Large volumes of cheap North American natural gas from unconventional plays are driving companies to monetize the new supply in several different ways. One is to use LNG as a marine fuel. We have briefly touched upon the benefits of using LNG as a marine fuel in a previous article. There are two main drivers for the adoption of LNG as a marine fuel. First is the price differential between diesel and LNG and, second, the benefit of environmental regulatory compliance from using LNG.

LNG is not selling at as much of a discount to diesel as it was a year ago: While one of the primary drivers of switching to LNG from diesel fuel is that LNG is cheaper, it is no longer as cheap as it was about a year ago. The price differential between the fuels is important because LNG ships require a significant upcharge relative to those fueled by diesel or fuel oil. LNG-fueled ship are more expensive because of the gas-fired engine but primarily due to the fuel storage and delivery system. Upcharges range from $7 million to $24 million per ship. With diesel at $4 per gallon and LNG at $1.25 per diesel-gallon equivalent (DGE) payback periods were approximately 10 years for an LNG ship. In today’s low oil price environment, with diesel at $3 per gallon and LNG at $1.25 per DGE, the payback period increases to 13 years.

Even so, LNG ships may be attractive to fleet owners as the life of a ship is much longer than the current 13 year payback period. Further, a payback period of 13 years assumes that diesel stays at $3 per gallon. It is likely that the price of oil, and subsequently diesel, will rise faster than the price of natural gas over the next several years. This would widen the differential and amplify the discount that LNG has to diesel fuel. Meanwhile, the recent decline in diesel fuel prices will most likely slow down the adoption of LNG for marine use in the short term.

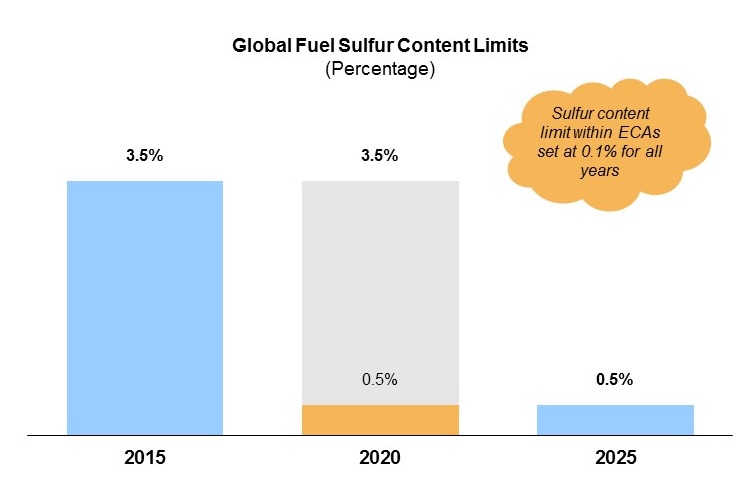

Stricter emissions regulations can serve as a secondary driver for LNG adoption: In addition to discounted fuel prices, environmental benefits of using LNG will also drive adoption. Today, there are global standards for marine fuel sulfur content that are set by the International Maritime Organization. These regulations apply to all marine fuel that is loaded, bunkered, and used onboard a vessel. Fuel with greater than 3.5% sulfur cannot be used anywhere in the world. There are plans to tighten regulations to 0.5% sulfur by 2020. However, in 2018 the regulations will be reviewed and possibly postponed to 2025. In order to meet these stricter emission regulations, vessels would have to use either more expensive low-sulfur diesel or employ the use of scrubbers. Alternatively, LNG can be used without scrubbers to meet all proposed emissions requirements. Exhibit 1 shows global sulfur content limits for marine fuel.

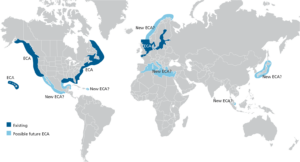

Emission Control Areas (ECA) are areas where the emission regulations are tighter than they are at open sea. In these areas, sulfur emissions are currently regulated to be no more 0.1%. Ships must use ultra-low sulfur diesel or advanced scrubbers while operating in these areas. Today, they are located near the coasts in northern Europe and most of the United States, including Hawaii. Consequently, there has been faster adoption of LNG as a marine fuel in these regions. ECA may also be expanded to Japan, Mexico, parts of Southeast Asia and the Caribbean, and the Mediterranean. Expansion of ECA to these regions will further drive the need for LNG as a marine fuel as fleet owners search for ways to meet tighter emissions regulations. Exhibit 2 shows current ECA and areas where ECA may be expanded to in the future.

There are a number of additional issues that will affect the adoption of LNG as a marine fuel. Other issues include the robustness of LNG supply infrastructure at ports, such as bunkering and liquefaction capabilities, equipment manufacturers’ ability to supply the market with LNG engines, storage tanks, and ships, and capital cost of alternatives to LNG fuel use, such as scrubbers, and other alternative fuels such as methanol. Additionally, the switching costs and environmental impact of using heavy fuel oil instead of diesel fuel. ADI Analytics is investigating these issues as part of our Natural Gas Monetization Research Service.

In summary, the price differential between diesel and LNG and lower emissions, increased expansion of ECA, and stricter global sulfur content limits are driving interest in LNG as a marine fuel.

-Tyler Wilson and Uday Turaga

[…] Recently, we wrote about how Emission Control Areas (ECA) are one of two major drivers in adopting LNG as a marine fuel. The other driver being the price differential between LNG and diesel fuel. Looking at the number and the location of both planned and operational LNG vessels across the globe can help paint a picture of the regional drivers for LNG adoption as a marine fuel. […]