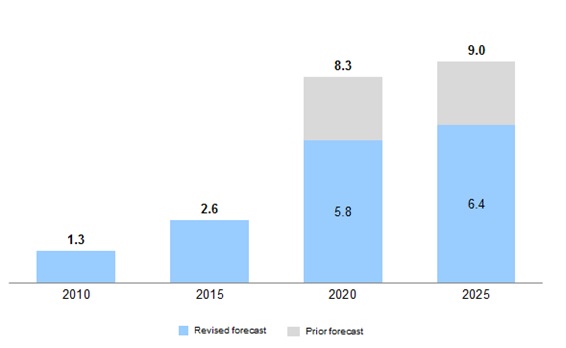

In 2014, China’s LNG demand peaked at 2.7 billion cubic feet per day (bcfd) making it the third-largest LNG importer in the world behind Japan and South Korea. However, as the Chinese economy has slowed LNG demand declined for the first time since China started importing LNG in 2006. Figure 1 highlights the revised LNG demand forecast for China. This decline has led to a slowdown in construction of new regasification terminals and growing uncertainty around the outlook for small-scale LNG.

Delays in terminal construction: Currently, China has 13 LNG import terminals in operation with a cumulative capacity of 5.4 bcfd and had planned to construct several more through 2019 which would add an additional capacity 3.4 bcfd. Due to the slowing and uncertain outlook for LNG demand, startup for several of these projects has been delayed. Many of the contracts to supply LNG to the new regasification terminals were signed when oil prices were above $100 per barrel. Now that oil is at less than $50 per barrel, both spot LNG and LPG (liquefied petroleum gas) prices are more competitive. Oil and gas companies have been actively trying to suspend shipments of contracted LNG to the new terminals and instead buy lower-priced spot LNG. LPG is also being preferred by the terminal’s customers as it is cheaper than LNG priced under longer-term contracts.

Small-scale LNG may slow down: Since 2013, China has been investing heavily in LNG in an effort to improve air quality and restructure their domestic energy market. Their plan is to first introduce LNG as a marine fuel on inland waterways, then for coastal vessels, and finally for deep sea-going ships. So far, they have begun developing a market for LNG as a marine fuel and have created three small-scale LNG carriers. Over the next five years, China is hoping to increase the number of inland vessels which use LNG as a fuel from 2% to 20%.

However, there are a few challenges in implementing LNG fueled ships in China. For example, the economic benefits are uncertain, LNG fueled ships are more complex than diesel fuel systems, and there has been limited progress on establishing an LNG bunkering infrastructure in China. LNG-fueled vessels cost ~20% more to build than equivalent diesel ships and can accommodate less cargo. In addition to cost, there is a lack of manufacturing expertise as China has been heavily reliant on foreign companies in these areas in the past. Also, it will be challenging to implement LNG-fueled ships in China because of the lack of subsidies for ship owners to invest in bunkering development. In an effort to increase adoption, emission standards are being developed for ship engines and subsidies are being offered to Chinese ship operators to build LNG-fueled ships.

ADI Analytics continues to closely monitor these and other developments in LNG globally through its Natural Gas Monetization Research Service and its new offering on alternative marine fuels.

-Brandon Johnson and Uday Turaga