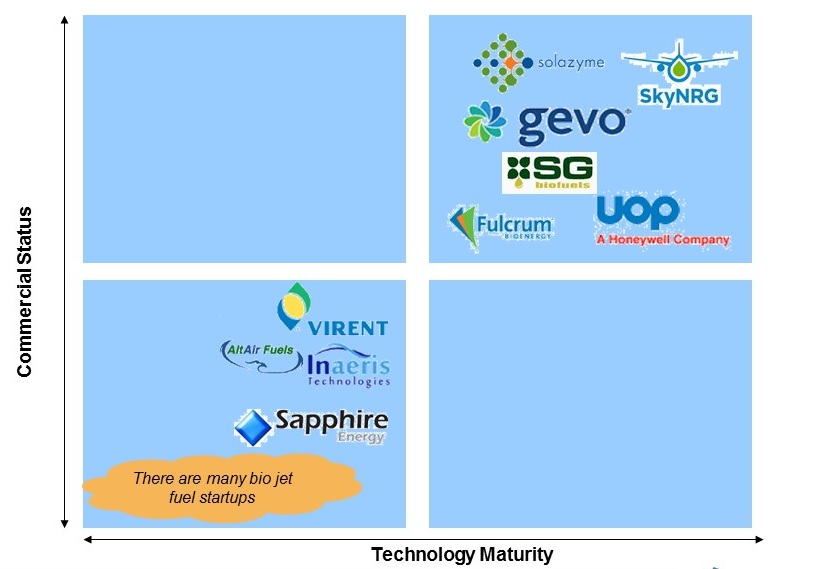

Fulcrum BioEnergy is not the only company that is looking to produce aviation biofuels. As part of ADI Analytics’ Biofuels Executive Briefing we profiled several players in the aviation biofuels industry and have detailed their operations. Companies in the upper-right quadrant are further along both technologically and commercially while companies in the lower-left quadrant are not as technologically and commercially mature. However, it should be noted that even the players in the upper-right quadrant are producing relatively small amounts of aviation biofuel and are still working to become more commercially viable. Figure 2 shows a quadrant of aviation biofuels with the x-axis representing technological maturity and the y-axis representing commercial status.

BPs investment into Fulcrum BioEnergy is an indication that major players are taking aviation biofuels seriously. ADI Analytics has explored this topic extensively in our Biofuels Executive Briefing. Please contact us to learn more.

-Tyler Wilson and Uday Turaga