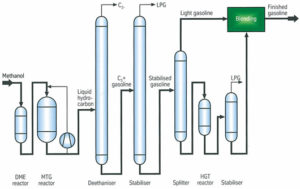

Earlier, we wrote about how methanol produced from natural gas can be used in many different processes. One of the processes in the methanol value chain is the methanol to gasoline (MTG) process. ExxonMobil and Haldor Topso are the only two companies who own the licensing rights to this technology. Mobil started the first commercial MTG plant in New Zealand that operated from 1985-1997. Creating gasoline from methanol is an attractive monetization for companies for a number of reasons, although, MTG technology is not without its drawbacks. Below is a visual of the MTG process.

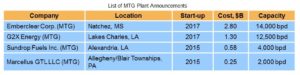

One of the greatest benefits of MTG projects is that they offer a higher rate of return than GTL projects. This is because they have an overall lower capital cost than GTL projects. Developers of MTG plants are offered more room to remain profitable as the gap between the price of oil and natural gas closes. The gasoline produced from the MTG process can also be integrated within the United State’s current fueling infrastructure without any modifications. Combined with the benefits listed and the shale gas boom, there are a few MTG projects being planned in North America. Below is a list of MTG projects planned in the United States.

Potential MTG projects suffer from three main risks, margin risk, capital cost, and technology risk. Margin risk threatens projects when the price ratio between oil and natural gas begins to close. As the ratio begins to close the rate of return on MTG projects lowers. Gasoline demand is also declining due to CAFE standards, more efficient vehicles, and biofuels.

Capital cost risk is the greatest threat to MTG projects. Although MTG projects are cheaper than GTL projects there are still high capital costs associated with them. A project developer has to be able to allocate a significant amount of resources in order to be able to construct and operate an MTG plant. This is risk is also on top of all the other risks associated with MTG projects.

Finally, there is technology risk. There are only two companies that have developed MTG technology. ExxonMobil is the largest licensor of MTG technology. The only other company with their own MTG process is Haldor Topose. Additionally, commercial deployment of MTG technology is limited to one project, Mobil’s project in New Zealand. Without many plants to compare to, new plants may face reliability and performance issues as they may be forced to deal with unexpected problems.

The future of MTG plants is unclear as there are not many projects under development, the technology is relatively untested, capital costs are still high, and the natural gas and oil price differential is no longer large enough to incentivize MTG projects. Even so, the projects offer higher potential returns than GTL projects and if the price gap between natural gas and oil widens it may usher in several more MTG projects. However, at this time it is unlikely that MTG projects will play a major role in North American gas monetization.

-Tyler Wilson and Uday Turaga