Earlier this year, Petronas launched the world’s first floating liquefied natural gas (FLNG) vessel, PFLNG 1. The vessel is capable of producing 1.2 mtpa of LNG and is located offshore in the Kanowit field ~115 miles southwest of Malaysia. PFLNG 1 marks the first of what could be many FLNG projects worldwide. However, falling oil prices have impacted the profitability of many projects that once looked promising. For example, Petronas had originally planned to start operations from a second FLNG vessel, PFLNG 2, but has delayed the project until 2019. We see three major trends in the global FLNG market today.

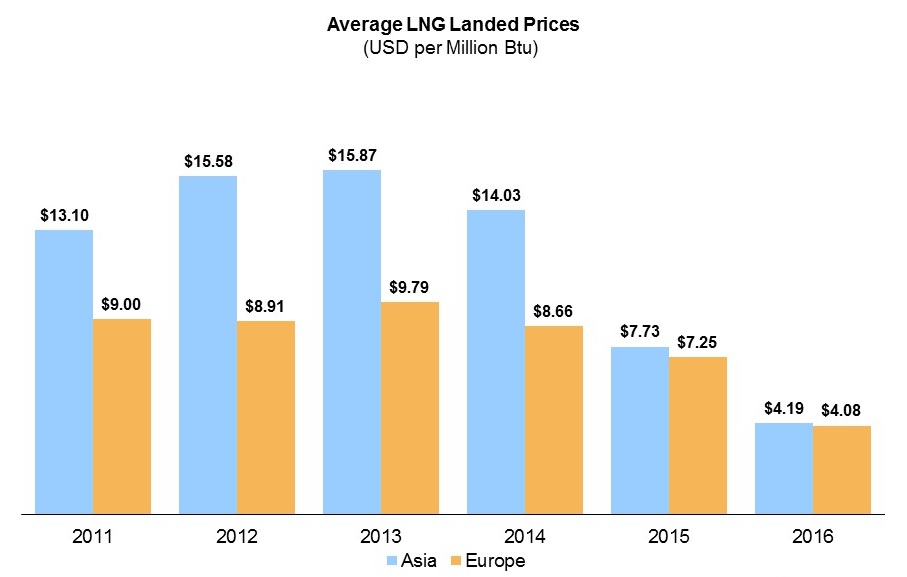

Oil prices are negatively impacting global LNG prices: In most parts of the world, the price of LNG is pegged to the price of oil, which we have written about previously. With the drop in the price of oil combined with a surplus of new LNG supply coming from recently completed Australian LNG projects, LNG prices have decreased worldwide. Average LNG landed prices hit highs in 2013 with average prices above $15 per mmBtu in Asia and nearly $10 per mmBtu in Europe. Since then, prices have dropped to barely above $4 per mmBtu in each region.

The steep drop in LNG prices has caused several FLNG projects to be cancelled. In March of 2016, Australian E&P Woodside announced that it is shelving its plans for a $40 billion FLNG vessel and instead redeploying the capital toward a potential acquisition or share buy-back.

Browse is not the only FLNG project to be cancelled amidst falling oil prices. Excelerate Energy had plans for a FLNG vessel but cancelled them in December of 2014, shortly after oil prices steeply fell. In Canada, AltaGas cancelled its Douglas Channel FLNG project citing economic concerns and in Columbia, Pacific Exploration and Production cancelled a FLNG project that was already under construction, again citing economic concerns. Figure 1 shows average LNG landed prices per mmBtu in Asia and Europe of the past six years.

Some projects will move forward and some regions will see an influx of FLNG activity: In 2011, Shell took a final investment decision on its massive FLNG project, Prelude, which we have written about previously. Prelude is set to commence operations in 2017 off the northwest coast of Australia where it will produce up to 3.6 mtpa of LNG, 1.3 mtpa of condensate, and 0.4 mtpa of LPG. The primary driver behind Prelude moving is that Shell has secured offtake agreements for its LNG cargo. Shell has signed an offtake agreement with Osaka Gas. Additionally, Shell has partnered with three companies on the project, all of whom will take delivery of LNG. Inpex has a 17.5% share while KOGAS has 10% and Taiwan CPC has a 5% share.

While Shell is moving forward with Prelude there are several operators looking to exploit reserves off the coast of Africa using FLNG. Golar has two FLNG projects planned off the coast of Cameroon and Eni has three FLNG projects planned off the coast of Mozambique. Additionally, Ophir Energy has one FLNG project planned for Cameroon as well. Ophir Energy has originally planned to construct a FSRU, but due to the discovery of natural gas reserves decided to plan a FLNG project.

FLNG is a particularly good option for use in Africa for three main reasons. First, an FLNG vessel can be constructed off-site and then transported to where it will operate, eliminating the need for complex infrastructure and on-site personnel. Second, FLNG vessel are better able to avoid volatile political climates since they are not in a country’s territory. Third, FLNG vessels, typically being smaller than a standard large-scale LNG train, are able to draw from gas fields that would typically be too small for a large-scale LNG train to draw from. This opens up the ability to draw from reserves off the shore of Cameroon and Mozambique.

New technologies and techniques can help address challenges with FLNG: Operators face unique challenges with FLNG projects and new technologies can both alleviate these problems as well as help FLNG improve its value proposition. Some of the biggest challenges are dealing with space and weight requirements, inclement weather, and safety. Operators are applying new techniques and technologies to help address these problems.

While Prelude is using Shell’s dual mixed refrigerant liquefaction process most operators plan to use Black and Veatch’s Prico liquefaction process. While Prico is not as efficient as other liquefaction processes it both weighs less and uses less space than other liquefaction technologies. Designing an FLNG vessel is also a balancing act .The design must also balance weight accordingly across the vessel to minimize the chance that the vessel will capsize.

Offshore weather is also a major concern of operators. Hurricanes and cyclones will halt production for a certain period of time for almost all project, however, if the vessel is not suitable for all weather conditions it will have to be moved in the case of inclement weather. In help partially to its massive size, Prelude is rated to withstand a category five cyclone and will remain on-site in all weather scenarios. However, it will not be able to produce LNG under such extreme conditions.

The last concern, safety, can often be the hardest to handle. A vessel needs to be designed with the safety of crew in mind at all times. Crew quarters are often placed as far away from storage tanks and process facilities as possible to reduce the possibility of injury or death in the case of a major safety incident. In the case of Prelude, there are also 20 meter gaps between each adjacent process modules to allow personnel to move quickly away from danger if need be.

The launching of PFLNG 1 was the world’s first look into FLNG technology. While there are many planned FLNG projects they face many of the same problems that their land-based cousins have faced. However, given the unique characteristics of FLNG vessels there will likely be a space for them in the near future.

-Tyler Wilson and Uday Turaga