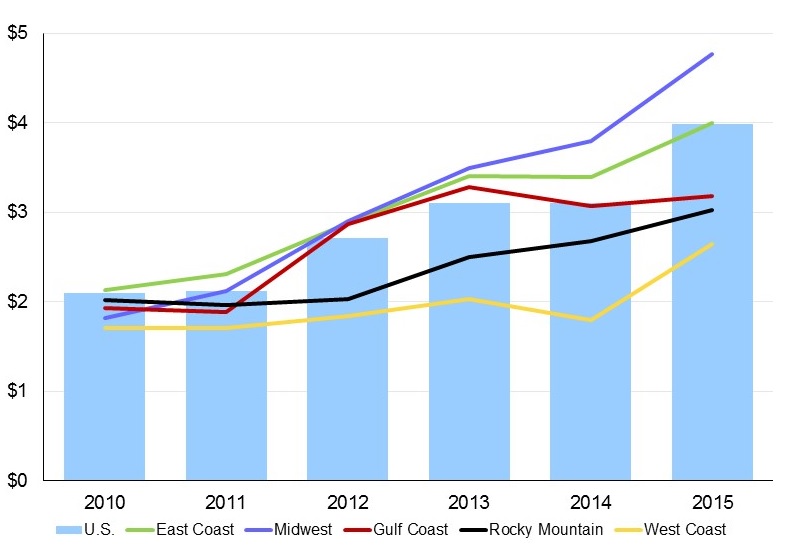

The value of an octane barrel has risen significantly in recent years going from $2.10 in 2010 to $3.99 in 2015. This has surprised industry analysts since the refining industry has been blending a growing amount of ethanol, which has an octane rating of ~113, and the general consensus was that the industry had a surplus of octane. However, there are multiple factors behind why the value of octane has increased over the past several years.

Growing use of light tight oil in North America: The North America shale revolution has led to a dramatic growth in the supply of light tight oil. Over the past five years U.S. refiners have increased the share of light tight oil processing from 600,000 bpd in 2010 to 4.5 million bpd in 2015. Figure 1 shows the amount of tight oil used in U.S. refineries in 2010 and 2015. In general, light tight oil is higher in paraffins than traditional crude oil. High-paraffin crude oil typically produces gasoline with lower octane ratings. To cope, refiners and blenders must obtain higher octane blend stocks from other sources driving up the value of octane.

Gasoline demand is rising in North America and globally: Demand for gasoline is growing at a faster rate than demand for oil and other major fuels such as diesel across the globe. In 2015, U.S. consumption for all liquid fuels grew at 1.5%, while diesel demand declined by 1.5%. In comparison, consumption of gasoline grew at 2.7%. This growth in gasoline demand pushes up the need for higher-octane gasoline blending and is one factor that increased the value of octane. In previous research, ADI Analytics has found that this trend also holds true around the world.

Ethanol fuel blending has reduced catalytic reforming capacity: Due to the Renewable Fuel Standard a certain number of gallons of ethanol must be blended with gasoline each year. In 2015, ethanol accounted for ~10% of the total volume of gasoline in the United States. Pure ethanol has an octane rating of ~113. As the share of higher octane ethanol in gasoline has increased refiners’ need for higher octane blendstocks have diminished. As a result, traditional supplies of high octane blendstocks such as naphtha reformers have decreased in importance and utilization.

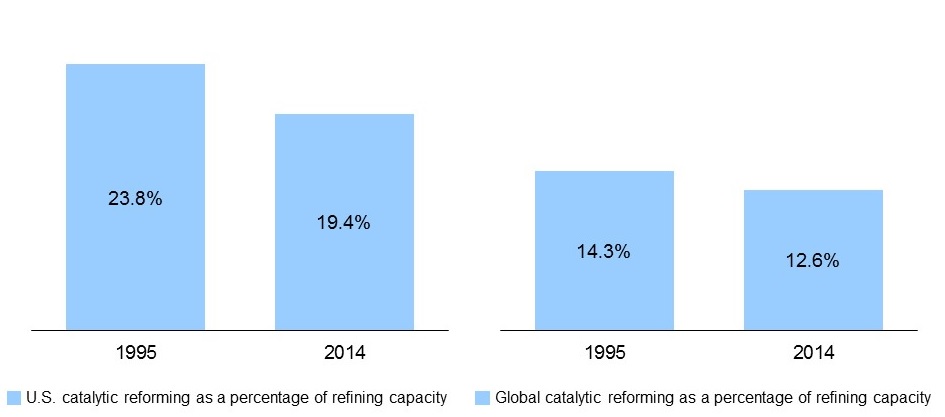

Since 1995, worldwide refining capacity has grown from 74.1 million barrels per day to 88.0 million barrels per day in 2014 at an annual growth rate of 0.9%. Catalytic reforming capacity, on the other hand, has grown from 10.6 million barrels per day to 11.3 million barrels per day in the same time period at a growth rate of 0.3%. In the U.S. over the same time period total crude oil refining capacity grew from 15.3 to 18.1 million barrels per day at 0.9% per year and catalytic reforming capacity shrunk from 3.6 to 3.5 million barrels per day at -0.2% per year.

As a result, catalytic reforming as a percentage of total refining capacity has steadily decreased over the past 20 years. Figure 2 shows catalytic reforming as a percentage of refining capacity in the U.S. and globally 1995 to 2014. Figure 3 shows the value of a barrel of octane in the U.S. and across all five PADD districts from 2010 to 2015.

Figure 3: The value of a barrel of octane in the U.S. and each PADD district from 2010 to 2015 (USD per barrel)

Collectively, the value of octane has increased for several reasons. First, gasoline demand is increasing faster than demand for other distillates. Second, refineries are relying more heavily on high paraffin crude oil as feedstock, which typically produces gasoline with lower octane ratings. Third, global catalytic reforming capacity is growing at a slower rate than refining capacity. ADI Analytics new research service focused on the North America refining industry has explored the increasing value of octane in great detail. Please contact us to learn more about our new research service.

-Tyler Wilson and Uday Turaga