Thanks to the increase in shale gas production many LNG export projects have been announced, and a few have started construction, in the United States. During the third quarter of 2015, the first of these projects, Cheniere’s Sabine Pass terminal, will start exporting LNG around the world. Most attention has focused on these projects securing LNG off-take agreements, but having an effective gas sourcing strategy to feed the liquefaction plant is just as important particularly as projects begin nearing start-up.

The first project set to begin exporting LNG is Cheniere’s plant in Cameron Parish, Louisiana. Examining Cheniere’s gas sourcing strategy for Sabine Pass may offer insight into how future projects may source feed gas for LNG projects. LNG export projects are likely to have a four part approach to secure reliable and cost-effective feed gas: redundant pipeline capacity to source gas from many different basins, having multiple counterparties to establish market liquidity, using short and long-term gas contracts to take advantage of pricing arbitrage, and the administrative back office to execute operations.

Redundant pipeline capacity to enable gas sourcing from many different basins: Natural gas from various sources must be transported to a liquefaction facility. Creating a portfolio of pipelines that connects oil and gas producing basins to the liquefaction plant enables a project the flexibility to source gas from different locations at multiple price points. As a result, LNG projects increase the chances of sourcing feed gas at optimal prices.

Cheniere has implemented such a strategy to diversify the shale basins from which they are purchasing feed gas. For Sabine Pass, they have contracted pipeline capacity in excess of that required for the liquefaction facility. In fact, Sabine Pass has ~33% more pipeline capacity contracted than is necessary. This would likely enable Sabine Pass to optimize gas sourcing cost by sourcing from different basins and take advantage of prevailing prices and any discounts to Henry Hub.

Further, Sabine Pass has established pipeline capacity has been established though “firm transportation” contracts meaning that Sabine Pass is given the highest priority on the pipeline in order to ensure that there are no breaks in supply. Such firm transportation contracts will provide LNG export projects with several advantages. First, it reduces the risk of pipeline bottlenecking during times of high demand. Second, it helps Sabine Pass access the cheapest gas sources. Third, it provides the ability to maintain high operating rates by managing maintenance and outages. Finally, it reduces the dependence on a single supplier or basin.

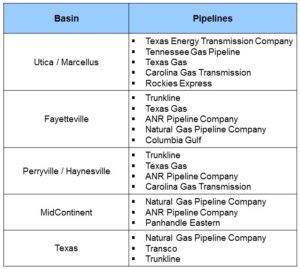

LNG export projects may have to build their own pipelines in order to gain access to other pipelines. For example, Cheniere owns the Creole Trail Pipeline that connects their liquefaction facility to various gas sources in South Louisiana. The pipeline was originally built in 2008, but was recently expanded. Exhibit 1 shows pipelines with whom Sabine Pass currently has agreements and the basins they are connected to.

Multiple counterparties to provide gas sourcing liquidity: Just as there are advantages to having access to multiple pipelines there are advantages to having multiple suppliers of feed gas. The biggest advantage is that one can choose from a variety of prices to contract feed gas. The North American Energy Standards Board (NAESB) provides natural gas buying and selling contracts. Cheniere has 91 NAESB contracts for its operations with 14 more under negotiation. The first train at Sabine Pass, which is set to start production by the end of the year has 65% of its feed gas requirements filled.

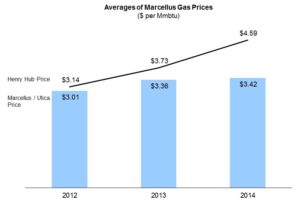

Cheniere has structured the total price they charge customers in off-take agreements to be the sum of the price of 115% of Henry Hub Natural Gas plus a liquefaction fee between $2.25 and $3.00 per MMBtu. Currently, most of the feed gas contracted for Sabine Pass will come from the Marcellus and Utica shale plays. Gas from these plays is cheaper than Henry Hub as shown in Exhibit 2 which shows the average price of natural gas at Henry Hub by year compared to the average price of several gas contracts from the Marcellus and Utica basins. If Sabine Pass is able to source gas cheaper than Henry Hub, which their off-take agreements are pegged to, they will take advantage of an arbitrage opportunity and be more profitable. The combination of having redundant pipeline capacity and multiple counterparties allow Sabine Pass the flexibility to source gas from the least expensive basins.

Varying contract lengths provide gas sourcing liquidity: The importance of varying contract lengths is also important when sourcing feed gas for an LNG export project. This gives a project the ability to lock in a certain amount of feed-gas with long term contracts, but also allow the use of short-term contracts to fill the gaps taking advantage of more favorable contract pricing. Additionally, a project can purchase gas on spot price to fill immediate needs.

Administrative back-office is required to execute operations: Finally, a comprehensive back-office is necessary to run trading, accounting, risk management, treasury, logistics, and many other operations. Without an effective team managing day-to-day operations, an LNG export project will face execution inefficiencies. For example, an inexperienced trader may not be able to get the best price for natural gas, or a risk management team with little experience may make mistakes, costing both time and money for the project.

-Tyler Wilson and Uday Turaga