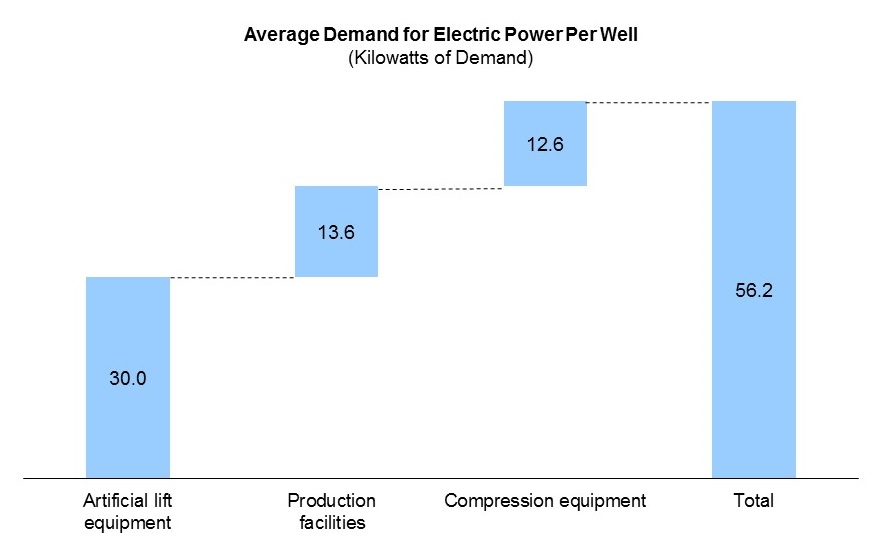

Unconventional oil and gas production has taken operators into areas that lack accessibility to electricity from the grid. While most operators believe that they will be connected to the grid within two years of drilling, that is still two years where operators have to produce their own electricity. An average oil and gas well typically needs 56 kilowatts of power. Figure 1 shows a breakdown of power demand for an average oil and gas well. About 50% of the power demand per well is from artificial lift equipment with production facilities and compression equipment each accounting for 25% of total power demand.

Operators are looking for ways to produce electricity cost-effectively, reliably, and efficiently and many are implementing new strategies and technologies to achieve this goal. These strategies include using natural gas-fired power generation for lower fuel costs, establishing and operating microgrids for well pads, and implementing new technologies.

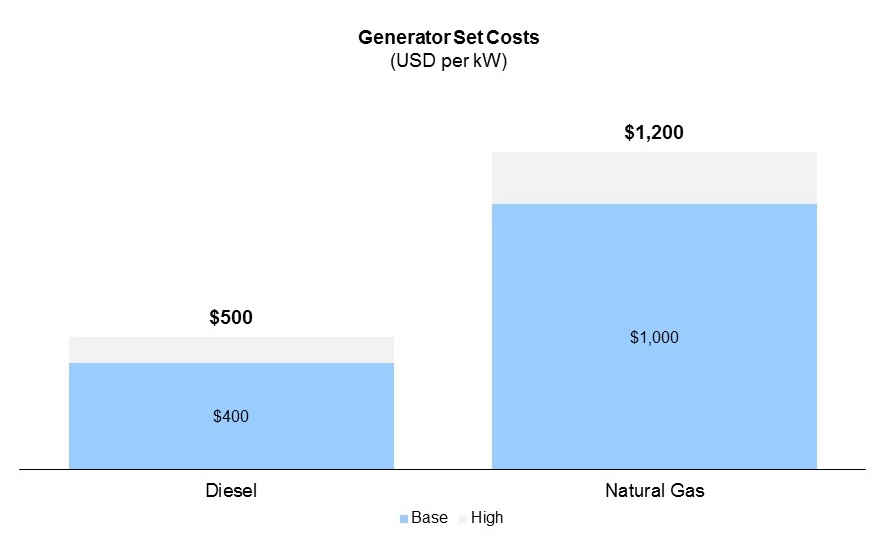

Natural gas-fired power generation is lowering power costs at the well pad. In order to generate the necessary power at a drill site, operators are have typically relied on diesel-fired gensets. In the past year, Tier IV emissions standards for diesel-fired generators have increased genset capital costs and therefore power costs. Even so, capital costs for diesel-fired gensets are still lower than those of natural gas-fired gensets, as shown in figure 2. It is much more economical for operators to use gas that is produced at the wellhead to power their equipment than it is to have diesel shipped in. Additionally, natural gas-fired generators are also better at meeting emissions standards. As a result, there is growing interest in and use of natural gas for oilfield power generation.

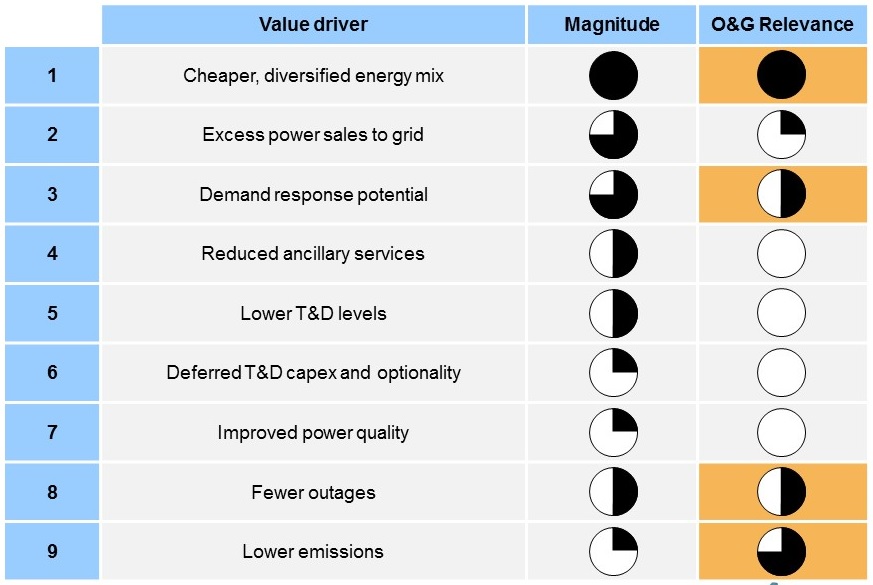

Microgrids are one option that operators are experimenting with to reduce energy costs. Oil and gas operators face several challenges when it comes to power. Microgrids can address these challenges and deliver value to operators through a number of ways. Setting up a microgrid can allow operators to use one of several different fuels or energy sources to generate electricity. Further, a diversified fuel and energy mix may help operators lower emissions. Both cost and emission reductions are issues that are very important to oil and gas operators, as shown in figure 3 which identifies value drivers for microgrids and those that particularly benefit oil and gas operators based on our interviews and primary research.

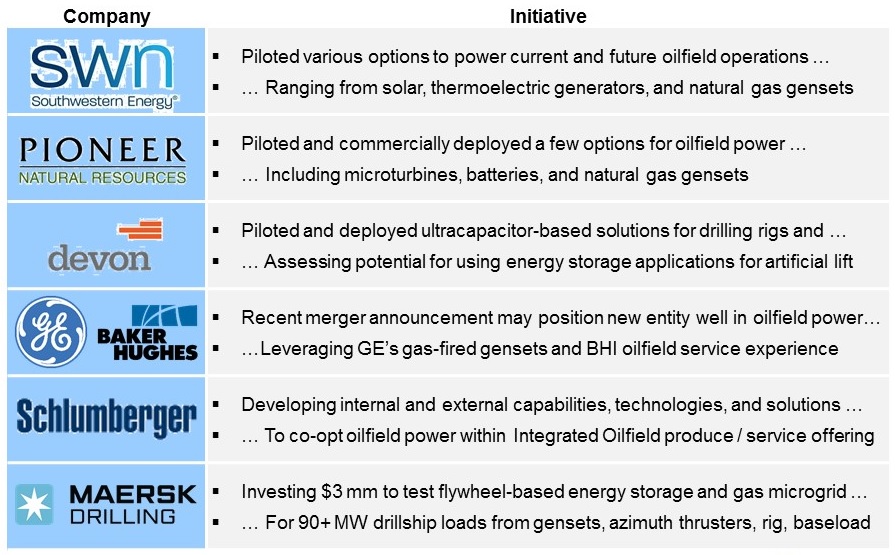

A number of oil and gas operators are trying various microgrid-related technologes. For example, Southwestern Energy has realized energy savings by piloting several projects with different energy sources including solar, natural gas, and diesel. Figure 4 shows a few efforts by operators to integrate microgrids into their portfolios. Similarly, Devon has deployed an ultracapacitor-based energy storage solution, offered by a start-up, FlexGen Power Systems, to address power issues with drilling using natural gas gensets. Pioneer Natural Resources has piloted and commercially deployed a number of oilfield power options including microturbines, batteries, and natural gas gensets.

Oilfield service players are also exploring opportunities in oilfield power closely. For example, Schlumberger is working to develop power-related capabilities, technologies, and solutions to combine with its Integrated Oilfield strategic offering. Maersk has recently invested $3 million to test a flywheel-based energy storage and gas microgrid for drillships. The recent announcement of the merger between GE Oil & Gas and Baker Hughes could position the new entity well in oilfield power. GE has an extensive portfolio of natural gas and diesel-fired gensets and Baker Hughes is one of the largest oilfield service companies in the world. With power becoming more expensive at the well pad and operators looking for ways to cut costs, GE and Baker Hughes are well-positioned to make an impact.

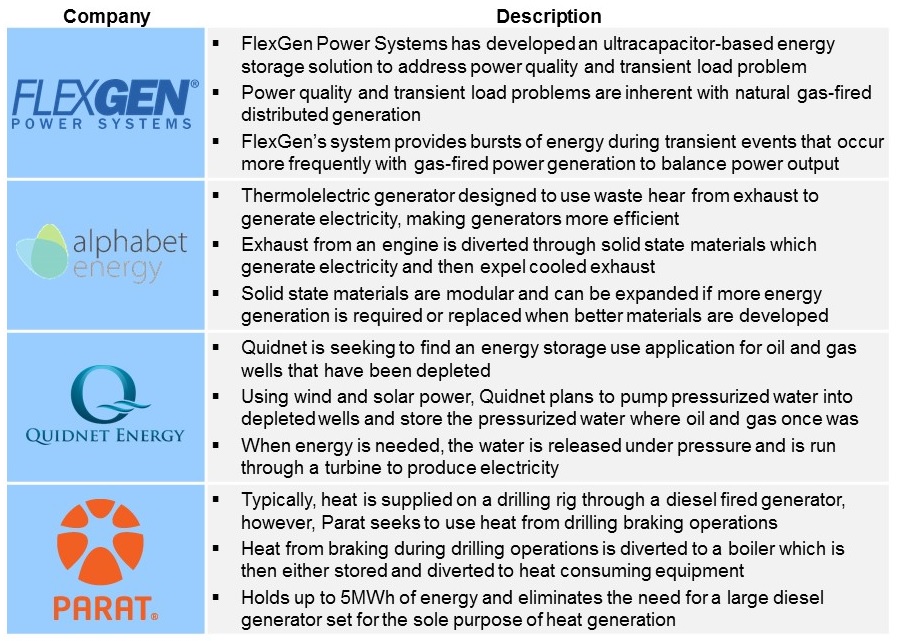

New technologies are increasing energy efficiency at the wellhead. Many companies are looking to develop and deploy microgrid-related technologies and innovations in oilfield power. Figure 5 shows four companies and outlines the technologies that they have developed in oilfield power.

The first, FlexGen Power Systems, is addressing both power quality and transient load problems that are inherent when using gas-fired power generators. FlexGen’s system uses ultracapacitors to provide very short bursts of energy during transient events that occur more frequently with gas-fired power generation.

Alphabet Energy has developed a solid state generator that uses exhaust heat as fuel. Exhaust heat is channeled through solid state materials that then generate electricity. Additionally, the solid-state modules can be easily expanded or replaced when new materials are developed making Alphabet Energy’s system completely upgradable.

Quidnet Energy sees depleted oil and gas wells as opportunities for energy storage. They are using wind and solar power to pump water into depleted oil and gas wells and store the water under pressure. When energy is needed, the pressurized water is released and is run through a turbine to produce electricity.

There are a number of pieces of equipment on oil rigs that require heat to function properly. Typically, heat is provided through a diesel generator. However, Parat is looking to change this. Parat has developed a technology that uses the heat created during drilling braking into energy, which in turn runs a boiler to provide heat to the rest of the rig. This is a huge improvement over wasting energy that is produced when braking occurs during drilling.

Power availability, reliability, and quality issues coupled with low oil prices have motivated operators to explore new models and innovations in oilfield power. Microgrids are related technologies are advancing and are likely to gain further share and space in the oilfield.

-Tyler Wilson and Uday Turaga