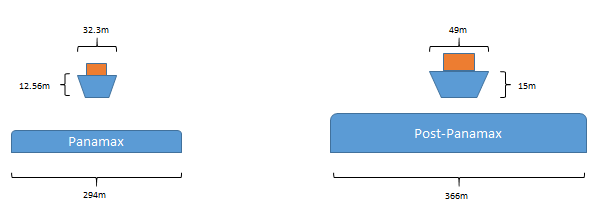

Today the Shell-chartered Maran Gas Apollonia became the first large LNG tanker to transit the newly expanded Panama Canal carrying cargo from Cheniere’s Sabine Pass liquefaction plant to East Asia. Since its inception in 1914, the Panama Canal has connected 160 countries and 1,700 ports around the world. Today, between 13,000 to 14,000 ships use the canal every year making it essential to world shipping. The original Panamax 294.1m long, 32.3m wide, and 12.56m deep was the biggest ship that could cross the canal.

In June, the Panama Canal completed an expansion to accommodate post-panamax vessels up to 366m long, 49m wide, and 15m deep as illustrated in Figure 1. This means that vessels up to 13,000 twenty foot equivalent units (TEUs), more than 8,000 TEUs than previous ships will be able to transit the canal. This expansion could impact multiple markets. We have analyzed the crude oil, LPG, and LNG trading markets for the Panama Canal’s expansion impacts.

Minimal impacts on crude oil: The expansion will have a minimal impact on crude oil trading. Very-large crude carriers (VLCC) and ultra-large crude carriers (ULCC), vessels that haul the majority of crude shipments, will still not be able to fit through the canal. A VLCC can carry between 1.9 to 2.2 million barrels of crude oil while a ULCC can carry between 2.2 to 3.7 million barrels of crude oil. However, the Suezmaxes, which typically carry one million barrels of crude oil, will be able to move through the expanded canal. Given this coupled with the already modest exports to China and Japan, crude oil isn’t expected to be significantly impacted

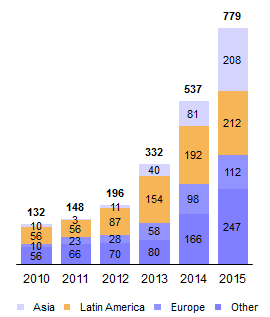

LPG will have moderate growth: The Panama Canal expansion will also allow passage of very-large gas carriers (VLGCs) typically used to carry LPG which will potentially increase exports to Asia. China is already the second biggest customer of U.S. LPG and this flow will only increase with the canal’s expansion. EIA data showed that imports from the U.S. to China and Japan accelerated before the canal expanded as illustrated in Figure 2. LPG shipments to Asia nearly tripled in the first quarter of 2016 compared to the same period in 2015. This trend will only increase as the canal has made it more efficient to ship LPG to Asia.

LNG will be significantly impacted: Before the canal was expanded, only 23 of the existing 421 LNG vessel fleet could pass through the canal. Now, nearly 90% of all LNG vessels can pass through the canal. However, Q-Max, the world’s largest class of LNG vessels, and most of the Q-flex vessels still will not fit. Over time as the canal gets broken in and gains experience with the transits through the new locks, there is a possibility that some Q-flex vessels may be able to transit through the canal. Since every vessel that transits the canal must pay a toll based on its size and cargo volume, larger ships will save more time and money.

The expansion is expected to primarily benefit trade between the U.S. Gulf and East Coasts and the Asian markets as the canal will significantly shorten the distance and transit time. For example, a typical trip from Sabine Pass to Japan is roughly 16,000 nautical miles without the canal and 9,133 nautical miles using the canal. That’s a saving of 42%. On average, an LNG vessel travels between 18 and 20 knots saving an LNG vessel 26-28 days over a round trip from the U.S. Gulf Coast to Japan.

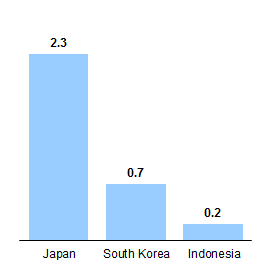

While the expansion’s impact may not be felt in the near term due to low LNG prices and an oversupplied market, there are long term ramifications. By 2020, the U.S. is expected to become the world’s third-largest LNG producer after Australia and Qatar. This will allow U.S. exporters to compete more efficiently in Asian markets. The EIA has estimated that about three billion cubic feet per day (bcfd) of U.S. LNG is likely to transit the Panama Canal as shown in Figure 3.

Figure 3: Likely U.S. LNG export volumes in bcfd to transit the Panama Canal through 2020 (Source: EIA)

Overall, the canal’s expansion is great news for the U.S. oil and gas industry. The expansion coincides with oil and gas demand growth in Asia-Pacific and South America and it came after the export restrictions for crude and LNG were lifted. The U.S. will now be more competitive in Asian and South American markets as it now gives them the ability to increase their ability to supply products. ADI will continue to monitor these developments through its subscription-research service on natural gas monetization.

-Brandon Johnson, Uday Turaga