Artificial lift is a method of increasing pressure within an oil and gas reservoir to maximize hydrocarbon recovery. Historically, artificial lift was primarily used on wells with insufficient pressure but now in an effort to improve flow rates its use on naturally flowing wells has increased. In total there are ~1 million wells utilizing artificial lift worldwide. Use of artificial lift systems has increased significantly as the oil and gas industry continues to adopt cost effective solutions to optimize production. Further increases are anticipated as North American unconventional wells will likely adopt artificial lift once their production rates start declining. Artificial lift can reduce lifting cost and optimize production, making it a vital product to the oil and gas industry going forward.

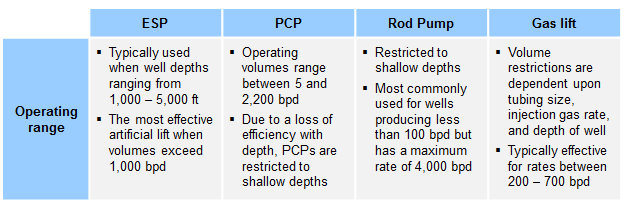

There are several artificial lift options with each applicable to specific market conditions, but ESPs drive most of the market value: Electrical submersible pumps (ESP), progressive cavity pumps (PCP), rod pumps, and gas lift. Figure 1 illustrates the typical operating range for each artificial lift. ESPs consist of a series of centrifugal pumps, an electrical motor, a separator to prevent fluids from entering the motor, and a power cable which connects the motor to the surface. Because of its ability to effectively move large volumes, the use of ESPs has outpaced the growth of the artificial lift market.

PCPs are fairly simple consisting of a stator and a rotor and are restricted to shallow wells. The oldest and most common type of artificial lift is rod pumping. The pump is inserted inside the tubing of a well, gathers fluids from beneath it, and lifts them to the surface. Gas lift, the preferred lift technology for unconventional wells, involves injecting gas in the tubing to reduce the weight which allows the reservoir pressure to push the fluids to the surface. Although each artificial lift is designed for specific applications and reservoir conditions, usage varies by region as oil and gas operators typically use what they are comfortable with.

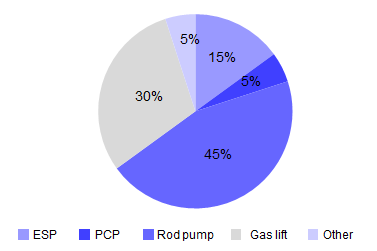

As the artificial lift market expands, key players will have to respond to growing consolidation: A majority of wells using artificial lift are located in North America, Russia, and South East Asia. With the advent of the unconventional boom, North America has been the primary driver for artificial lift demand. In the U.S. alone over 95% of oil wells require artificial lift, with the bulk of those utilizing rod pumps. The product mix of artificial lift used in Asia is fairly even across ESPs, PCPs, rod pumps, and gas lift while Russia relies heavily on ESPs. Rod pumping is the leading artificial lift method globally, followed by gas lift, ESP, and PCP. Figure 2 illustrates the share of artificial lift units worldwide.

There are several players active in the artificial lift market which is estimated at $14 billion annually. Recent events will, however, likely lead to an adjustment in market share for OEMs. Weatherford is the leader in terms of market share followed by Schlumberger, Baker Hughes, Dover, GE, Borets, and Halliburton. GE and Baker Hughes have recently announced a merger which has created an oilfield service giant. One of the key segments that will be impacted by this deal is the artificial lift market. Both GE and Baker Hughes are major players in artificial lift, especially ESPs, with Baker Hughes leading the ESP market and GE in the third place. The GE-Baker Hughes merger may also incentivize other deals as artificial lift businesses prepare to address growing consolidation.

Unconventional oil and gas wells represent the next big growth opportunity but artificial lift options have to address a few critical performance issues through innovation and new technology: The artificial lift industry will continue to grow as innovation and education occurs. Unconventional wells will soon transition to artificial lift in the near-to mid-term but customized solutions are needed to make this a reality. Rod pumping technology has evolved and is now finding applications in horizontal wells. ESPs are ideal for large shale wells but solids and gas handling capabilities must improve.

ADI Analytics has done a lot of work in the artificial lift market with various stakeholders in the oil and gas value chain. Recent work has focused on market sizing and segmentation, operator needs and pain points, emerging technology and innovation, and competitor and go-to-market strategies. Please contact us to learn more.

– Brandon Johnson, Uday Turaga